USD/JPY Signal Update

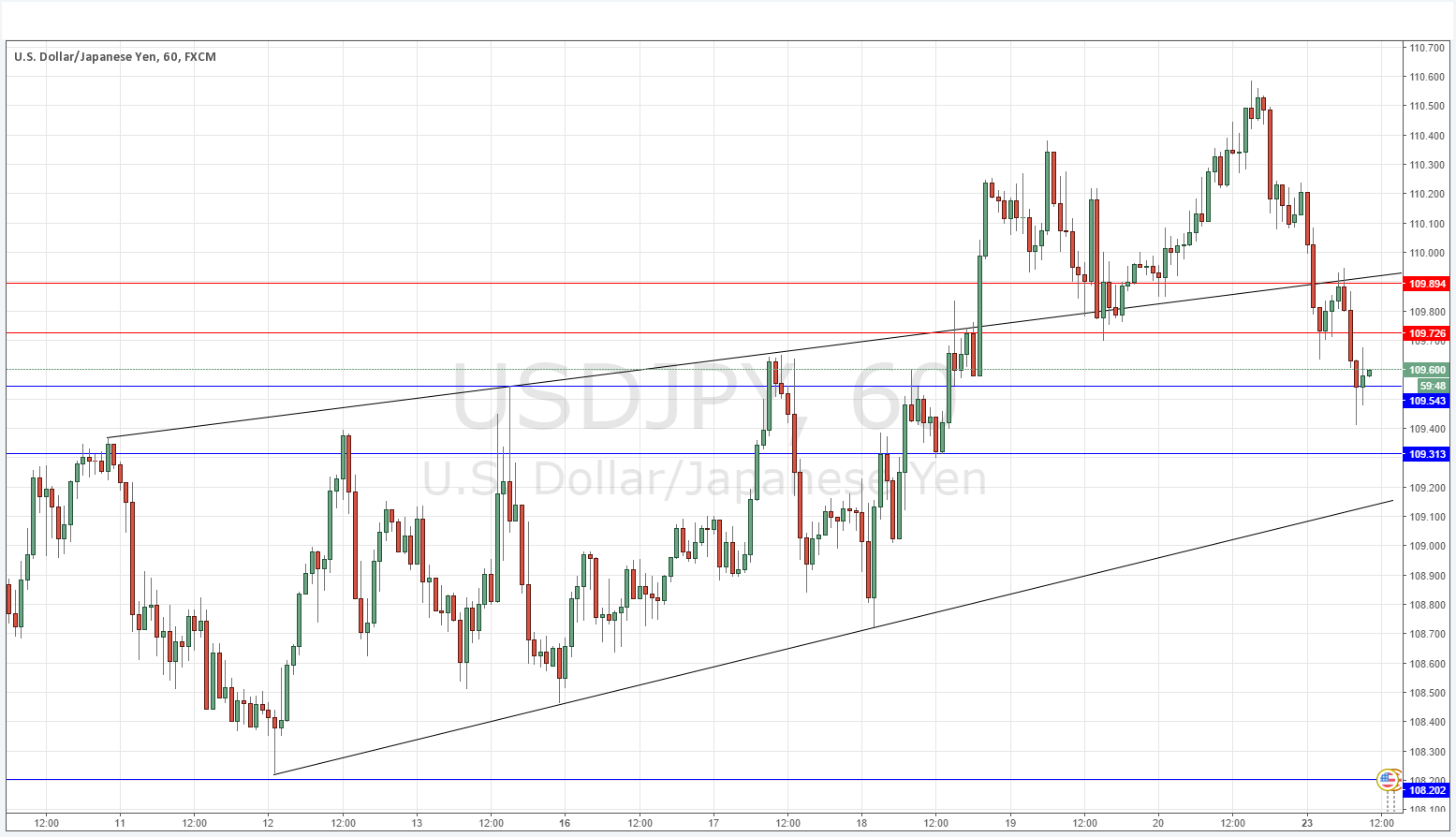

Last Thursday’s signals gave profitable long trades off support levels at 109.89 and 109.80.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be entered from 8am New York time until 5pm Tokyo time.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 109.73 or 109.89.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at 109.15, or 109.31.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

We have had quite a strong downwards move since late Friday, continuing since trading opened this week. The price fell back into the channel, pulling back and then finding resistance at 109.89 which was confluent with the upper trend line of the channel, so this seems to have now flipped from support to become resistance. The same thing has probably happened at 109.73. Don’t forget that this pair is still within a long-term downwards trend.

There seems to be support at 109.54 or thereabouts which is currently holding up the price.

This pair is worth keeping an eye on.

There are no high-impact events due today concerning either the JPY or the USD.