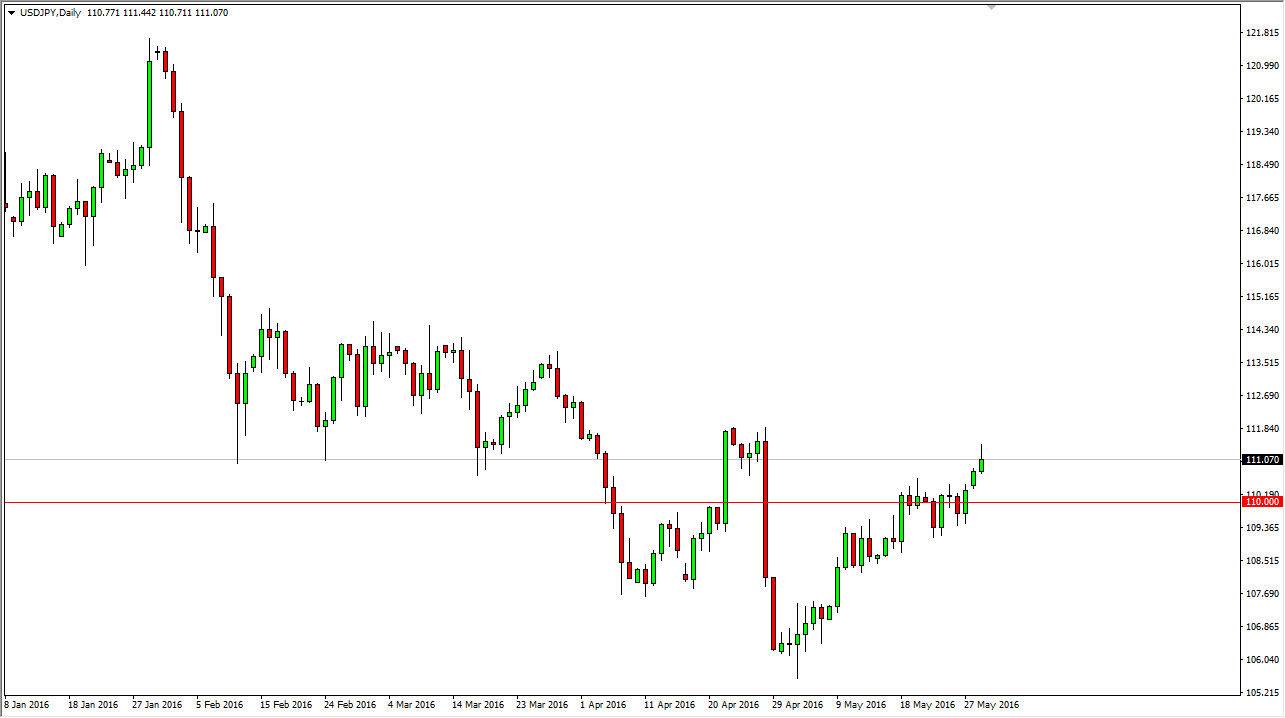

USD/JPY

The USD/JPY pair initially rallied during the session on Monday, which of course would of been a little bit thin due to the fact that the Americans were celebrating Memorial Day. That shuts down any trading by the Americans, so you can only put so much trust in this candle. The shooting star that formed for the day suggests that we could very well pullback but I think this is just simply going to be an opportunity to take advantage of value as it appears the market is trying to build up enough momentum to finally make the overall breakout. I have no interest in selling, and I believe there is a massive amount of support all the way down to the 109 handle. On the other hand, if we break above the top of the shooting star and more importantly the 112 level, I think the market goes much higher.

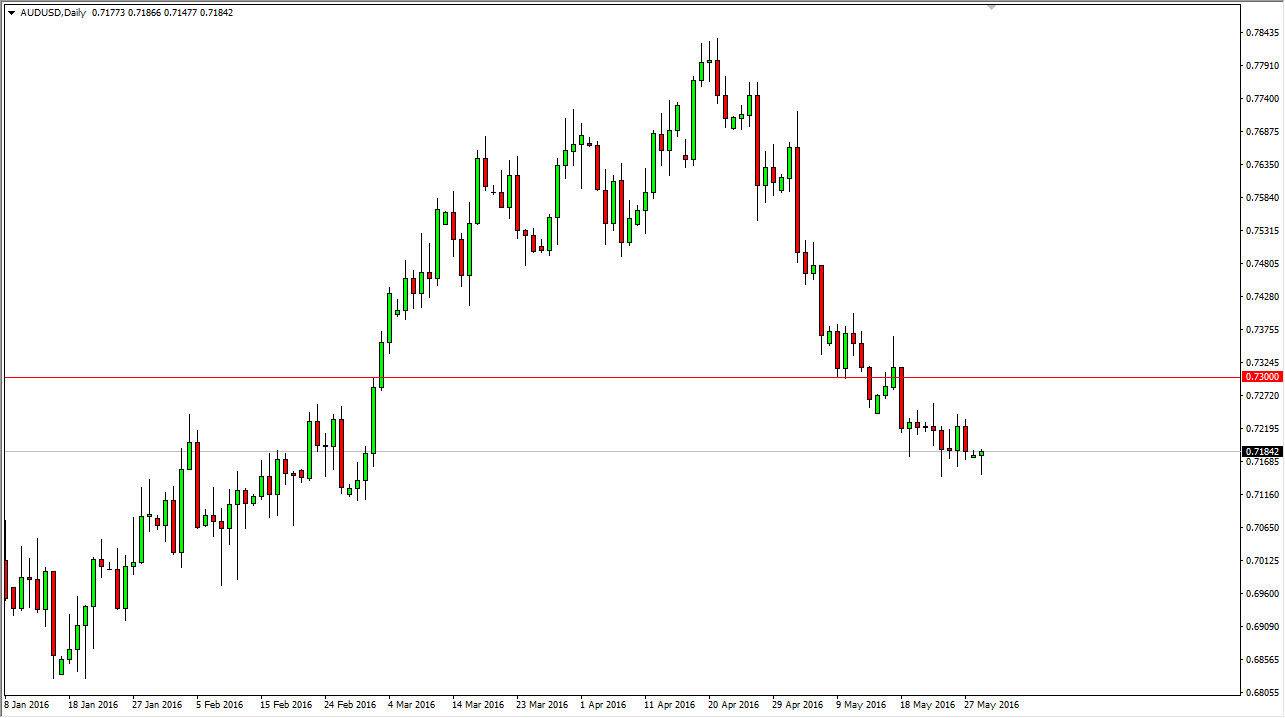

AUD/USD

The AUD/USD pair fell initially during the day on Monday but turned around to form a hammer. The hammer of course is a very bullish sign but I think there is quite a bit of resistance just above, especially once you get Close to the 0.73 level which was so supportive in the past. With that being the case, I think that a short-term buying opportunity may be presenting itself but I’m not looking to hang onto anything for more than just a few scant hours.

If we break down below the bottom of the hammer, then I believe we could break down even further and perhaps try to reach down to the 0.70 level, a psychologically significant number on the longer-term charts as well as the short-term charts. Ultimately, I believe that this is a market that will be very choppy to say the least, and as a result I am sticking to the short-term charts in the meantime.