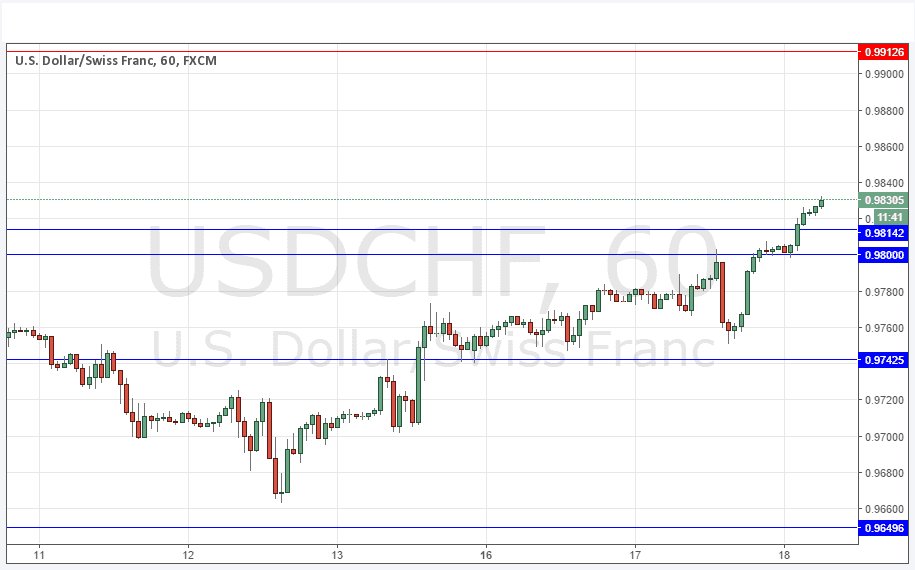

USD/CHF Signal Update

Yesterday’s signals triggered a profitable short trade following the rejection of resistance at 0.9800. However this trade is by now long and truly gone after the very strong bullish reversal which occurred later in the day.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 0.9814, 0.9800 or 0.9743.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 0.9913.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

There has been USD strength since the New York session, and we have seen a very clear break in this pair up past the previous strong resistance structure that was focused on 0.9800. This is probably now going to be good support. Before this movement there was an initial strong move down off 0.9800 that provided a profitable short.

It now looks as if this is going to be just about the best pair to use to take advantage of any continuing USD strength, especially off pullbacks to the 0.9800 area.

There are no high-impact events due today concerning the CHF. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time, followed later at 7pm by the FOMC Meeting Minutes.