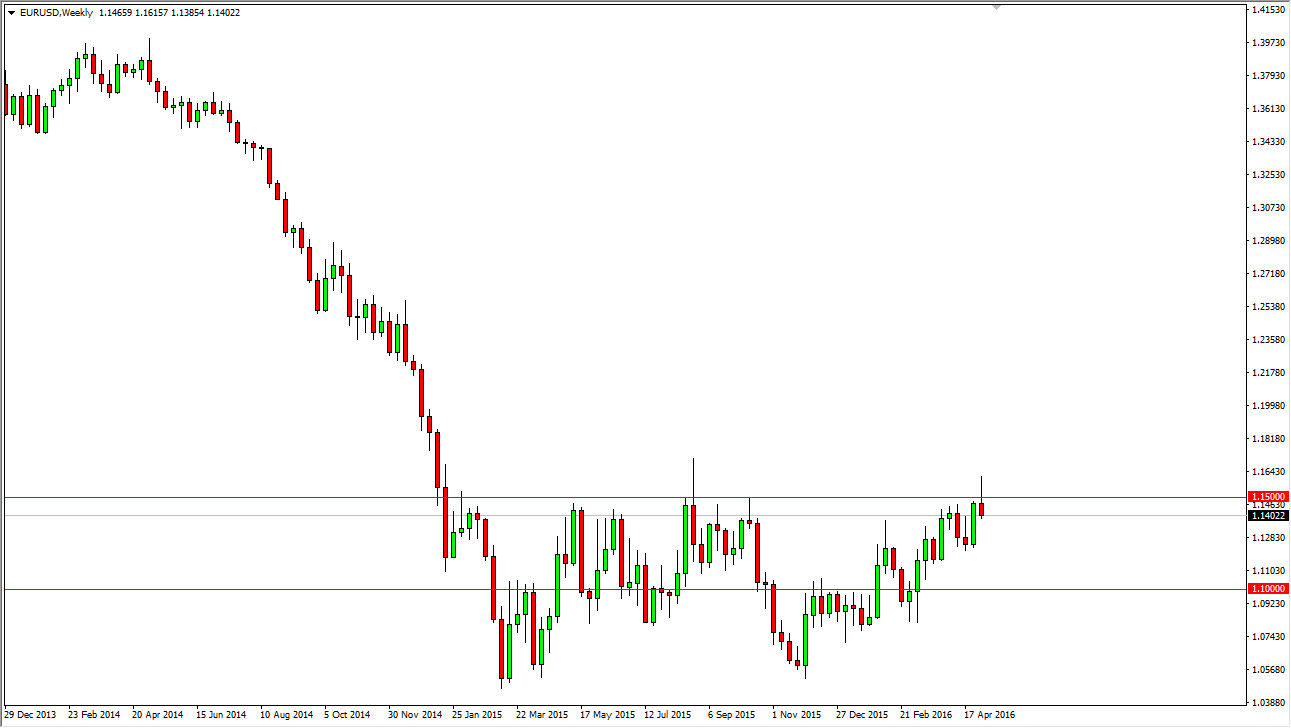

EUR/USD

During the previous week, the Euro tried to rally but was found waiting above the 1.15 level. Because of this, we ended up turning around in forming a shooting star so therefore I feel that we will more than likely see bearish pressure continue in this market. I’m not looking for any type of major meltdown, I believe that we are probably going to target the 1.12 level over the next several sessions.

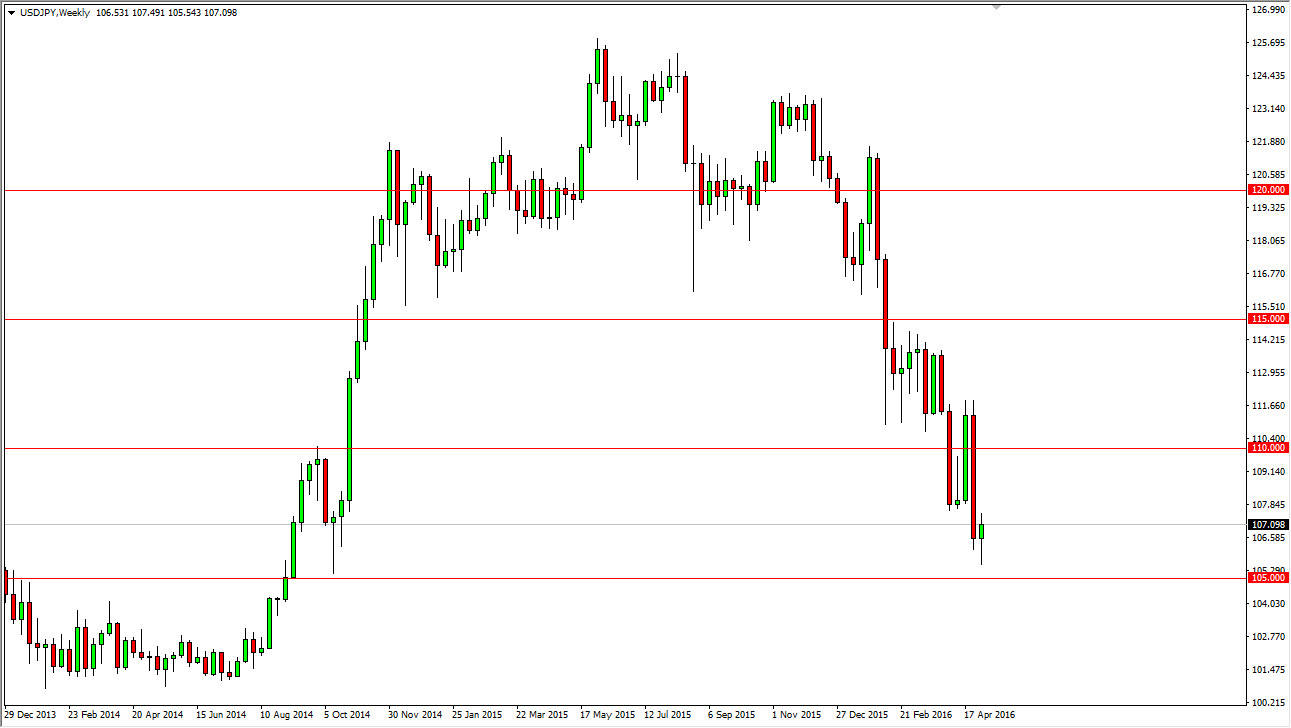

USD/JPY

The USD/JPY pair fell during the course of the week initially, but turned right back around in order to form a hammer. That being the case, it looks as if the market will try to bounce from here but I don’t think we get above the 110 level anytime soon. We will more than likely have to start building a base in order to see any real length in the rally. This market tends to bounce around quite a bit before making sudden moves, and I think right now are going to be doing more bouncing and moving.

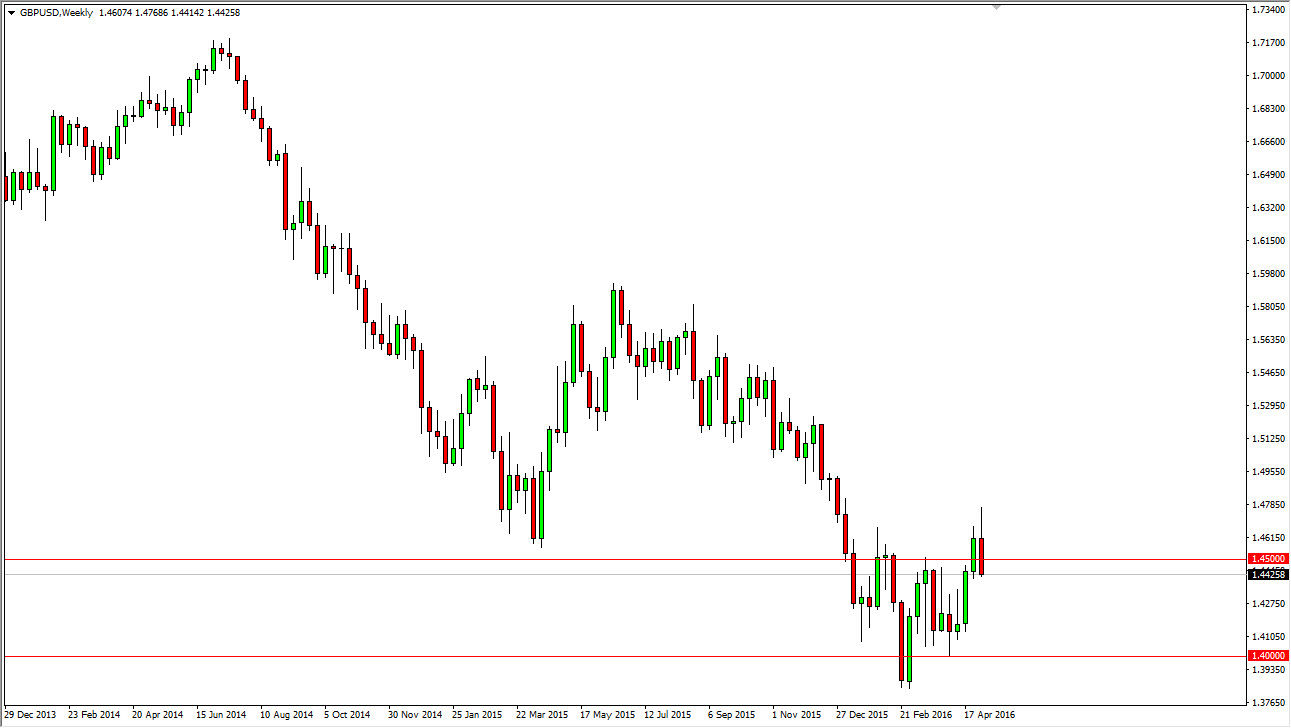

GBP/USD

The GBP/USD pair initially tried to rally during the course of the week but as we have seen in other markets, the turnaround was rather quickly. With that being the case, looks as if the market is probably going to drop from here and try to reach the 1.41 level. The market will probably be somewhat choppy, but it certainly looks as if the sellers are starting to assert their will again.

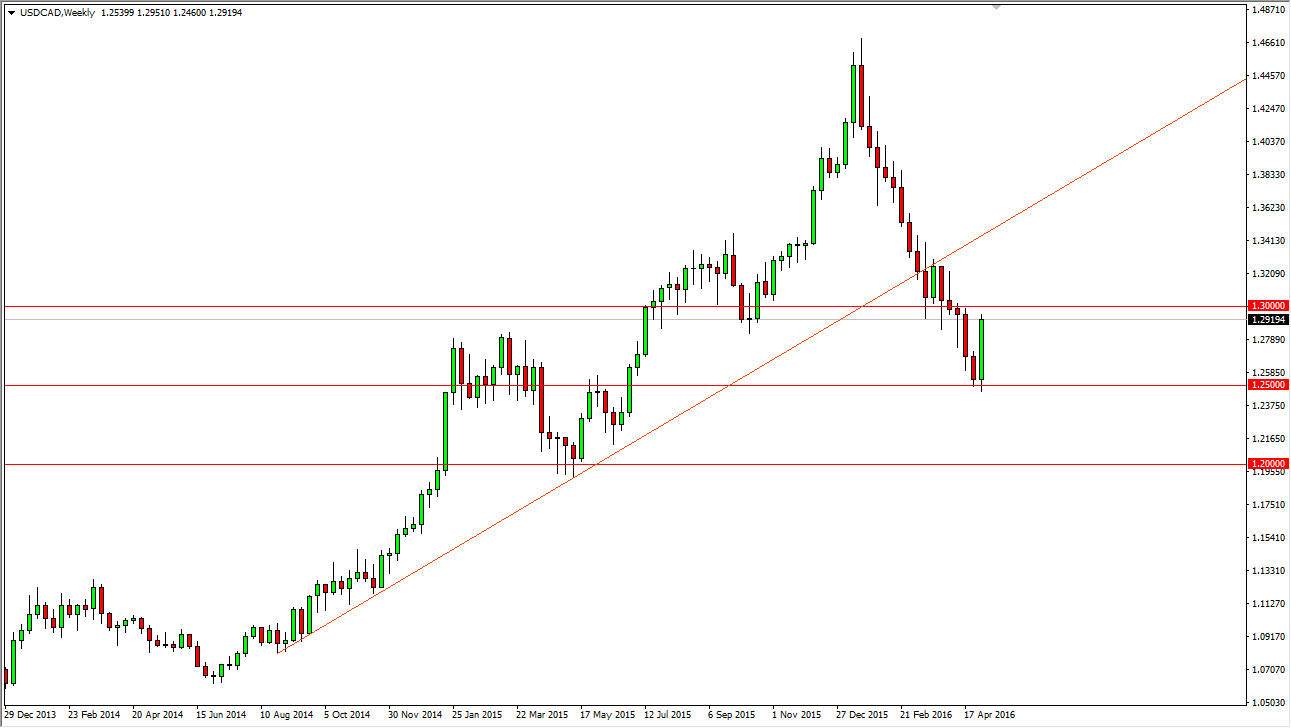

USD/CAD

The USD/CAD pair rallied during the course of the week, and found itself closing the end of the week just below the 1.30 level. By doing so, and we are pressing up against significant resistance. However, with this type of candle I expect to see some type of follow-through so I will be looking at pullbacks and show signs of support as potential value plays.