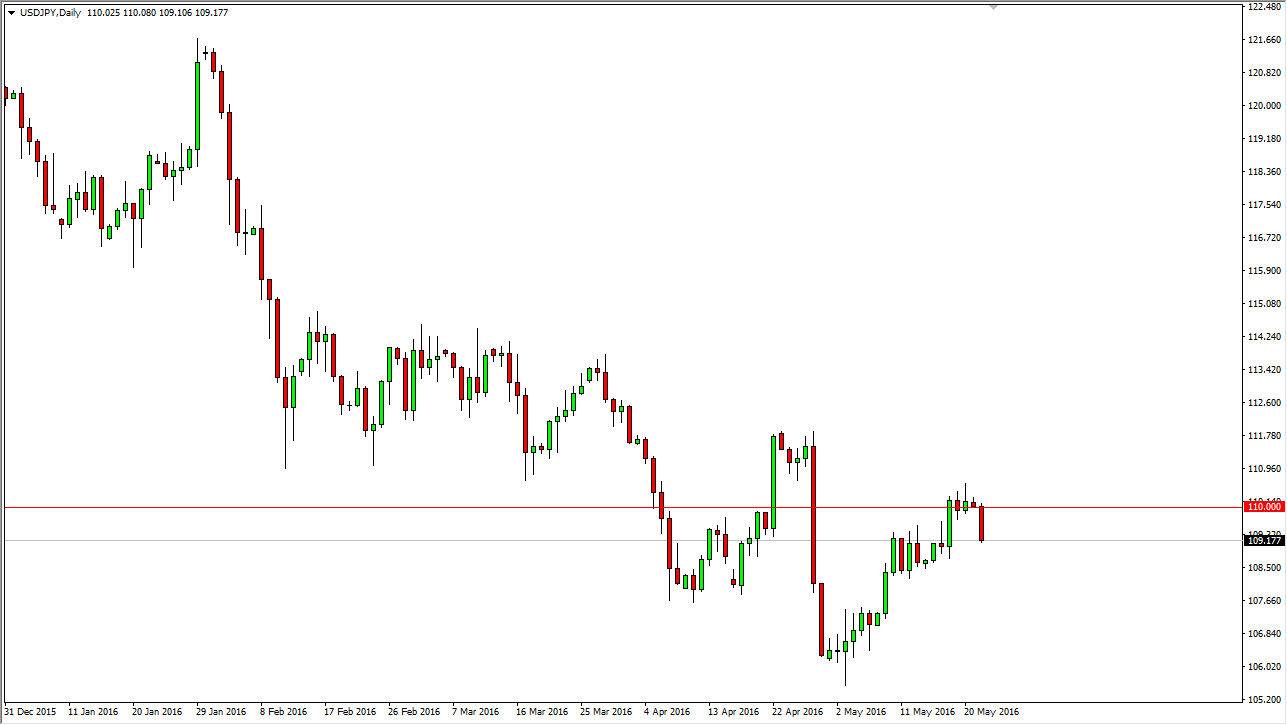

USD/JPY

The USD/JPY pair fell during the day on Monday, as the 110 level offered so much in the way of resistance. This is a market that of course is very sensitive to risk appetite, as the Japanese yen is considered to be the ultimate “safety currency.” With this, the market tends to favor the Japanese yen as we have quite a bit of concern out there. In this sense, the pair is a bit different than most of the other Forex pairs as the US dollars considered to be the “riskier currency.”

There is a significant amount of support just below, extending all the way down to the 108.50 handle. Because of this, some type of supportive candle in that area could be a buying opportunity, and on top of that we could break above the top of the shooting star from the Friday session, which of course would be a buying opportunity. If we can break below the 108.50 level, we will go farther to the downside.

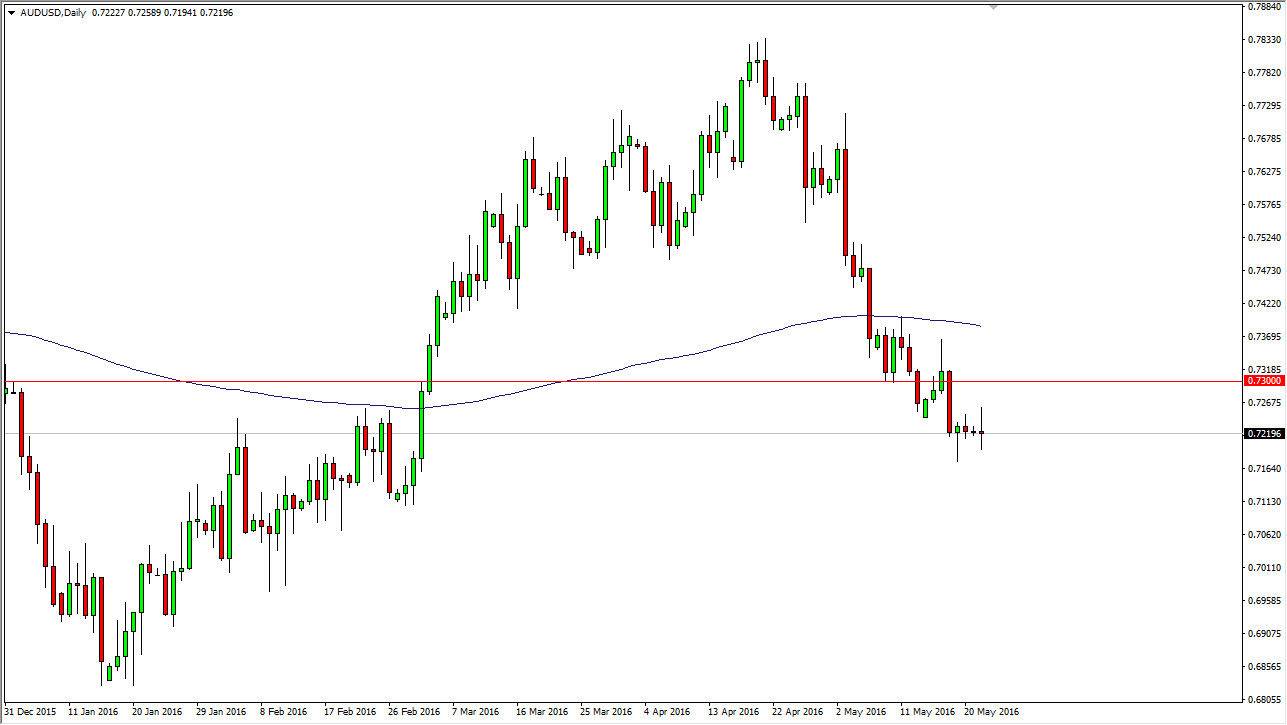

AUD/USD

The AUD/USD pair did very little during the day on Monday, as we had seen quite a bit of volatility during the day, but absolutely nothing resembling any type of determination. The 0.73 level above should be resistance, just as the 200 day exponential moving average above is also. In fact, at this point in time I have no plans whatsoever on buying the Australian dollar, and I believe that any rally will eventually offer a nice selling opportunity when we run out of momentum. I suppose if we can break above the 200 day exponential moving average, it might be possible to start buying, but at this point in time it seems very unlikely that happen.

If we can break down below the bottom of the hammer from a couple of sessions ago, that could also be a nice opportunity to start selling as it would show a pickup in momentum to the downside.