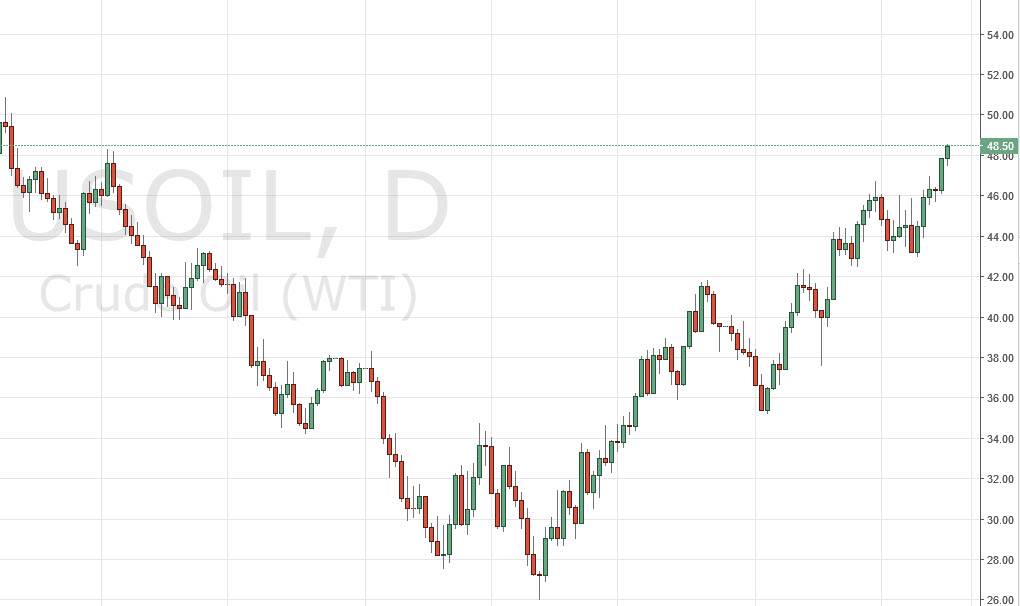

WTI Crude Oil

The WTI Crude Oil market rose slightly during the course of the day on Tuesday, as we broke above the $48 level. It now appears that the market is trying to reach towards the $50 handle, an area where I anticipate that there will be a lot of resistance. After all, it is a large, round, psychologically significant number, and those areas tend to cause a bit of trouble. Any resistive candle in that area could be a short-term selling opportunity but quite frankly I feel that the only way to sell this market is to do it off of a longer-term chart and a longer-term signal. Pullbacks at this point in time will more than likely find plenty of support near the $46 handle below.

Natural Gas

The natural gas markets have created a new trend line that is defining the uptrend, and we bounced right off of it during the session on Tuesday. However, we ended up forming a bit of a shooting star and it also sits above the $2.00 level which of course has a bit of psychological significance to it due to the fact that it is a large, round, psychologically significant number. So having said that, I think if we break below the $2.00 level, we should then continue the longer-term downtrend. Yes, we have had quite a rally lately but a lot of this is due to drillers stepping away from production. As prices rise, it becomes more and more pressing for them to get back into the marketplace.

Also, you have to keep in mind that we are getting away from cold weather, at least in the northeastern part of the United States which of course is a major driver of demand when it comes to the natural gas markets in the United States, so therefore it has a large effect on how the futures markets behave.