USD/JPY

The USD/JPY pair rose slightly during the course of the day on Thursday, but still remains fairly well surprised. I think that the 108 level above is still going to continue to cause a bit of resistance. However, this is the Nonfarm Payroll session, so it’s very likely that the market will continue to be volatile during the day, as it typically is during these announcements. Ultimately, I believe that we are trying to build some type of base that we can go long from, but truthfully it is probably going to be easier to wait until we get a daily close. There has to be quite a bit of resistance between the 108 and the 110 levels, so having said that, expect a lot of volatility.

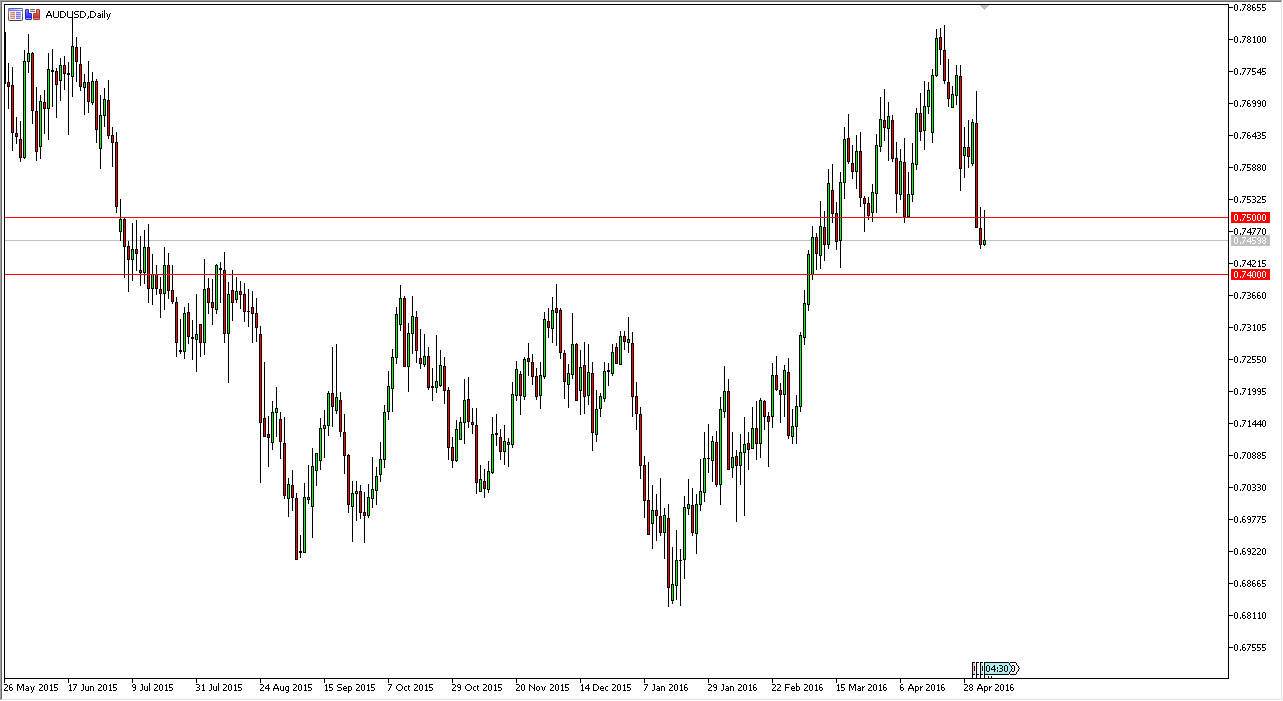

AUD/USD

The Australian dollar initially tried to rally during the day on Thursday, but struggled at the 0.75 level. By doing so, we ended up turning back around and forming a bit of a shooting star. I think we are going to try to grind a little bit lower from here, but I see the support extending all the way down to the 0.74 level below. It’s not until we get below there that I am willing to sell.

If we do break above the top of the shooting star for the Thursday session however, at that point in time I would assume that we are going to continue the longer-term uptrend, and reach towards the 0.78 level at that point. If we can break above there, the market should then go to the 0.80 level. Pay attention to the gold markets, because the Australian dollar is quite often influenced by that particular commodity as the Australians are one of the largest exporters of the yellow metal in the world.

Keep in mind that the Reserve Bank of Australia recently cut interest rates, so there is still a lot of trepidation when it comes to the Australian dollar itself. But having said that, the US dollar has been on its back foot lately as well.