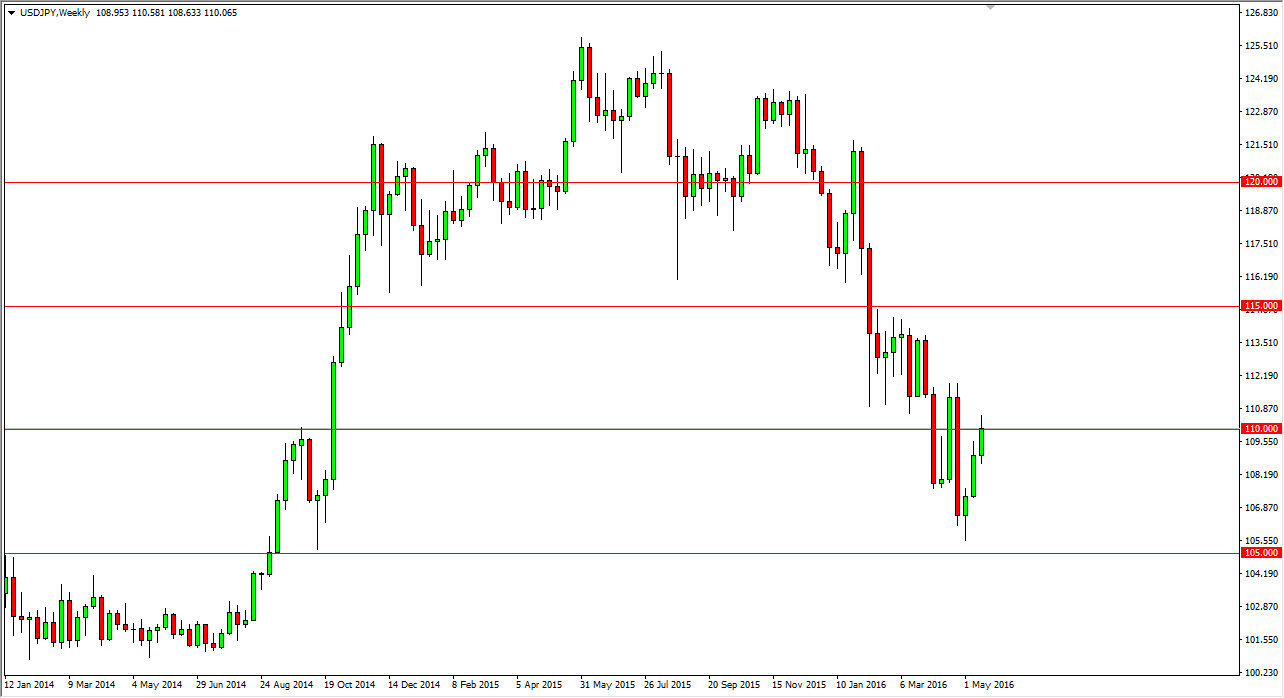

USD/JPY

The USD/JPY pair rose during the course of the week, but struggled at the 110 level. Because of this, I think that we will still have quite a bit of bearish pressure in this market, especially considering that the Friday candle itself was a shooting star. If we can break down below though bottom of the candle, the market will more than likely drop down to the 109 level, if not the 108 level. On the other hand, if we can break above the top of the range for the week, the market could very well go looking for the 112 handle.

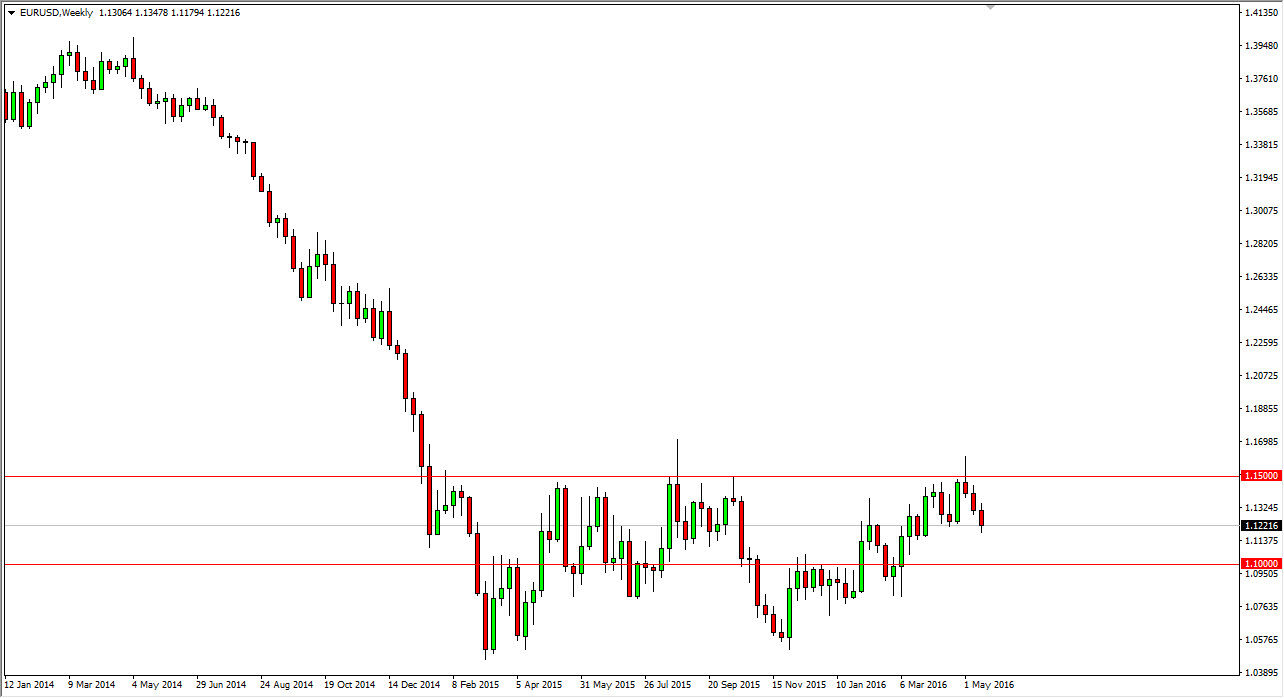

EUR/USD

The EUR/USD pair fell during the course the week, but remained supported near the 1.12 level. I think that we may get a short-term bounces week, but I’m not expecting much in the way of movement. In fact, this is a market that I will be surprised if I place any trades in or the next several sessions.

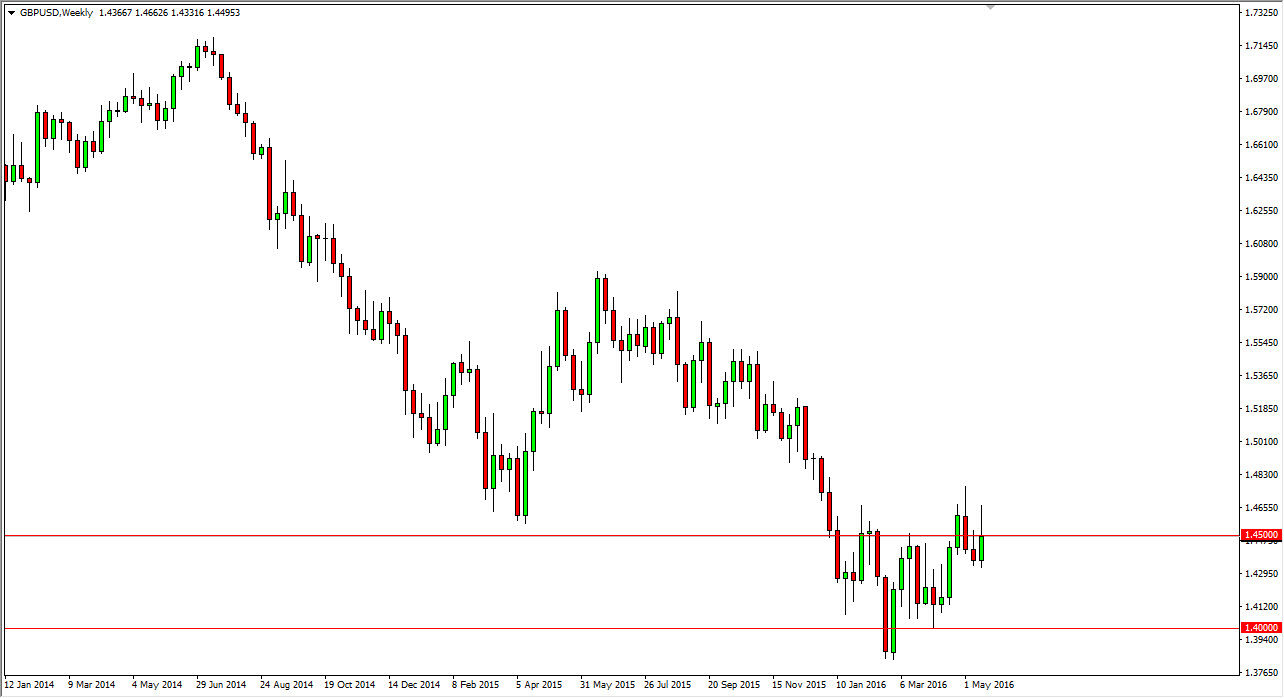

GBP/USD

The British pound continues to be very volatile as concerns about the United Kingdom leaving the European Union continues to be in the forefront of trader’s minds. Ultimately, at this point in time I believe that the market will try to grind itself lower but there is going to be so much volatility due to headlines that this is a pair that could be very difficult to deal with over the next several sessions, at least until we get to the month of June when we get the vote.

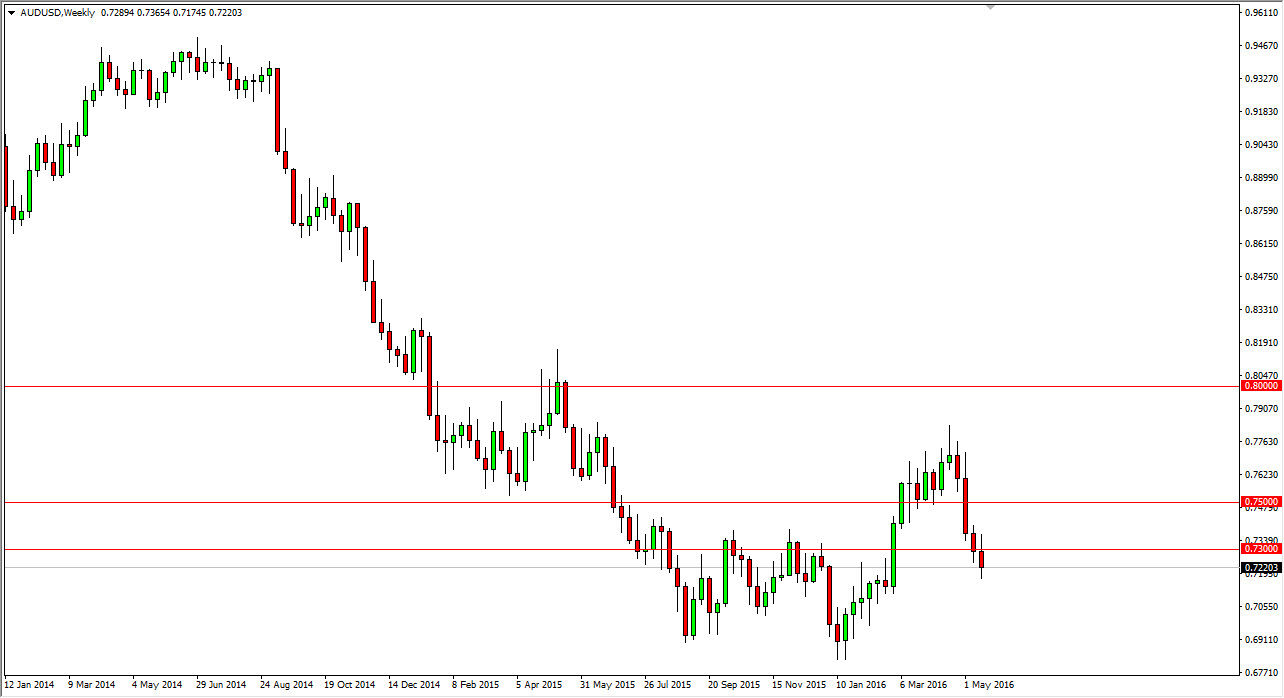

AUD/USD

The AUD/USD pair went back and forth during the course of the week, but the thing that I noticed is that even with the short-term rally we have seen quite a bit in the way of resistance near the 0.73 level. Ultimately, I think that we will continue to see bearish pressure in this market as the Reserve Bank of Australia has cut rates recently. Short-term rallies will be selling opportunities based upon exhaustion as far as I can tell.