S&P 500

The S&P 500 went back and forth during the course of the day on Monday as we continue to basically go nowhere. There is a significant amount of support below at the 2040 handle, so at this being the case it looks as if we will continue to see buyers below. With that being the case, we are more than likely going to see short-term pullbacks offer short-term buying opportunities. On the other hand, if we can break above the 2060 level I am more interested in buying as it would show pre-significant bullish pressure. At that point I would anticipate that the market should then go to the 2080 handle. The 2100 level above continues to be the overall ceiling of the market, so this point in time it’s until we get well above there that I think we will have an easy set up.

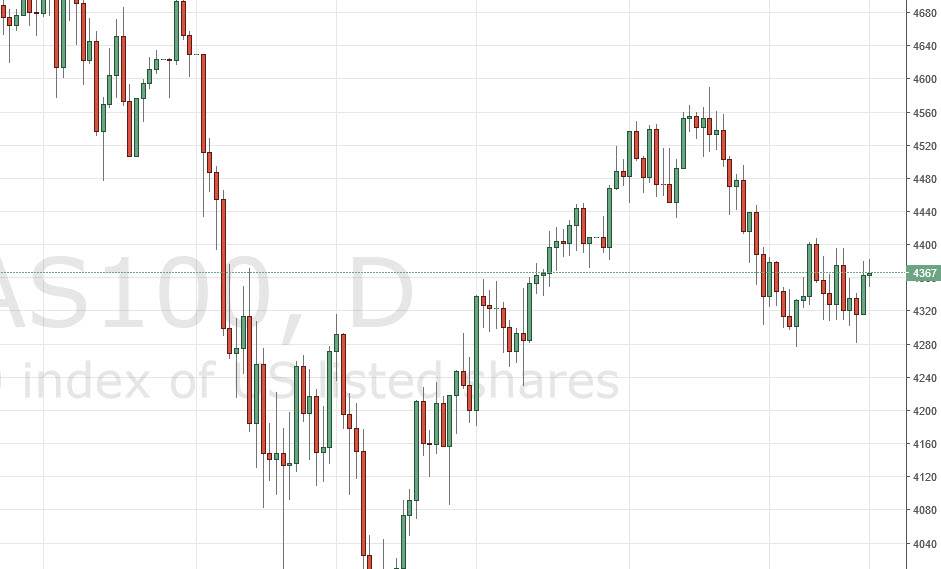

NASDAQ 100

The NASDAQ 100 went back and forth during the day on Monday, as we continue to see quite a bit of volatility in this market. If we can break above the 4400 level, we could then go much higher, perhaps reaching towards the 4500 level. A pullback from here will more than likely find plenty of support, extending all the way down to the 4680 handle. Ultimately, I have no interest in selling this market until we see a massive move to the downside. There is so much in the way of support below that the selling of this market would be almost impossible. Because of this, I feel much better buying, and as a result am going to be much quicker to buy that aforementioned break out.

Keep in mind that the US dollar will have an effect on what happens with the NASDAQ 100, as it is generally thought of as a way to play exports when it comes to the United States.