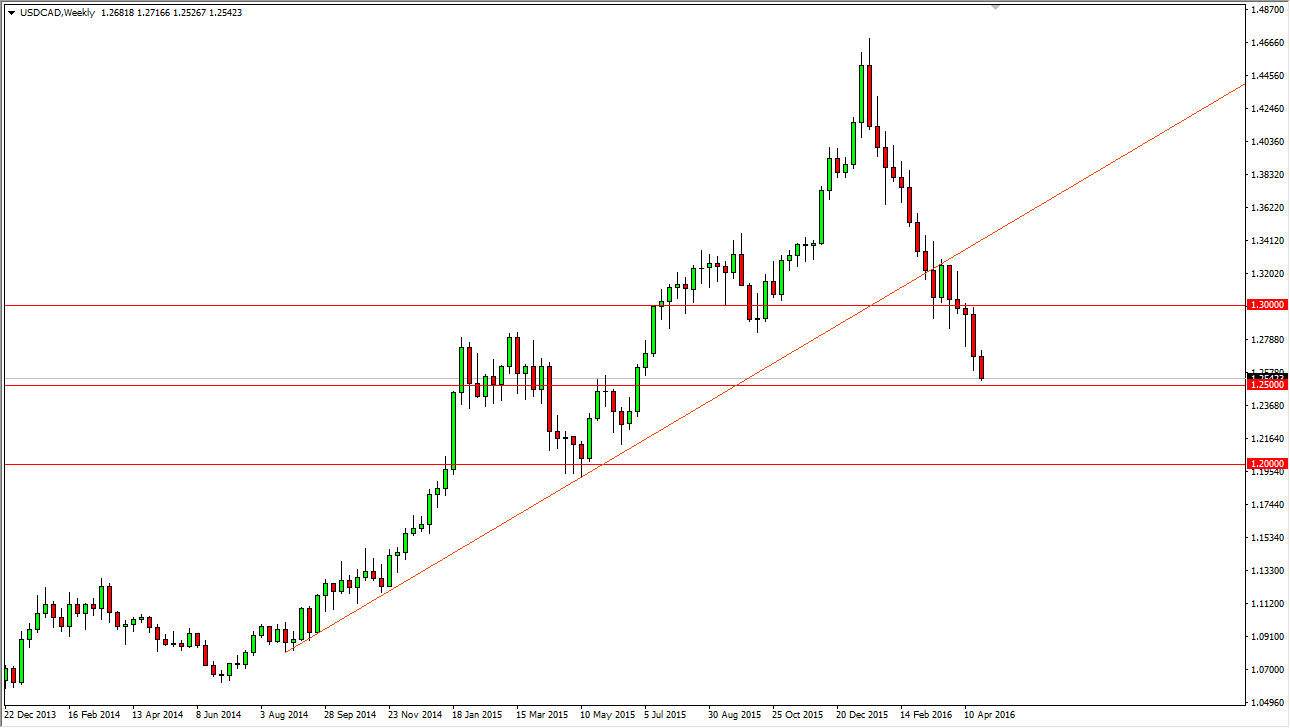

The USD/CAD pair fell significantly during the course of April, as we broke below the 1.30 level. This was an area that I thought was going to be massively supportive. With this, it looks as if we are reaching some type of inflection point. Crude oil markets have rallied significantly over the last month or 2, and the Canadian dollar has as well. The question now begs whether or not we can continue to go any lower? I think we can, as the 1.25 level is being tested. However, don’t be surprised if we see a little bit of a rally in the short-term.

Oil Markets

Oil markets continue to look very bullish, and if we can break above current resistance, the Canadian dollar should continue to show strength. The question with this particular market is whether or not we can break down below the 1.25 handle as a sign, but if we do I think we then reach towards the 1.21 handle, perhaps even the 1.20 level. However, there is another factor that could come into play.

The Federal Reserve certainly has a part to play in this currency pair as well. After all, the interest-rate situation is a bit of a question at the Federal Reserve right now, and with that being the case we will have to pay attention to what the Fed does next. The Federal Reserve is anticipated to raise interest rates sometime in June, but it appears that the currency markets aren’t necessarily buying this scenario. There were four expected interest-rate hikes coming out of the Federal Reserve previously, but recently we have seen a bit of a shift in thinking as people are now starting to speculate that there might only be a pair of them. With this, expect quite a bit of volatility, but at this point in time it does look like breaking down below the bottom of the trend line that had previously kept this market higher should send this market to lower levels.