USD/CAD Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at 1.3005.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken from 8am until 5pm New York time today.

Long Trades

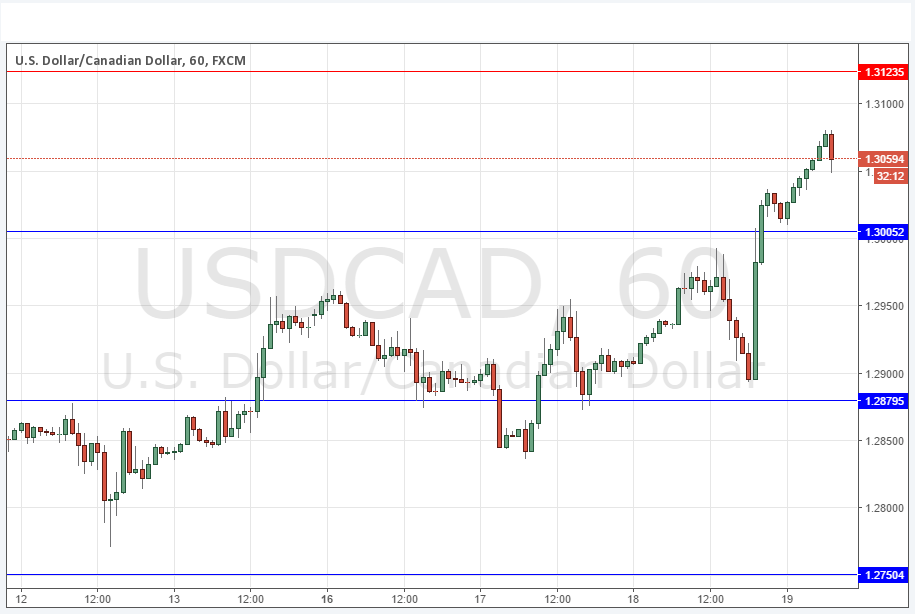

Long entry after bullish price action on the H1 time frame following the next touch of 1.2880 or 1.3005.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.3123.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

The price almost got back down to the support level at 1.2880 before taking off again bullishly when the FOMC meeting minutes were released. For a few minutes the price was unable to break up above the resistance level at 1.3005, but soon enough the break came and that level has not yet been tested from the other side. As it is a very big level, it is extremely likely to become supportive now.

This pair looks bullish as the prospect of higher interest rates for the USD does not just drive up that currency, it also arguably dampens demand for Crude Oil which would tend to put downwards pressure on the CAD.

There are no high-impact events due today concerning the CAD. Regarding the USD, there will be a release of Unemployment Claims and Philly Fed Manufacturing Index data at 1:30pm London time.