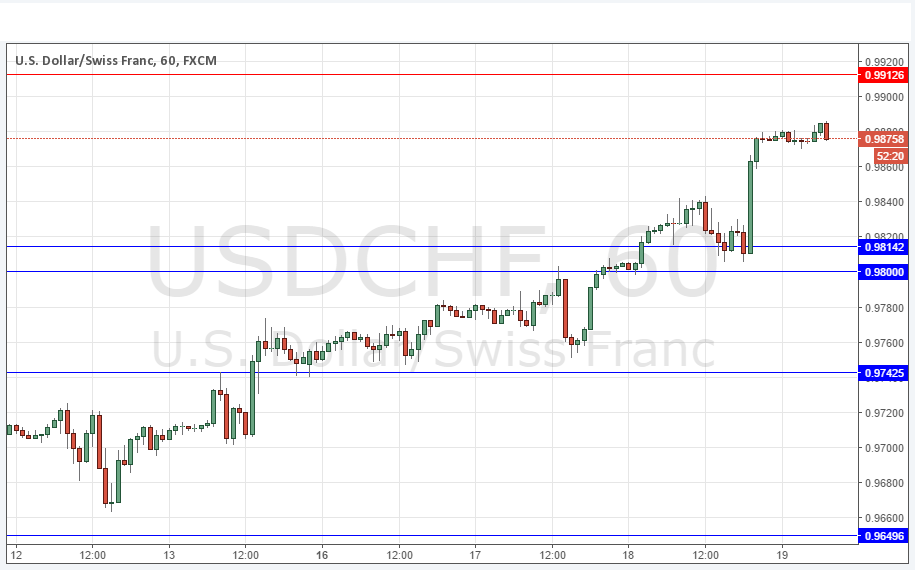

During the day on Wednesday, the US dollar took off to the upside against the Swiss franc, as we finally broke above the 0.98 resistance barrier. Because of this, I believe that the market will continue to grind its way higher, perhaps trying to reach as high as parity. This should coincide with a selloff in the EUR/USD pair, as the two tend to move in opposite directions. This seems to be more or less a run to the US dollar overall, and as a result the Swiss will more than likely be more than accommodating for this move as the Swiss National Bank would love to see a weaker Swiss franc.

Pullbacks are buying opportunities

I believe that going forward, pullbacks will continue to be buying opportunities and we should now have a significant amount support, perhaps even a “floor” somewhere near the 0.98 handle. Previously, we had formed something akin to an inverse head and shoulders, or perhaps even a “W pattern”, but the which are fairly bullish. That should give us a run of about 300 pips, maybe even 400. Either way, at this point time I believe that parity will be targeted, as it is a large, round, psychologically significant number. In fact, it is probably the most significant number when it comes to charts.

If we can get above the parity level, I believe the next target will be the 1.02 handle, which was the scene of significant resistance previously. The US dollar has had it struggles recently, but the Swiss of course will do whatever they can to facilitate a softer Swiss franc as it has played absolute havoc on the Swiss economy lately. As central banks around the world play the liquidity game, the one saving grace for the Swiss in this particular pair is that the Federal Reserve probably isn’t paying too much attention to it as it is such a small trading partner to America.