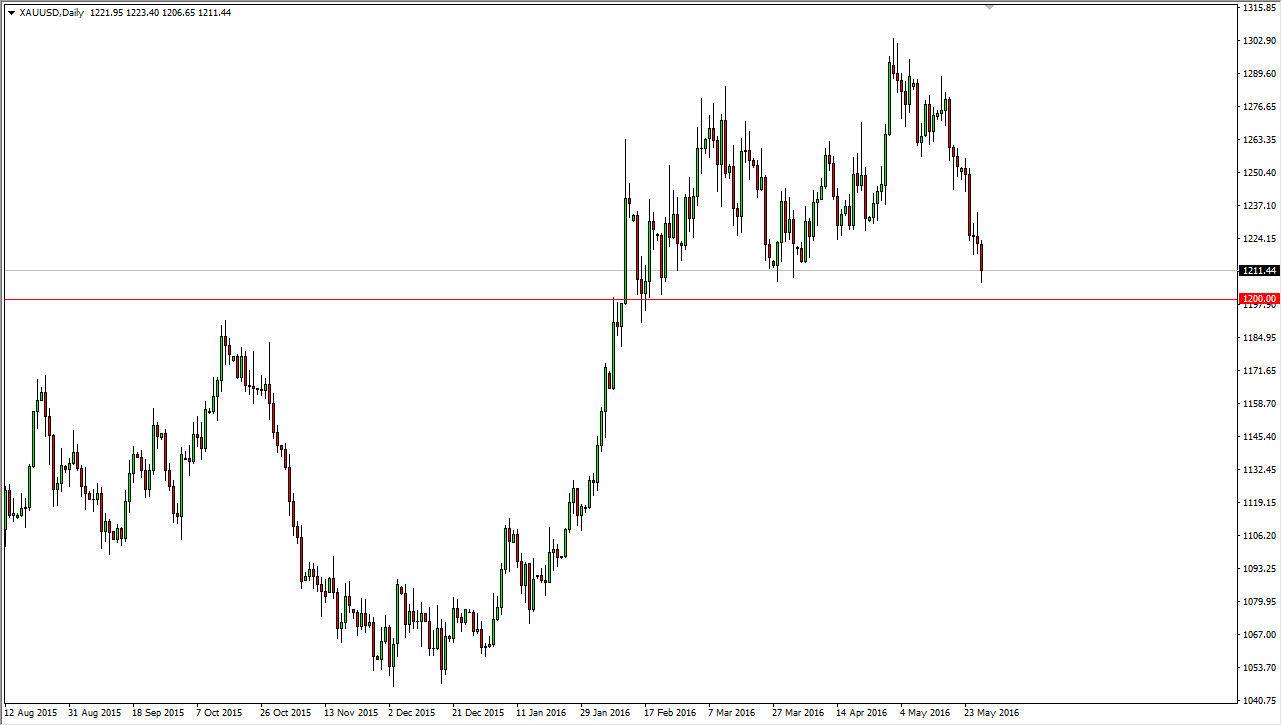

Gold markets, the CFD variety, fell rather significantly during the Friday session as we appear set to test significant support below. I think that the $1200 level will continue to show support as it has in the past, plus the fact that it is a large, round, psychologically significant number will probably help as well. I’m simply looking for a bounce from here in order to start buying, or perhaps a supportive candle just above the $1200 level. I have no interest in selling this market until we get well below that area, and I believe that it is only a matter of time for people start to think of this market as offering quite a bit of value.

US dollar

You have to keep in mind that the Federal Reserve and its interest-rate policy will be interesting to watch, as the markets are still trying to figure out what is going to happen this year. Initially, the thinking was that we would get a total of 4 interest-rate hikes during 2016. However, the markets are now starting to realize that perhaps we aren’t going to get as many interest-rate hikes as initially thought. In fact, it’s likely that we will continue to see quite a bit of volatility in the US dollar so that’s why I feel like sooner or later people will be interested in gold.

It’s also the Euro that you have to pay attention to as well as European traders will step into the gold market and pick up the yellow metal instead of the currency market. Either way, this is a market that looks a bit oversold at this point so it would not surprise me to get that bounce and I’m just going to have to be patient and wait to see what happens. On the other hand, if we do close well below the $1200 level on a daily chart, I could be convinced to start selling again.