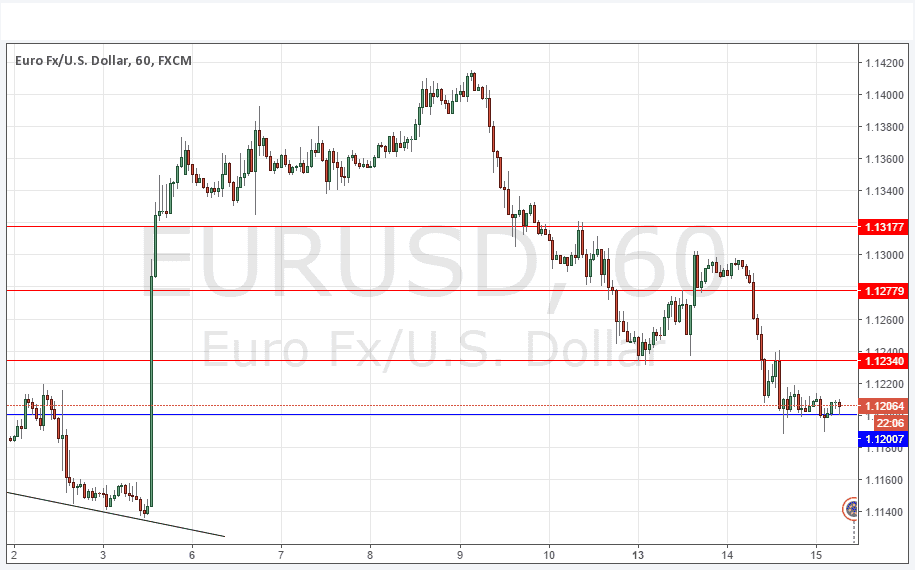

EUR/USD

The EUR/USD pair fell during the day on Tuesday, testing the 1.12 level. However, there is a cluster just below that could be rather stubborn, so I think that the sellers are going to have to put in real momentum to break this pair down. If we break down below the 1.11 level, then I think we are all assured a move to the 1.10 handle. It will be interesting to see what happens today, because we get the FOMC Statement and that of course can move the US dollar drastically. In fact, I am actually staying away from trading this pair today as I want to see how the market reacts at the close. The daily candle should tell us a lot more.

GBP/USD

The GBP/USD is one of the more volatile pairs recently, and with good reason. There is a lot of concern that the United Kingdom is to leave the European Union, as the most recent polls have suggested this. The vote is on June 23, which is just around the corner so therefore I think that this market is going to be very difficult for some time. At this point, there’s a lot of bearish pressure on the British pound because all of the potential exit, but at the same time you have to worry about the US dollar as the Federal Reserve looks very unlikely to raise rates at as quickly of a clip as once projected. With that being the case it’s actually a US dollar negative situation.

However, I believe that the US dollar might be the big winner if the United Kingdom leaves the European Union, simply because it’ll be thought of as more or less a safety play. There are a lot of people who will not want to take much risk in the markets in that scenario, and as a result they will be buying U.S. Treasury bonds. One thing you can count on is a ton of volatility. At this point, I’m not overly excited to trade this pair either.