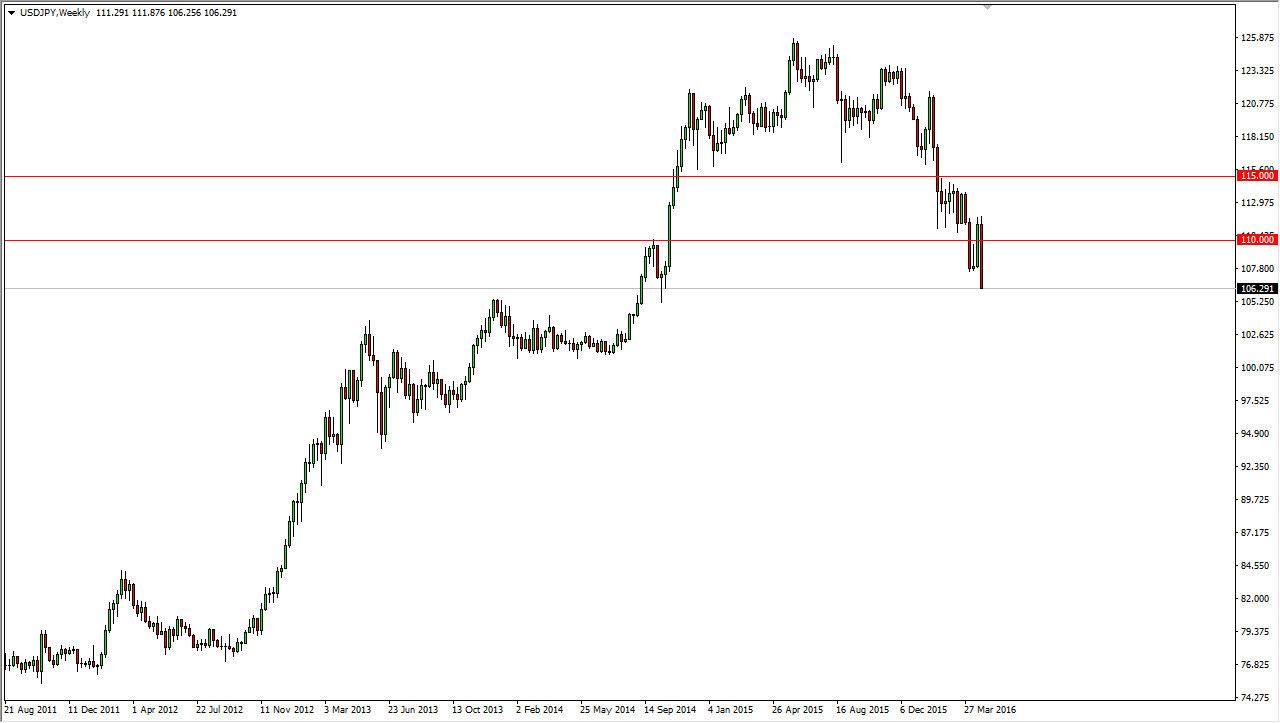

USD/JPY

The USD/JPY pair broke down significantly during the course of the week, as we are now well below the 110 level, and even closed below the 107 level. With that being the case, I believe that rallies will continue to be sold off. I believe that the market is now going to try to reach towards the 105 handle.

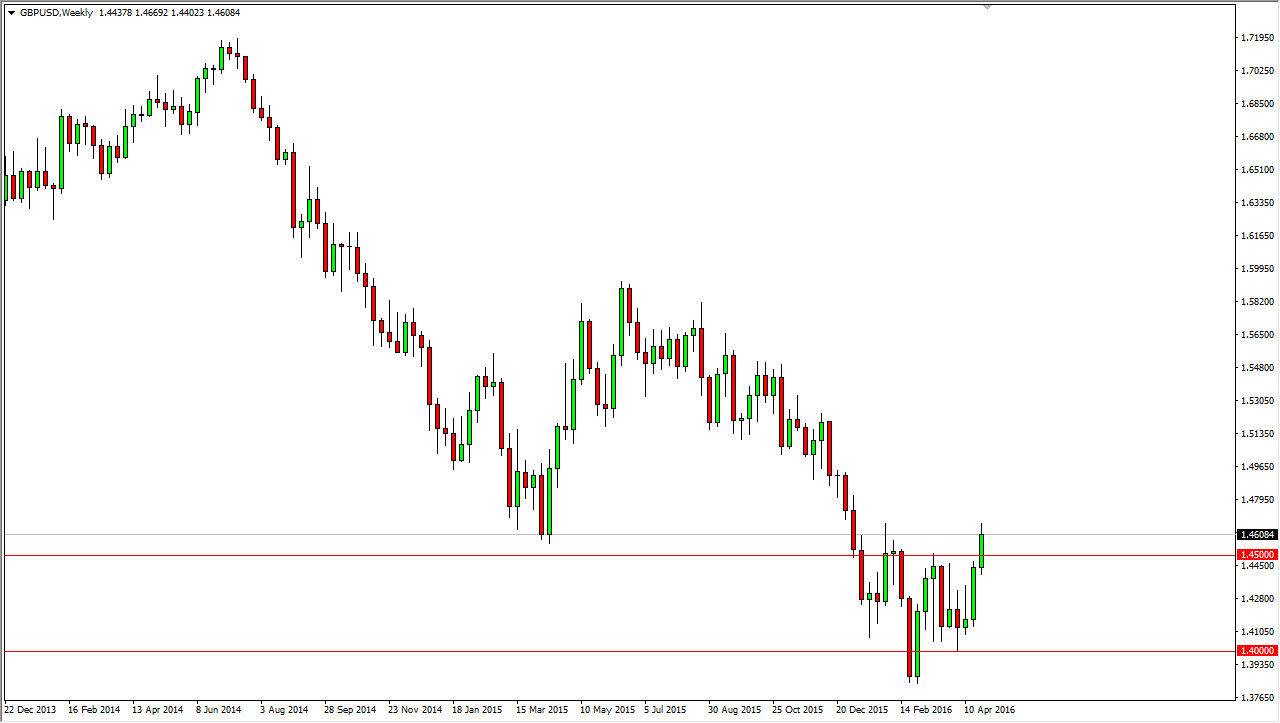

GBP/USD

The British pound rose during the course of the week, clearing the 1.45 level in the process. If we can break above the top of the range for the week, I am more than willing to start buying this pair as I feel we will then try to grind away towards the 1.50 handle. It looks as if the US dollar is on its back foot in general right now, so the British pound probably won’t be any different.

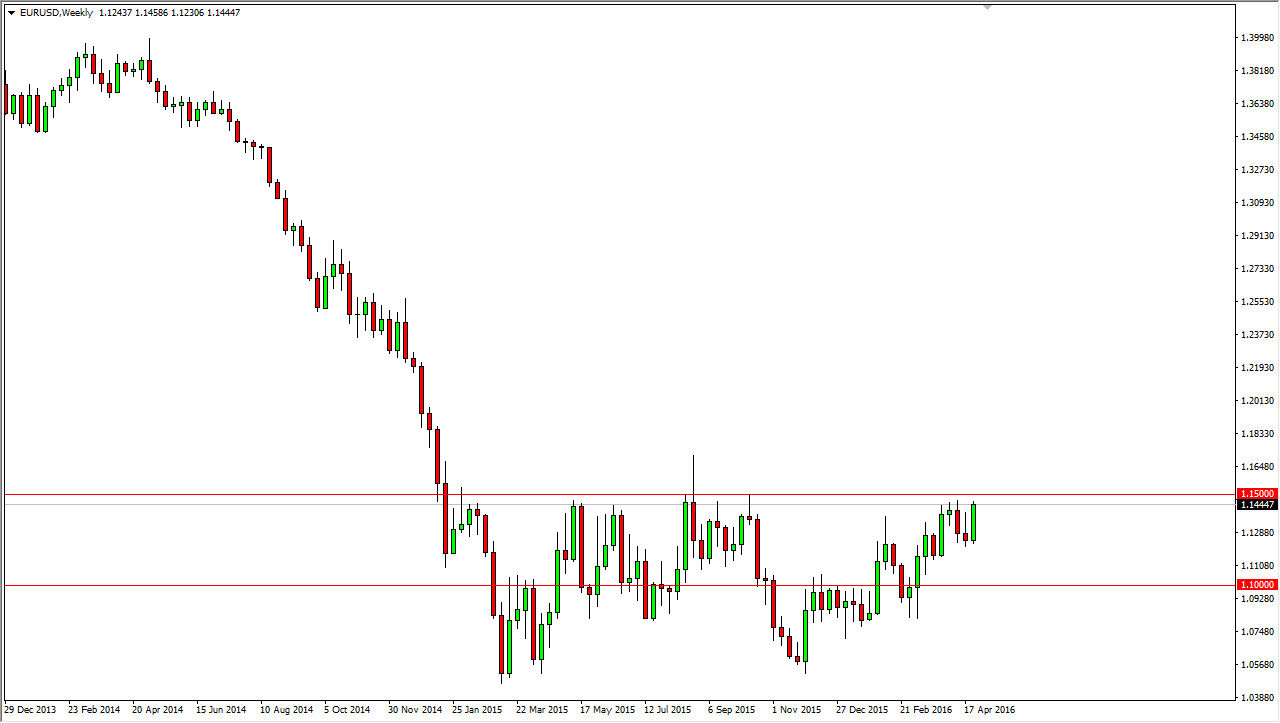

EUR/USD

The EUR/USD pair broke higher during the course of the week, clearing the top of the shooting star from the previous week. Because of this, the market will more than likely try to break above the 1.15 level and if it does I feel that we will finally break out to the upside for a longer-term move. In fact, if we can do that I believe that we are going to try to go as high as 1.25, although not this week obviously. Pullbacks offer buying opportunities.

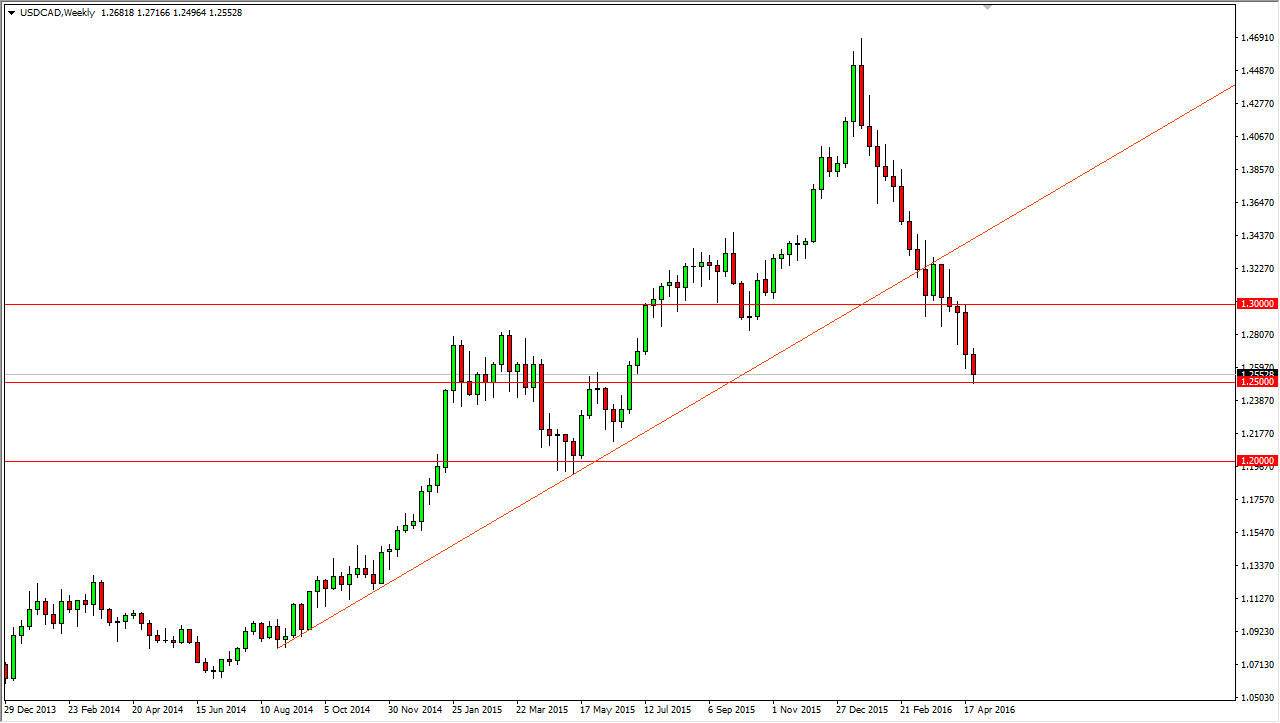

USD/CAD

The USD/CAD pair fell during the course of the week, touching the 1.25 level. I believe there is significant support here, but any pullback at this point in time will only end up forming an exhaustive candle to start selling. I believe that the 1.30 level is the floor in the foreseeable future. With this being the case, keep an eye on oil but it certainly looks like it wants to go higher, and that typically drives this pair lower in the process. In fact, I believe that the trend line being broken previously was gold that we were starting to run into real trouble. Further confirmation was shown last week once we broke below the bottom of the hammer from the previous week.