USD/CHF Signal Update

Last Wednesday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trades

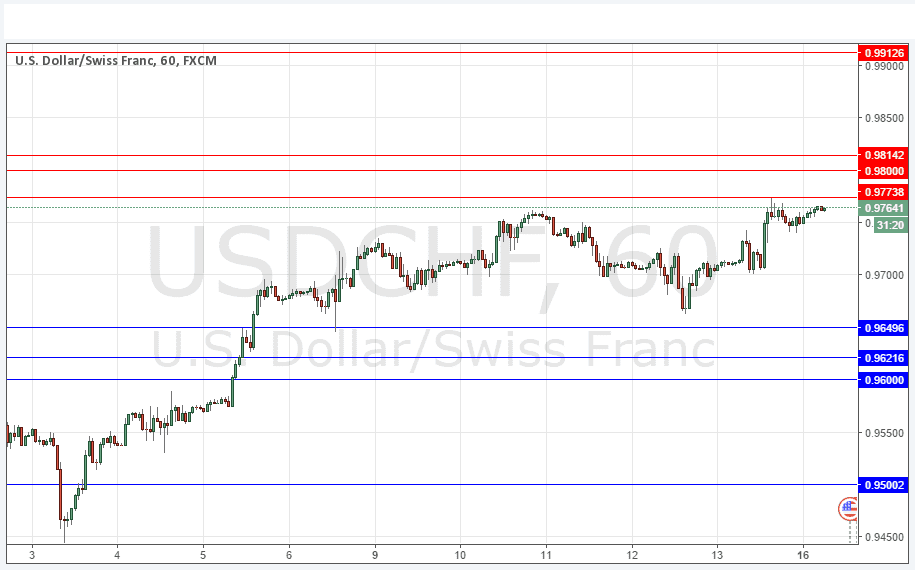

Go long after bullish price action on the H1 time frame following the next touch of 0.9650, 0.9622 or 0.9600.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9800, 0.9814 or 0.9913.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The conditions still remain the same: a strong USD over the past week or so that has not seen any news to turn the sentiment around, and a fairly weak CHF. It is likely to be a quiet day today, at least until New York opens.

Although the resistance at 0.9773 did contain the price towards the end of last week, the action of the recent prices suggests that we are going to continue moving upwards to the round number at 0.9800. This is a very resistant zone and might be an opportune place for a reversal.

There may be minor support at a retest of 0.9700.

There are no high-impact events due today concerning either the CHF or the USD. It is a public holiday in Switzerland.