USD/CHF Signal Update

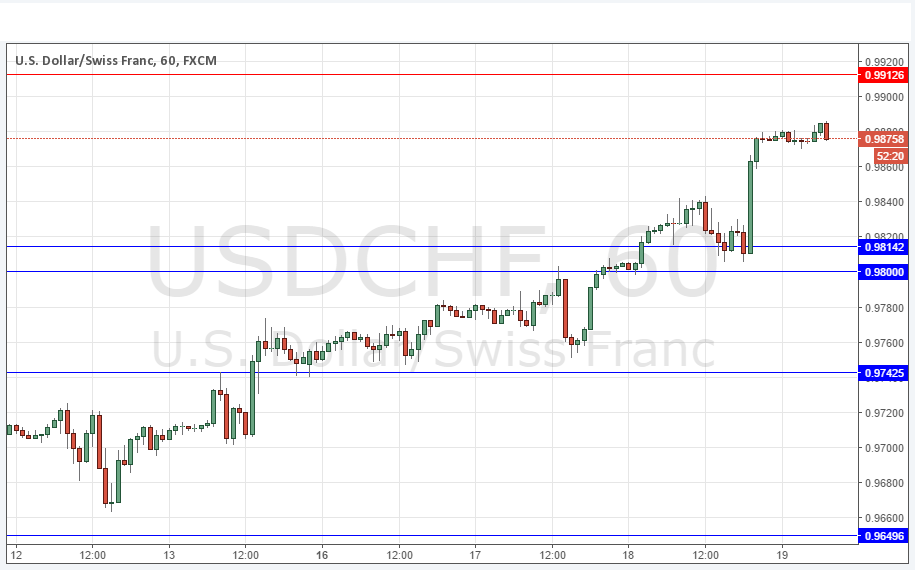

Yesterday’s signals produced a winning long trade during the London / New York session overlap, as there was a bullish candle rejecting the anticipated support level at 0.9814. It would be a good idea to take substantial partial profits if that has not been done already.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken from 8am until 5pm London time today.

Long Trades

Long entry after bullish price action on the H1 time frame following the next touch of 0.9814, 0.9800 or 0.9743.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 0.9913.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I wrote yesterday that the area at around 0.9800 was probably now going to be good support, and this turned out to be exactly right. The FOMC release strengthened the USD which already had the wind behind it in this pair and that has taken us up to new multi-week highs.

There is a key resistance level just a little above the round number at 0.9900, but nothing above that for quite a while. However I think the price might need to take some rest before it might be able to really break above 0.9913.

There are no high-impact events due today concerning the CHF. Regarding the USD, there will be a release of Unemployment Claims and Philly Fed Manufacturing Index data at 1:30pm London time.