EUR/USD Signal Update

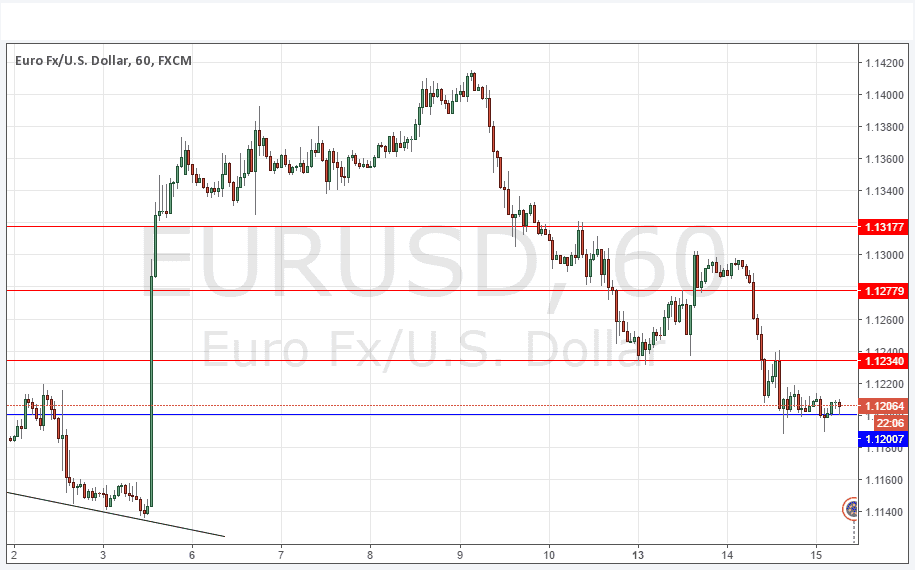

Yesterday’s signals gave a long trade following the bullish pin bar’s rejection of the anticipated support level at 1.1200. At the time of writing this trade is still in play but showing a slight loss. This does not currently look as if it is going to turn out to be a profitable trade.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time today only.

Protect any open trades by 6:30pm.

Long Trades

Long trades following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1068 and 1.1035.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short trades following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1234, 1.1278 or 1.1318.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

This pair has turned bearish, failing fairly hard and breaking down past two supportive levels at 1.1278 and 1.1234 and now looking as if it is going to break 1.1200 also.

This is very bearish and below 1.1200 there are no key support levels until 1.1068. The price could reach 1.1140 quite quickly as the base of where the upwards move of some time ago began.

The Euro is being dragged down by continuing fears of a British exit from the European Union. New polls are still showing the Leave campaign pulling into the lead with only just over one week to go until the vote is held.

There is nothing due today concerning the EUR. Regarding the USD, there will be a release of PPI data at 1:30pm London time, followed later at 3:30pm by Crude Oil Inventories. At 7pm there will be the release of the Federal Funds Rate, FOMC Statement and FOMC Economic Projections, followed by the usual press conference.