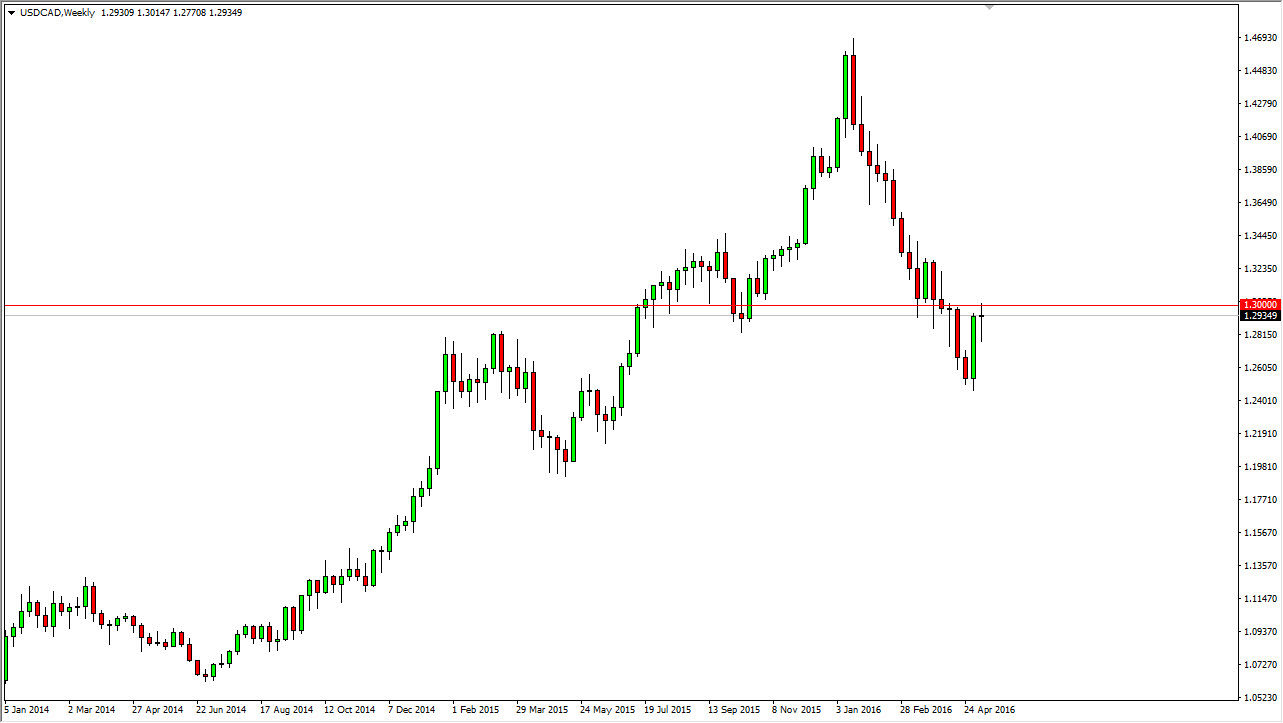

USD/CAD

The USD/CAD pair initially fell during the course of the week but turned right back around to form a hammer on the weekly chart. I believe that we are simply trying to build up enough momentum to break above the 1.30 level. If and when we do, the market should continue to go much higher, perhaps 2 handle. I believe that of course you have to pay attention to oil, and right now it does look likely to struggle.

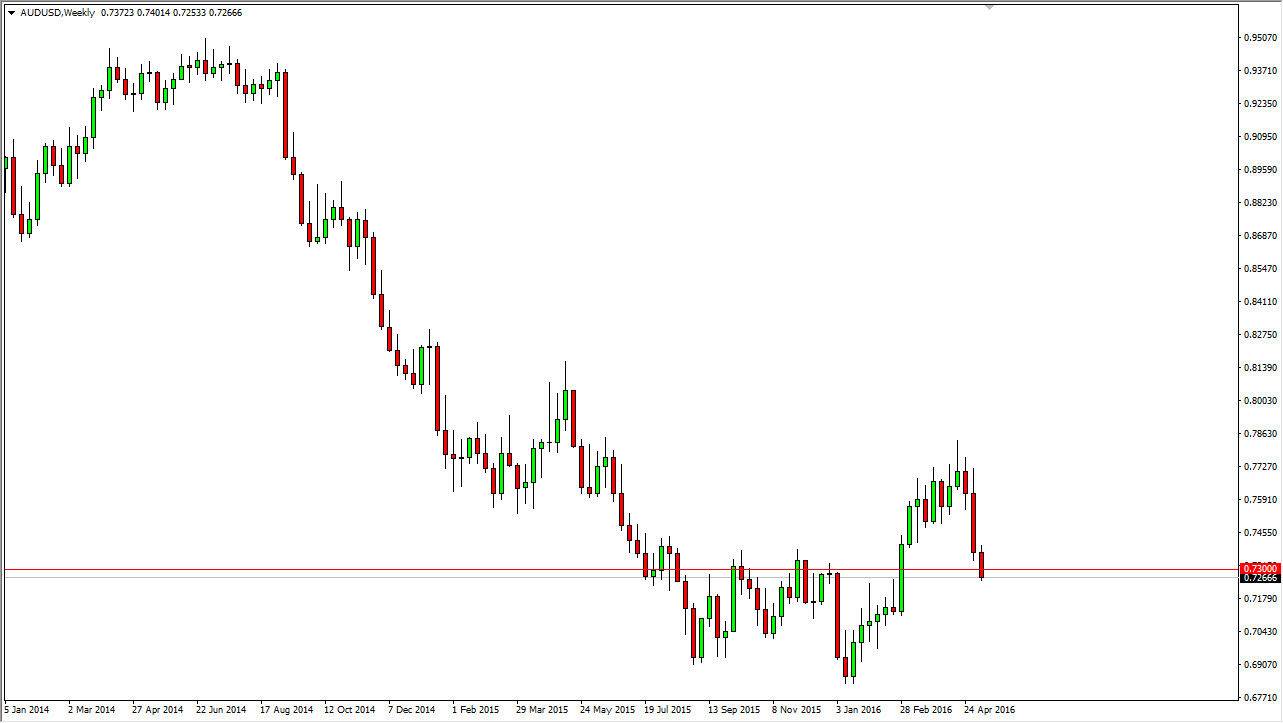

AUD/USD

The AUD/USD pair broke down during the course of the week, and more importantly went below the 0.73 level. This is an area that begins a pretty significant noisy range all the way down to the 0.70 level. Because of this, I believe that the Australian dollar will grind lower, but grind is probably the key word in that sentence.

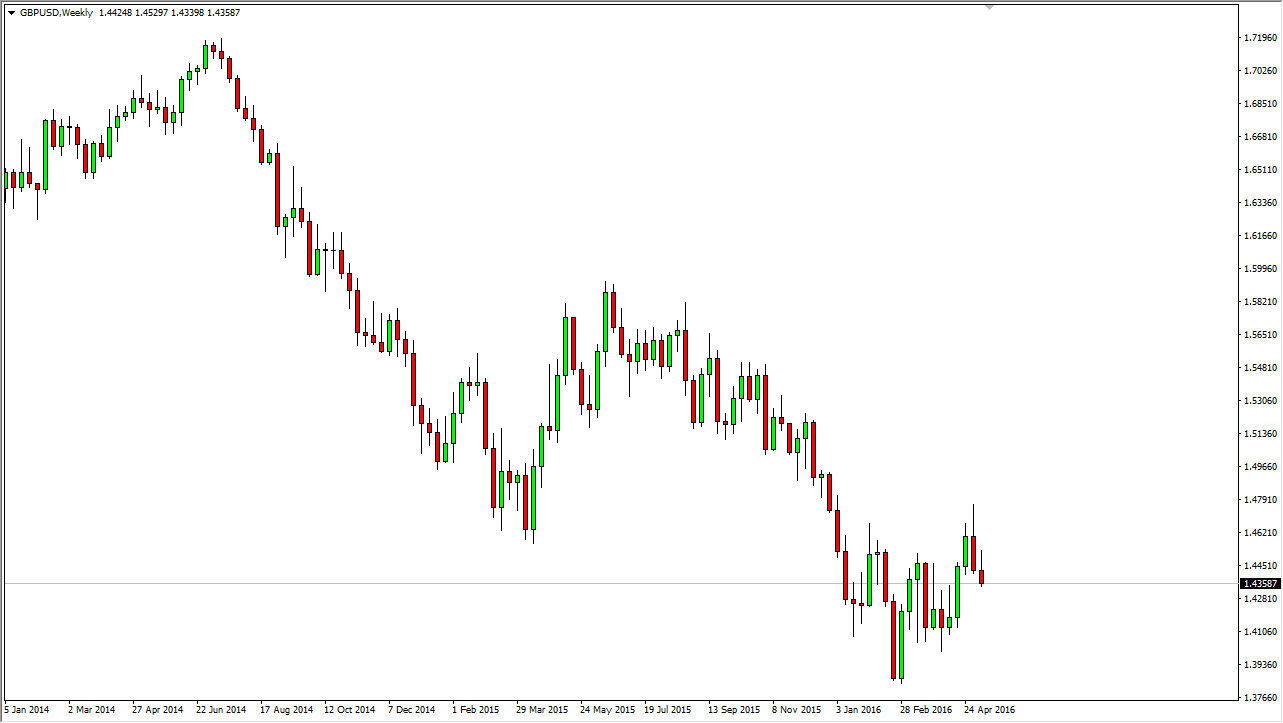

GBP/USD

The British pound initially tried to rally during the course of the week but turned around to form a shooting star. This looks like a pair that is trying to “roll over”, and as a result I think we will continue to see a little bit of weakness. We will more than likely see an attempt to reach towards the 1.41 level over the course of the week. I’m not looking for any type of meltdown, just a slight grind.

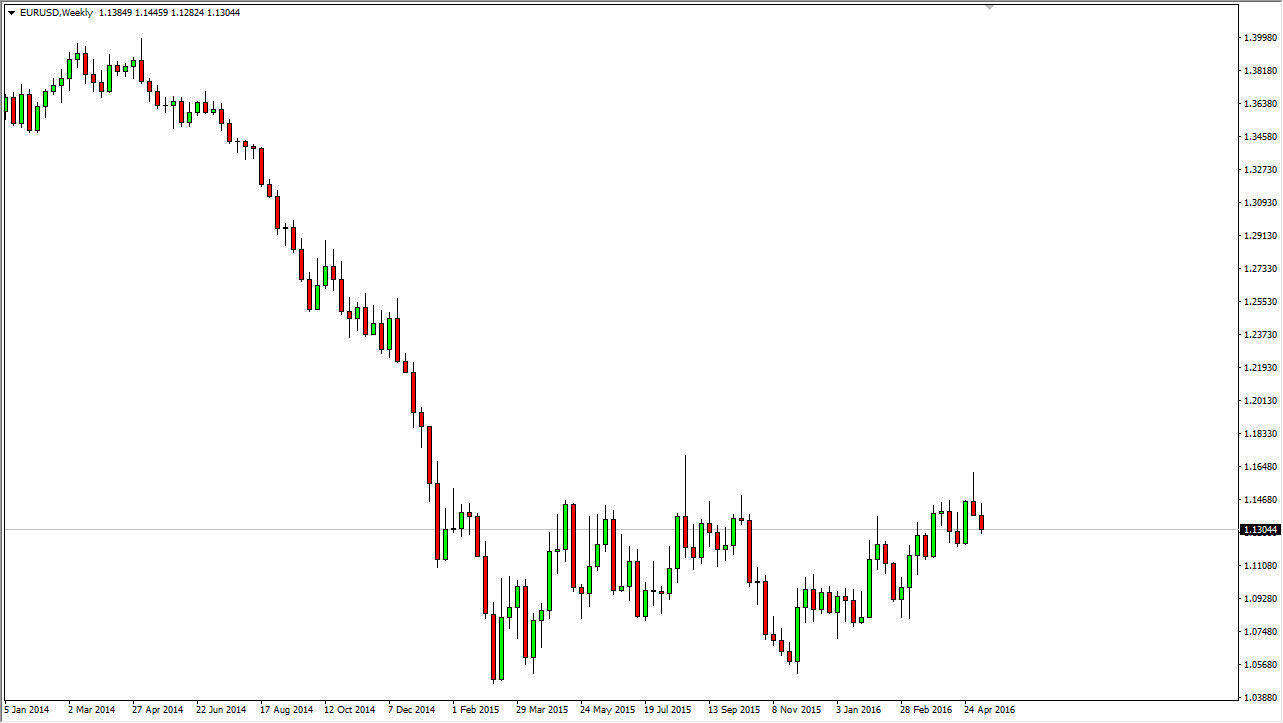

EUR/USD

The EUR/USD pair initially tried to rally during this past week, but turned around as we closed just above the 1.13 handle. This is a market that continues to show extreme amounts of volatility, and of course quite a bit of resistance at the 1.15 level. However, I think that the 1.12 level below will be supportive so this could be a very choppy week in the Euro. At this point in time, I believe it’s probably best to leave this particular market alone for the next several sessions.