EUR/USD Signal Update

Yesterday’s signals were not triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time today only.

Long Trades

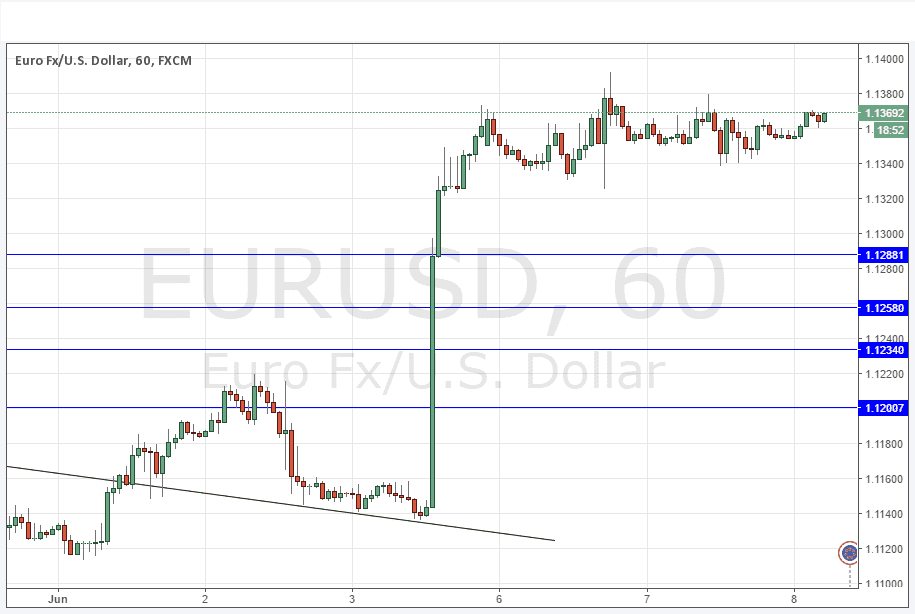

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1288 or 1.1258.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trades

No short trades today

EUR/USD Analysis

There has been no real change to the picture, with the price of this pair just consolidating within the volatility range established last Monday during Yellen’s speech.

This bias must still be bullish, as an eventual upside breakout looks likely in both the long term and short term. However the price is quite likely to take a dip first before rising to make new highs.

Turning to the longer-term picture, is should be noted that the area between 1.1400 and 1.1500 has been a strong cap on the price for about 18 months now. This suggests that should a breakout come against a newly weak USD, the move upwards beyond this area could be strong and fast.

There is nothing due today concerning the EUR. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.