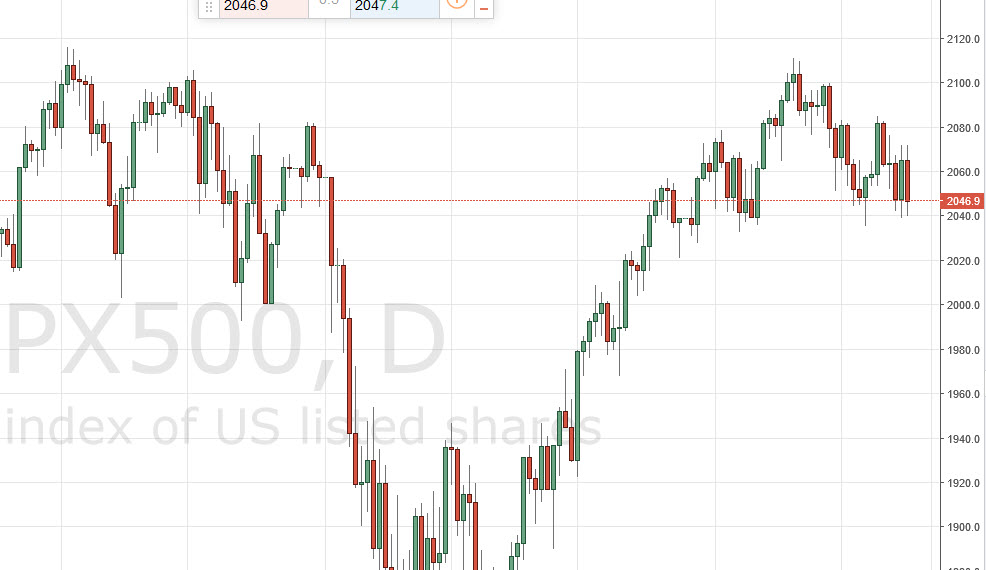

S&P 500

We had a fairly volatile session in the S&P 500 on Wednesday, as the 2040 level offered support. However, the 2060 level above offered resistance as well, and it now looks as if the new crew candle is telling us that the market just isn’t ready to make anything significant happen. Even if we broke down from here, I have to think that the 2020 level would be supportive, just as the 2000 level would be underneath that. I’m actually much more comfortable going higher than I am lower, and am willing to start buying on a break out above the 2060 handle. I think at that point we would probably go to the 2080 level, and then eventually the 2100 level. It is not until we break below the 2000 level that I feel this market can be sold.

NASDAQ 100

The NASDAQ 100 reached towards the 4360 level, but turned right back around to form a bit of a shooting star. By doing so, it looks as if we are going to drift a little bit lower but I see so much in the way of support at the 4280 level that I have absolutely no interest in shorting this market. Honestly, I believe that there is massive support all the way down to about the 4000 handle so this is essentially a “buy only” market as far as I’m concerned. I’m not saying that we can break down, but certainly we can. However, I’m saying that I’m not willing to put up with that kind of volatility as I know it could be fairly enormous below.

On the other hand, if we break above the 4400 level, it would be a very bullish sign and could send this market towards the 4500 level rather quickly. That’s actually what I’m hoping to see, but the action on Wednesday did very little to make the think it’s going to happen anytime soon.