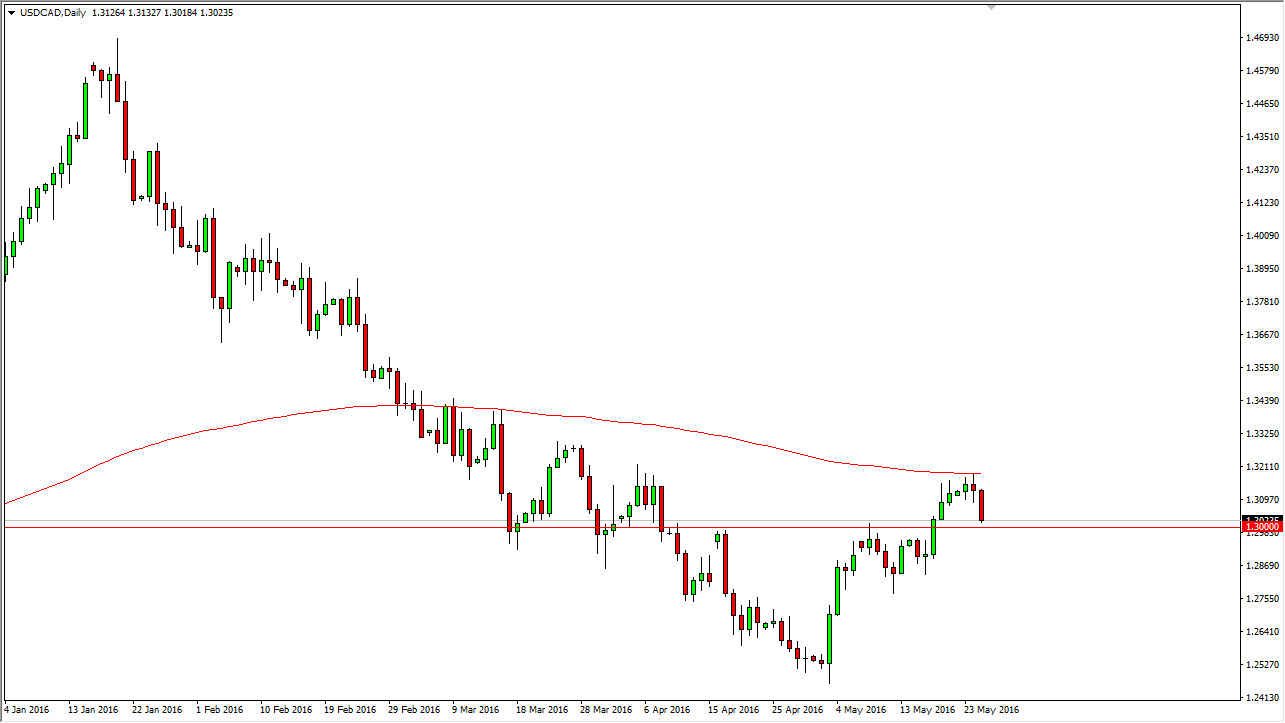

The USD/CAD pair fell during the day on Wednesday, as we approached and failed out the 200 day exponential moving average, denoted by the red line on my chart. However, I do think that the 1.30 level below is going to be somewhat supportive, so therefore we could have a bit of a fight on our hands. I recognize that we are closing at the very bottom of the candle for the session, and that typically means that we will get a bit of continuation, but I see a bit of support just below the 1.30 level.

On top of that, it is of course a large, round, psychologically significant number so I think that there will be some interest in that general vicinity anyways. I believe that the support goes all the way down to the 1.28 handle, so at this point in time I am a bit hesitant to start selling. Quite frankly, I think there are other forces at work here.

Canadian interest-rate

The Canadian interest-rate decision was a nonstarter, as the Bank of Canada held firm as we anticipated, so therefore there is in a whole lot to play off of when it comes to interest-rate expectations, or differential for that matter. With this being the case, I think that we are actually going to play this market according to what happens in the crude oil markets. Simply put, this pair tends to move inverse of what it has been doing, so if we continue to go higher, we should eventually break down. On entering, we can break above the resistance of the 200 day exponential moving average, I would be convinced that we are going to go much higher at that point in time. In the meantime, expect quite a bit of volatility, and choppiness to say the least. With that in mind, I am more or less waiting to get one of those longer-term signals to get involved.