The USD/CAD pair has been one of the more interesting ones to pay attention to lately, because we have seen so much in the way of volatility when it comes to the crude oil markets. Personally, I believe that the $50 level in both the WTI and the Brent markets will continue to be very important, and I think that is essentially where the decision will be made as to where we go for the longer term. I think that the USD/CAD pair will of course be very heavily influenced by the oil markets as per usual, so with this being the case, you have to watch both markets at the same time.

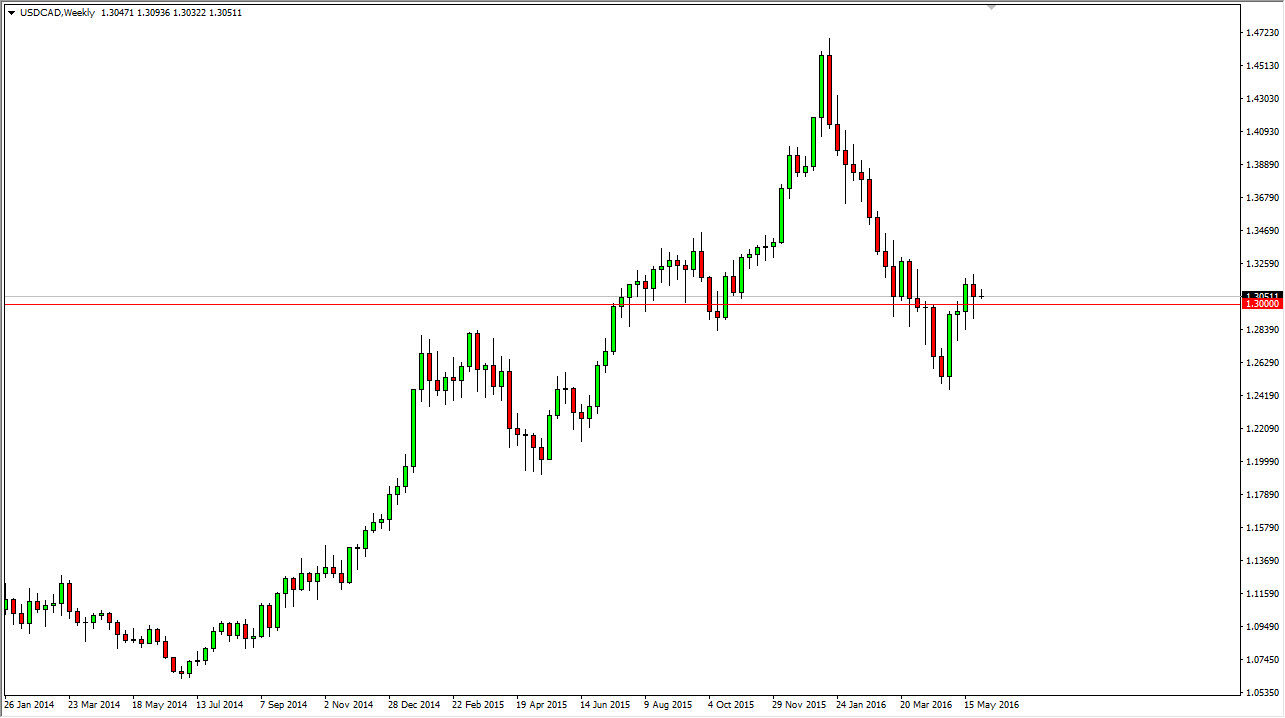

What I do find interesting is that we ended up forming a hammer for the course of the week, at least the last week in the month of May. The hammer sits just above the 1.30 level, and that of course is a nice large, round, psychologically significant number. If we can break above the top of that hammer, and more importantly the 1.32 level, we could go much higher.

Oil

Oil markets of course are more than important when it comes to this marketplace, so if we break above the top of the hammer, I think that the oil market also has to fall from the $50 level. If we fall significantly, and this market goes higher, then all things will be of the usual type of movement. On the other hand, if we break down below the bottom of the hammer for the last couple of weeks that had formed, and of course get oil going higher, it makes sense that we continue to fall. After all, oil is the biggest influence on this marketplace, but you also have to worry about the Federal Reserve and what they are going to do as far as interest rates are concerned. At this point in time, it seems that we are going to get one more interest-rate hike this year, but we still don’t know about the other two that had originally been anticipated.