NZD/USD Signal Update

Last Wednesday’s signals were not triggered.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time only.

Long Trades

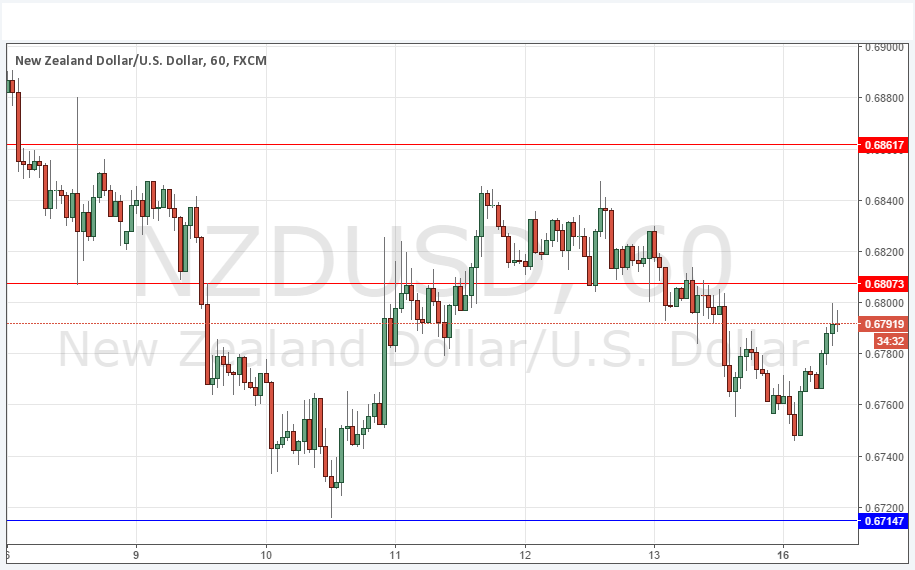

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6714 or 0.6625.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6807 or 0.6862.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

There is not a lot to say about this pair. It tends to range and it is ranging now. The action is neither particularly bullish nor bearish. Although this sounds like good behaviour for trading reversals at anticipated levels, this pair’s levels tend to be quite slippery so need to be given some leeway either side.

Currently the price is finding it hard to break up past the round number at 0.6800, and there is a key resistance level just above that, so there might be a short trade coming there later today.

Concerning the NZD, there will be a release of Inflation Expectations data at 4am London time. There is nothing due regarding the USD.