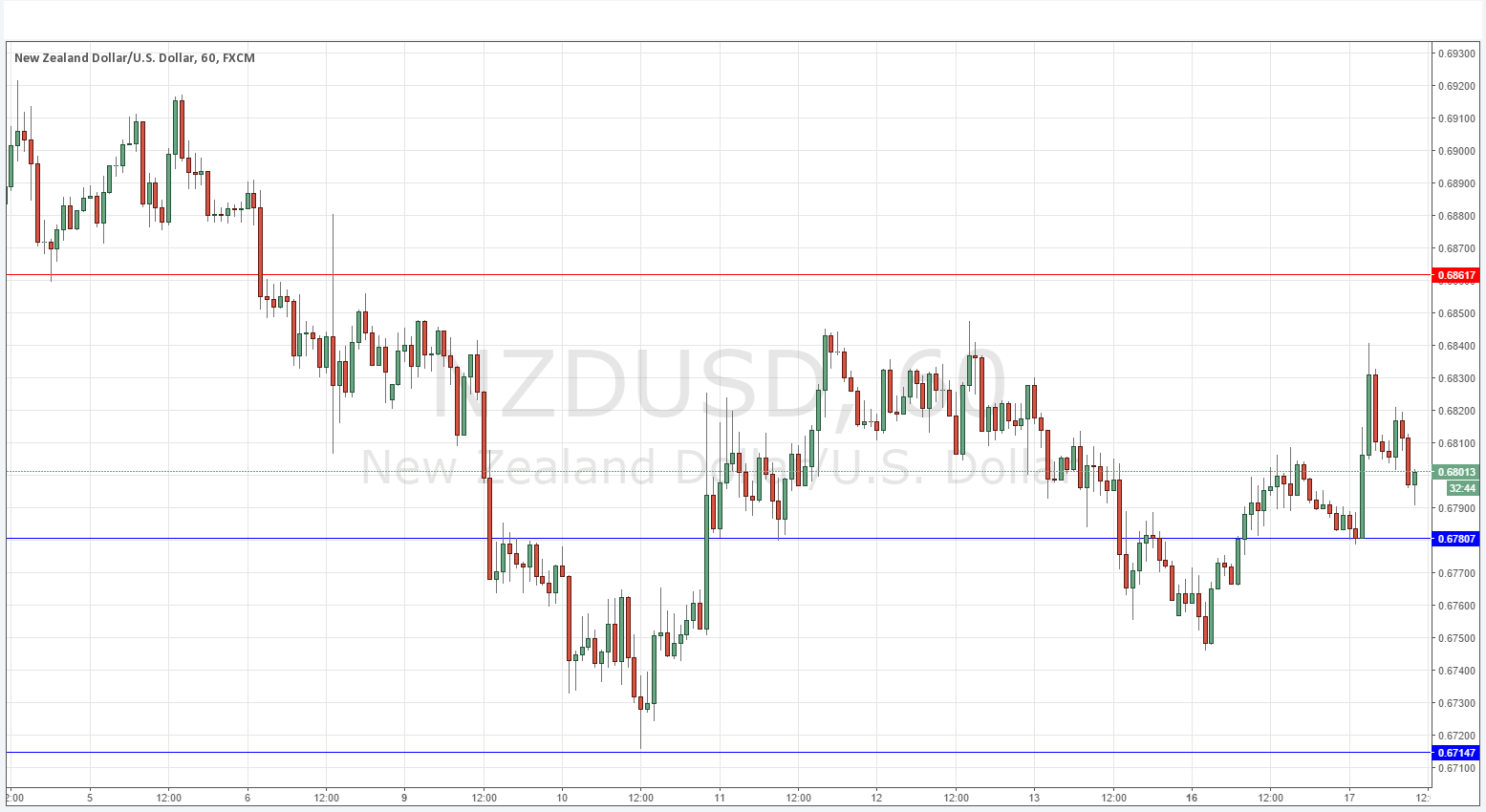

NZD/USD Signal Update

Yesterday’s signals were not triggered as the bearish price action at 0.6807 was not sufficiently strong (the turn candle did not break down during the next candle’s time).

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6714 or 0.6781.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6862.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

There are better opportunities elsewhere. Overall it is mostly just a fairly messy, choppy price action that we have seen, with slippery and inaccurate support and resistance levels. There is little to no trend or momentum.

Regarding the USD, there will be releases of CPI and Building Permits data at 1:30pm London time. Concerning the NZD, there will be a release of the GDT Price Index, followed by PPI Input data at 11:45pm.