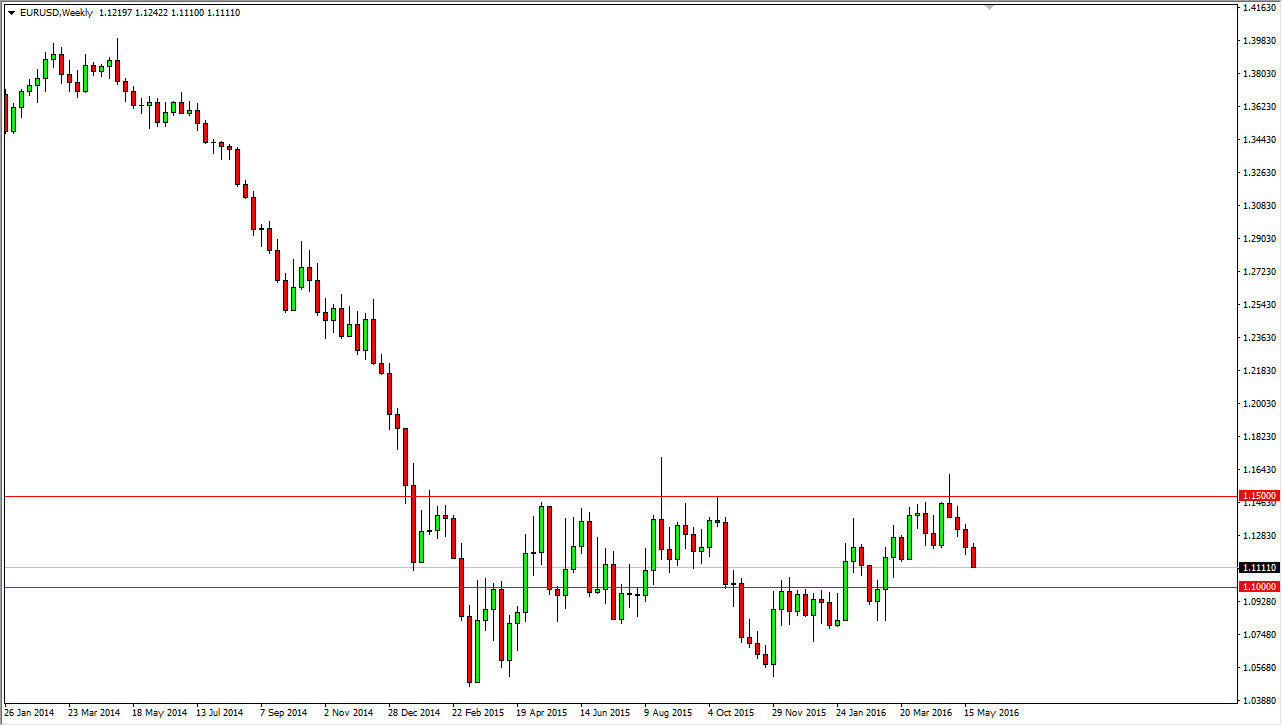

EUR/USD

The EUR/USD pair fell again during the course of the week, and closed at the very bottom of the candle. With this in mind, I believe that we are going to continue to go lower, but it’s going to be more or less a grind than anything else. In other words, I think that we reach down towards the 1.10 level but it won’t necessarily be this market showing extreme weakness, just a general softening of the Euro.

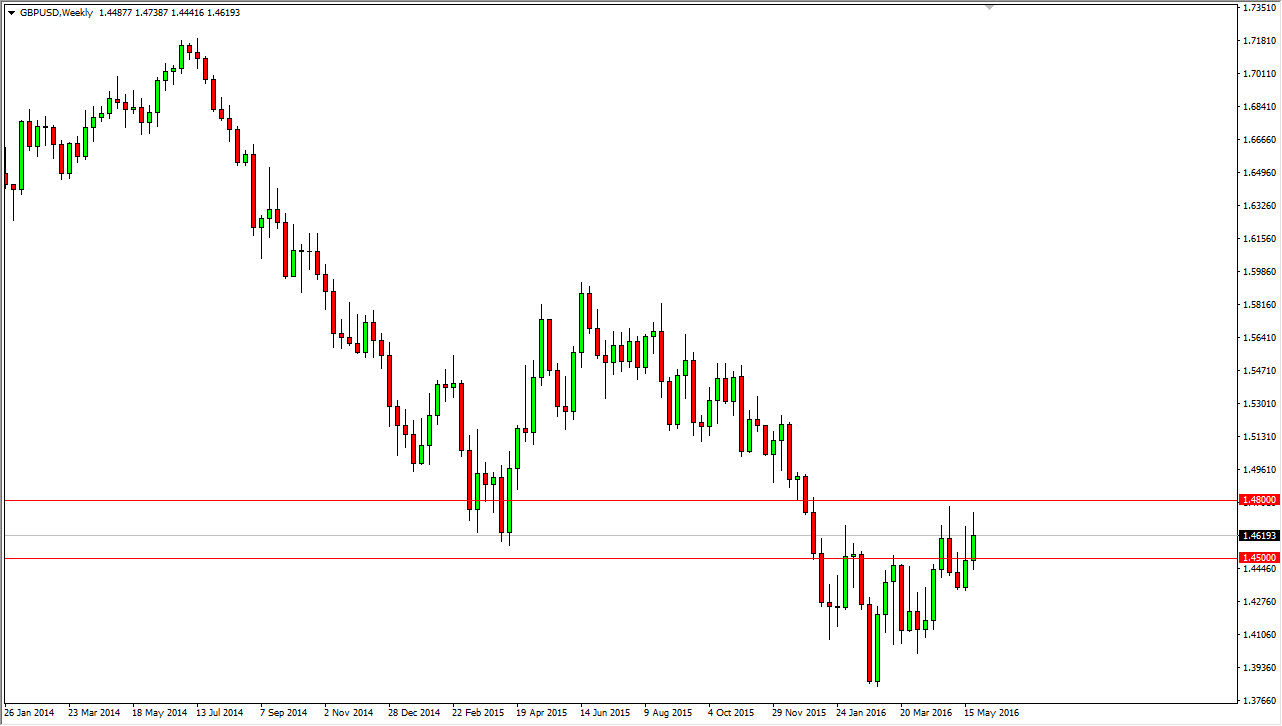

GBP/USD

The GBP/USD pair initially tried to rally during the course of the week but pulled back and gave back some of the gains. With this, I feel that this pair is going much like the EUR/USD pair, in the sense that we are going to drop a bit, but nothing major. I think that the next major support level will be somewhere near the 1.45 handle, so that is my target by the end of the week.

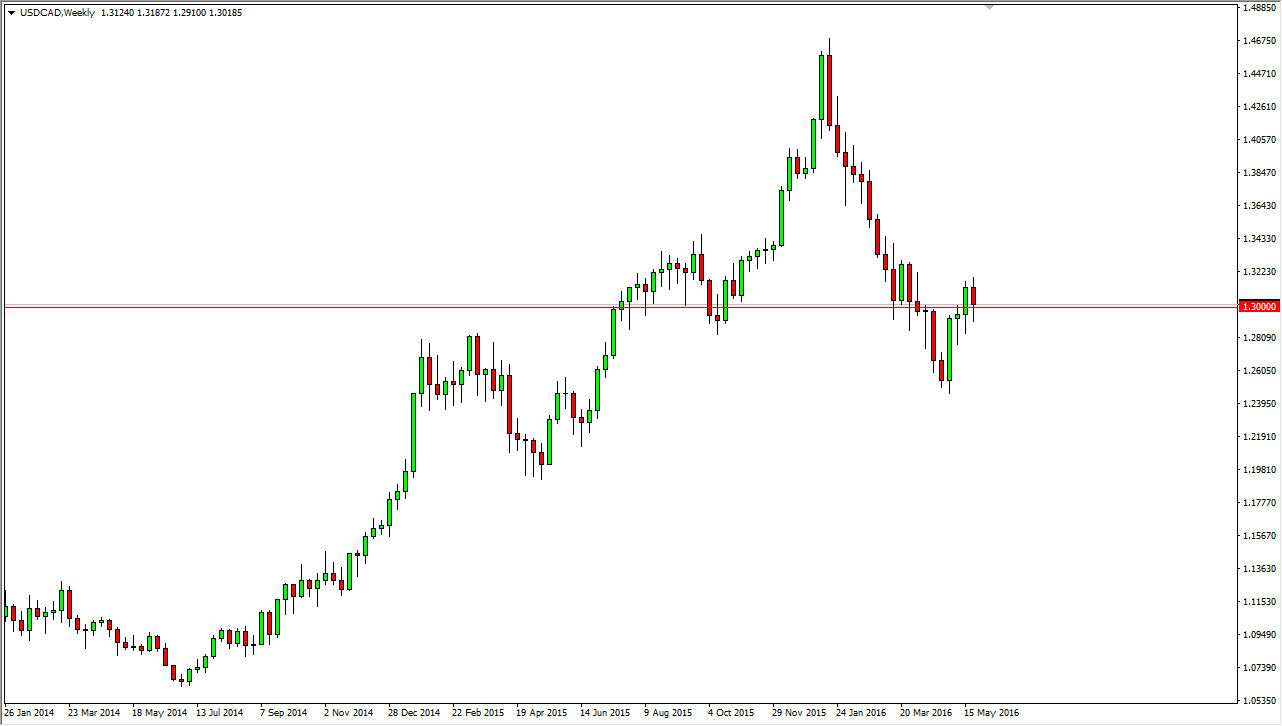

USD/CAD

The USD/CAD pair fell slightly during the course of the week, but once we got below the 1.30 level the buyers reenter the market for the third week in a row. This of course suggests that there is quite a bit of underlying support, and I believe that we are going to continue to see pullbacks be thought of as value in this market. With that, I would not be surprised at all to see this market reach towards the 1.32 handle.

EUR/JPY

The EUR/JPY pair fell significantly during the course of the week but still remains above a significant support level. With this, if we make a fresh, new low then I think the market probably drops down to the 120 handle. Any rally at this point in time should be looked at with suspicion, as the downtrend is so strong. It is not until we break above the 125 level that I would consider buying this pair, as it would show a significant amount of bullish pressure higher.