By: DailyForex.com

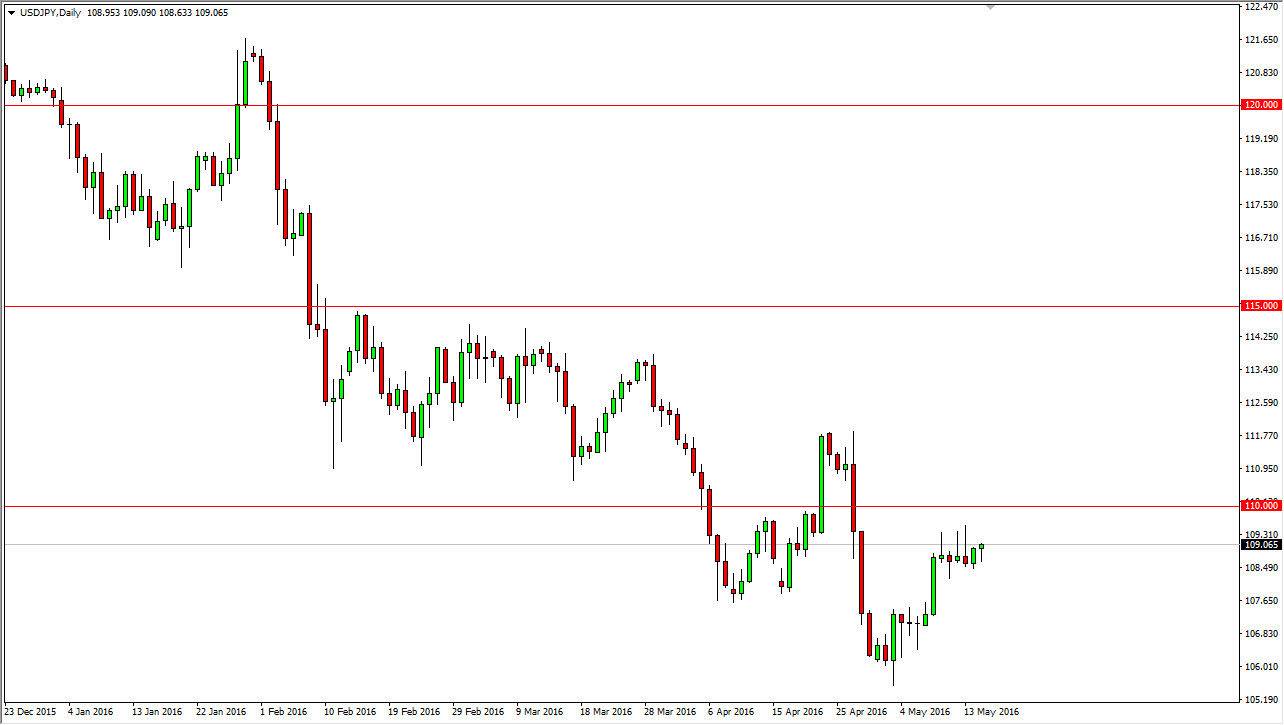

USD/JPY

The USD/JPY pair initially trying to rally during the course of the day on Monday, but could not continue the momentum to the upside in order to break out. There is a massive amount of resistance between here and the 110 level in my estimation, so I do not think that it’s going to be easy to buy this pair. At the same time though, I can certainly see where there is a significant amount of support, so given enough time I think that pullbacks might be buying opportunities more than anything else. It is possible that we can break above the 110 level, and start buying there but I don’t think it’s going to happen today. Quite frankly, this is probably a market that’s best left alone until the momentum picks back up.

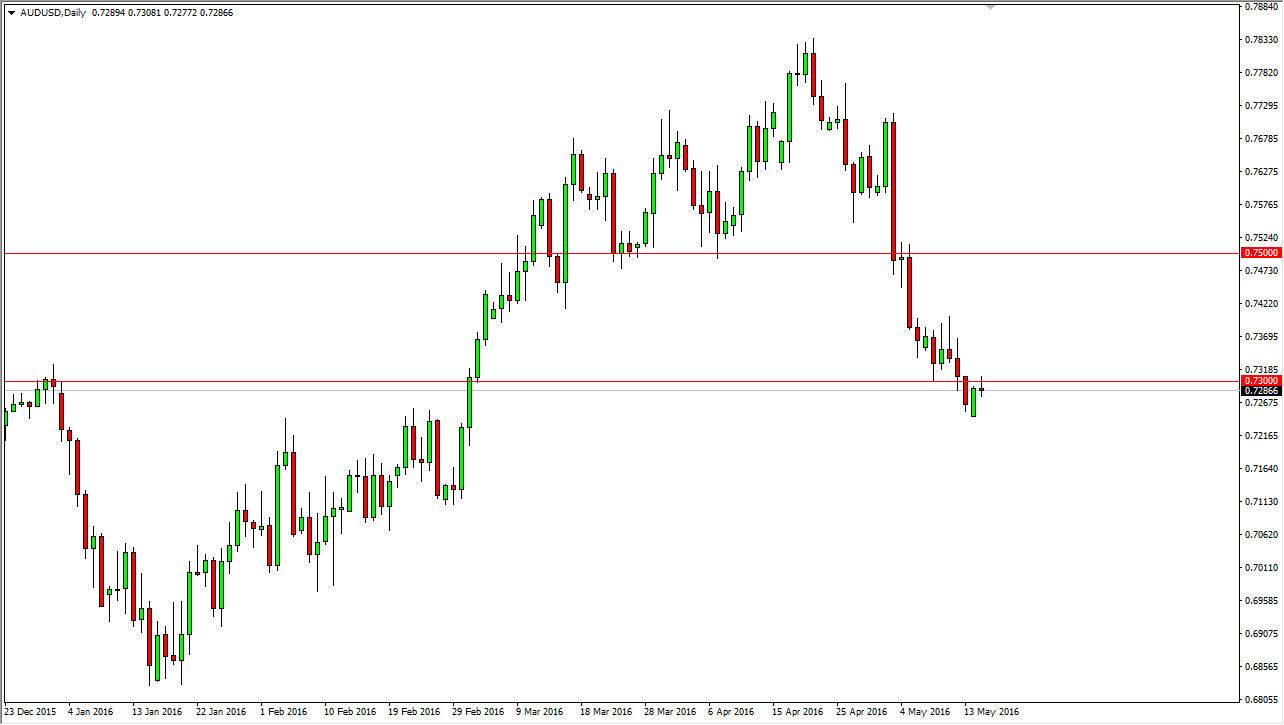

AUD/USD

The AUD/USD pair initially tried to go higher during the day on Monday, but ran into a significant amount of resistance at the 0.73 level. The market does have a substantial amount of support below here, but at this point in time I think you are probably better served selling short-term rallies that show signs of exhaustion like we got on Monday. I think we will grind lower, and as a result this is going to be more or less a “short-term only” type of market going forward.

I think there is significant resistance above the 0.73 level all the way to the 0.74 level, so I’m willing to simply ignore bullish pressure until we break above there. Quite frankly, I do believe that the Australian dollar continues to go lower over the longer term, unless of course gold suddenly skyrocket. The Reserve Bank of Australia recently cut interest rates in a bit of a surprise move, and that of course will continue to weigh upon the value of the Aussie dollar going forward. Selling short-term rallies that show signs of exhaustion will be the easiest way to trade this market.