WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Wednesday, but you can see turned right back around during the US session to show bullishness as we ended up forming a hammer at the top of this move higher. We are sitting just below the vital $50 level, which of course can find quite a bit of psychological resistance. The fact that we did up forming a hammer though tells me that the buyers are becoming more and more aggressive, and as a result we should break above there given enough time.

On a move above the $50 level when we get a daily close above there as well, I will start buying as it will show that we are entering the next leg higher. You can see on the chart that I have plotted the 50 and the 100 day moving averages, which of course crossed quite a while ago. All things being equal, it does look like we are going higher.

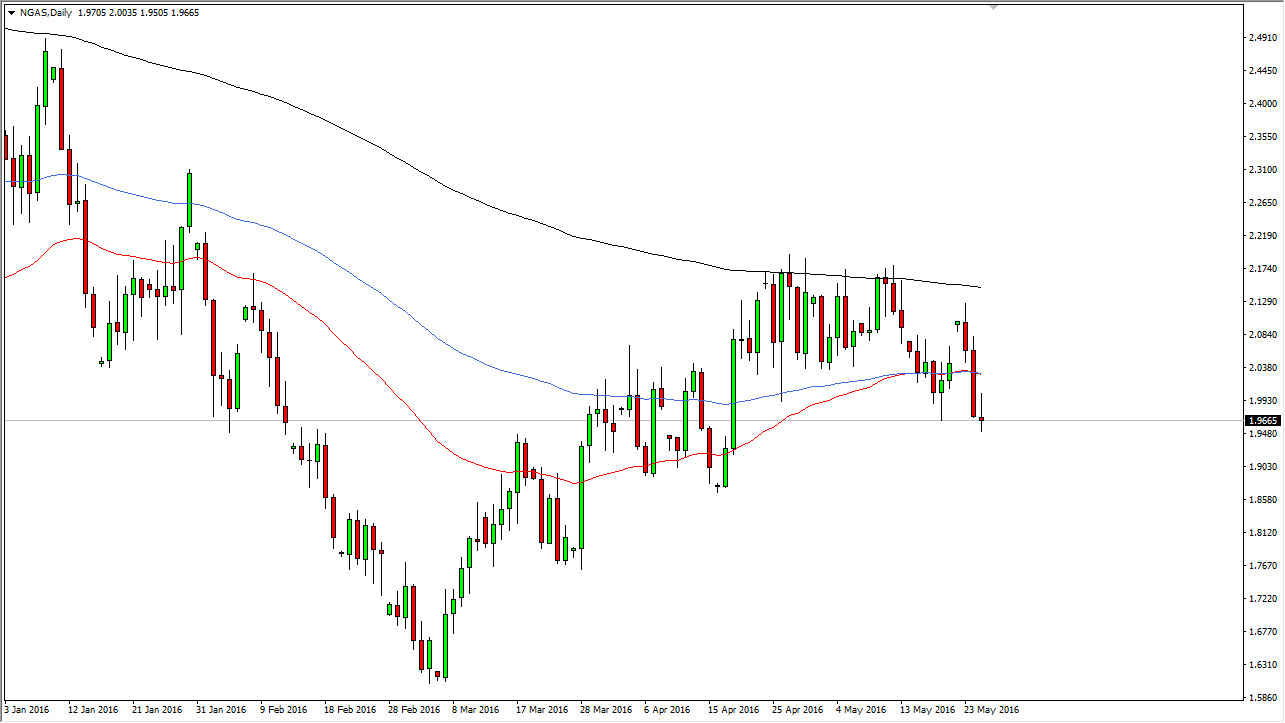

Natural Gas

Natural gas markets initially tried to rally during the day on Wednesday, but turned right back around just below the $2.00 level. By doing so, we did up forming a shooting star and a forming a shooting star at the bottom of the down move is a very negative sign. You have to think about what’s going on here, as this shows that buyers stepped into the marketplace, and then failed. In other words, they are starting to lose money yet again, and probably are going to lose even more if they stay in this market. Because of this, the market will more than likely break below the bottom of the shooting star, and then reach for the $1.90 level next, followed by the $1.80 level. A move above the top of the shooting star would be a bullish sign, but at this point in time it looks very tired in this particular market.