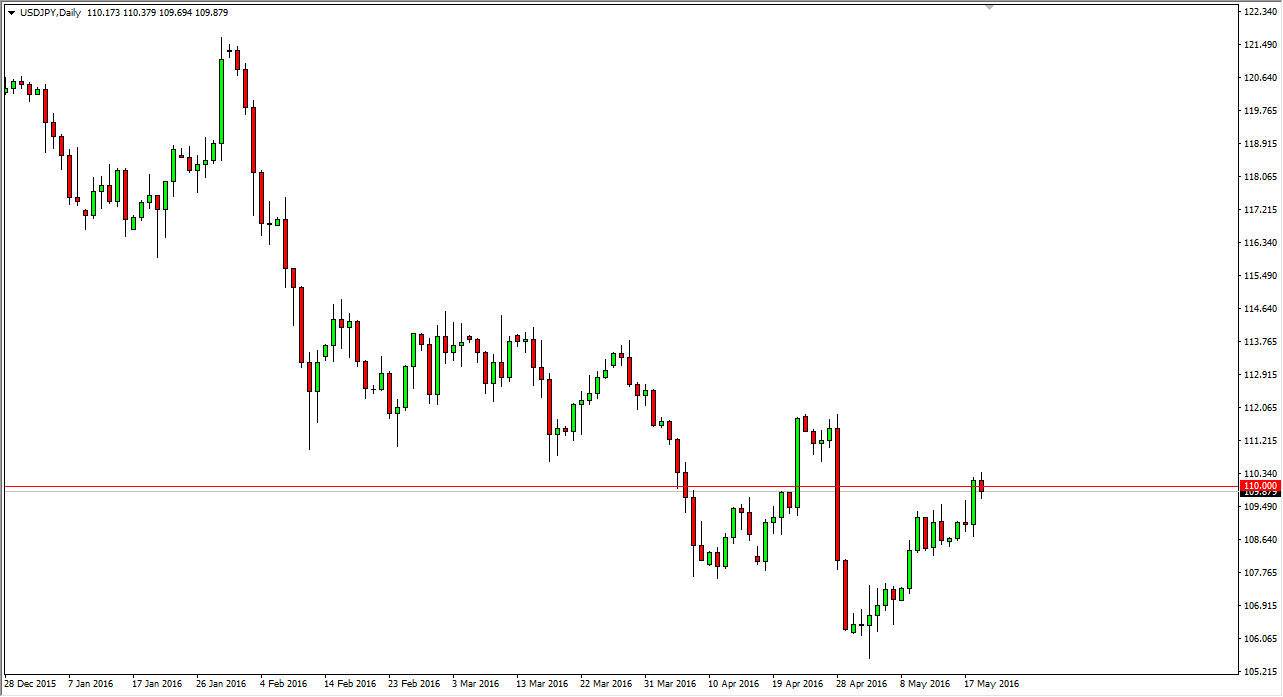

USD/JPY

The USD/JPY pair fell slightly during the course of the day on Thursday, as the 110 level has offered a bit of resistance as one would expect. This was an area that was fairly supportive in the past, so it makes sense that resistance could be expected at this point. The impulsive candle on Wednesday was fairly impressive, and as a result I still believe that the buyers are going to get involved in this market, and push the dollar higher. If we break above the top of the range during the session on Thursday, I believe that we will reach towards the 112 level. I also believe that there is a significant amount of support below at the 109 handle.

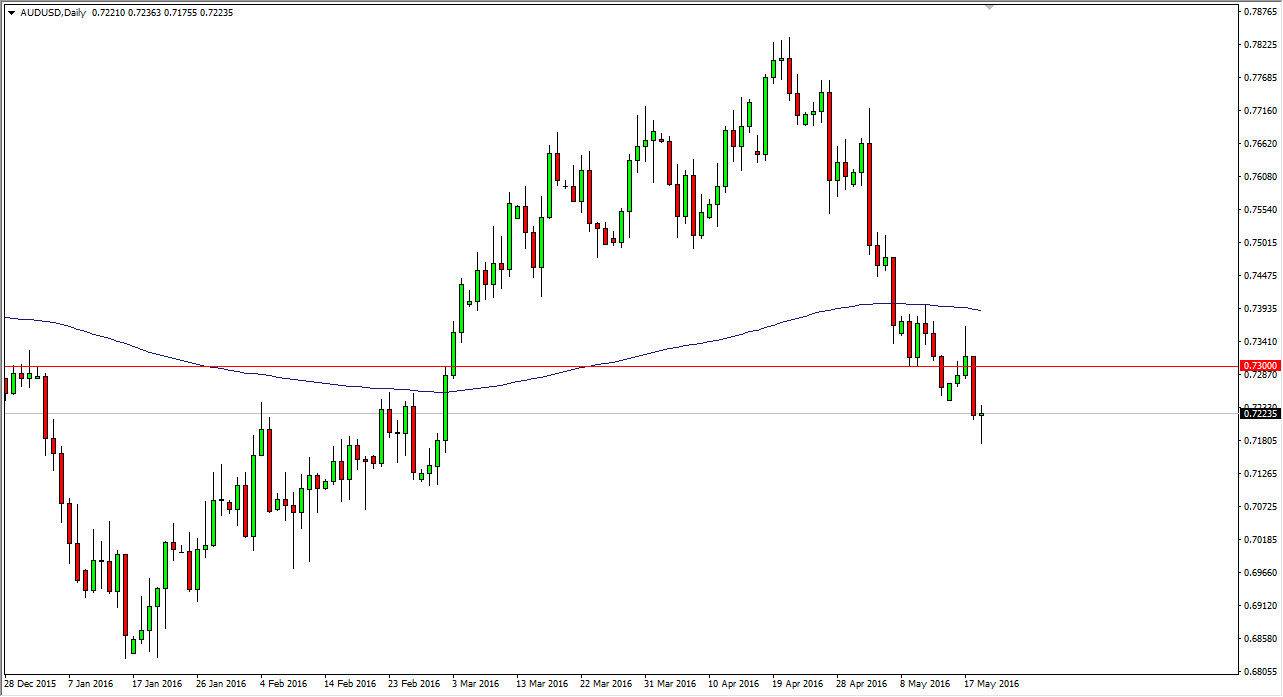

AUD/USD

The Australian dollar fell a bit during the course of the session on Thursday, but bounced off of support below to turn things around and form a hammer. The hammer of course is a very bullish sign, and if we can break above the top of a hammer, we should reach towards the 0.73 level above. That’s an area that has been supportive in the past, and should be resistive now. Because of this, I have no interest in buying this market, and I believe that simply waiting for exhaustive candle after a small rally would be the way to go to start selling. On the other hand, we do have the 200 day exponential moving average even above there, so this point it seems almost impossible to buy the Aussie.

Would also get a break down below the bottom of the hammer which of course would be very negative sign. At that point time, I would not hesitate to sell this market as it would be a continuation of the bearish pressure that we’ve seen recently. At that point, I would anticipate that the market could go down to the 0.70 level.