USD/JPY

The USD/JPY pair fell during the course of the session on Friday, as we continue to see traders buying the Japanese yen. After all, the Bank of Japan step away from what they had been thinking was going to be another dovish statement, and failed to add to quantitative easing. With that being the case, it caused a bit of a shock in the marketplace and we have now seen this market drop down well below to make a fresh, new low. With this, I think it’s only a matter time before we fall down to the next logical large, round, psychologically significant number: the 105 level. I believe that rallies will be sold on signs of exhaustion, and have no interest whatsoever in buying this pair at the moment as it certainly seems like a bit of a one-way trade.

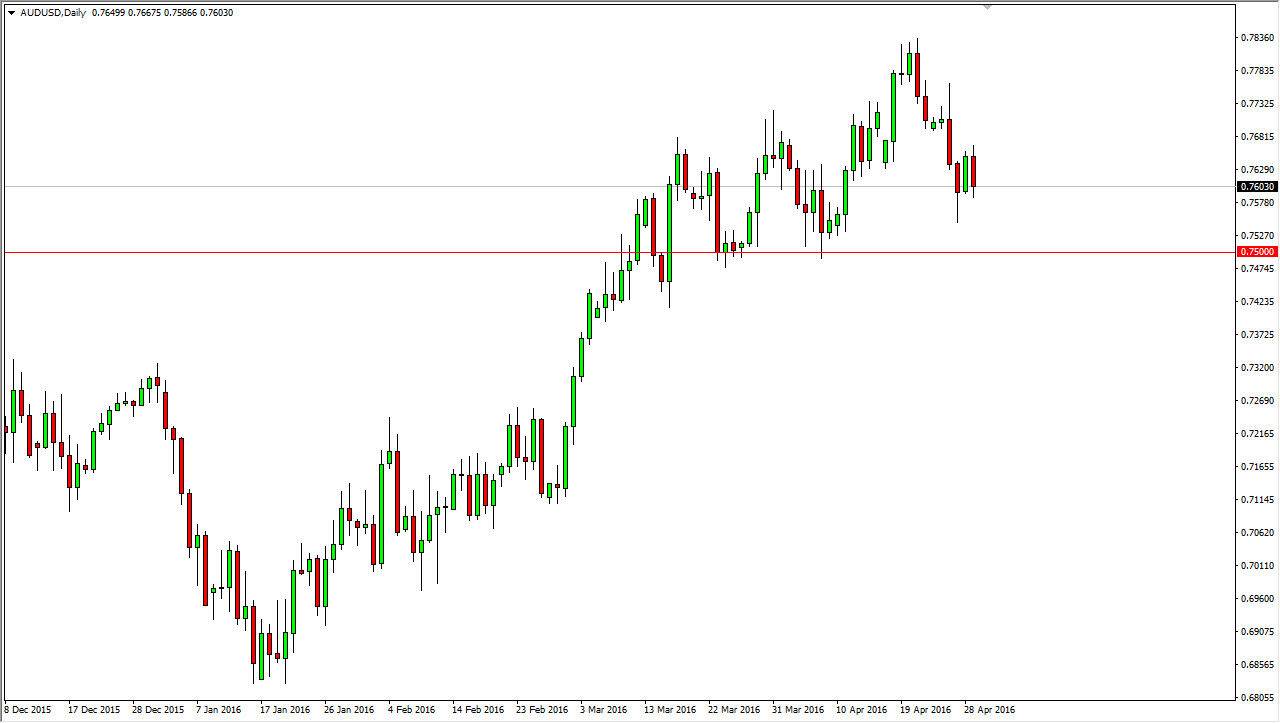

AUD/USD

The Australian dollar fell during the course of the day on Friday but we still have plenty of support just below in order to keep the market somewhat afloat. With this being the case, it’s probably only a matter time before the buyers step back into this market and start going long. I would love to see some type of supportive candle just above the 0.75 level, as it would be the logical place to see it based upon the recent breakout and of course the recent support at that level. I also think that the support extends all the way down to the 0.74 handle, and as a result I am essentially “buy only” when it comes to this marketplace.

Pay attention to the gold market, as it will more than likely have a great influence on this pair. The Australian dollar is very sensitive to the gold market anyway, and right now it appears of the gold markets are trying to make a move. If they do, it is a natural extension that the value the US dollar goes down, most certainly against the Australian dollar as it is a bit of a proxy for the yellow metal.