The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 13th June 2016

Last week I wrote a prediction that the best trades for this week were likely to be short USD against the JPY, the EUR and the CAD. Overall, the average result was very slightly negative at -0.05%. Focus shifted away from the USD towards the end of the week so results were driven by other currencies.

This week is actually a more difficult prediction as we have the FOMC Meeting Minutes Release due which can send the USD in any direction. Nevertheless, we still have a strong trend aligned with sentiment which is short USD. The strongest currency to be long of against the USD looks to be the JPY, and Gold and Silver as well which are both above the prices 1, 3 and 6 months ago respectively.

Fundamental Analysis & Market Sentiment

Fundamental analysis has become more useful in the Forex market now as the USD is seriously weakened by a data-driven central bank being driven away from a previously anticipated rate hike by very poor economic data. However the FOMC Meeting Minutes are quite likely to be calibrated to try to repair expectations of a potential rate hike, so they may shift sentiment away from the fundamental direction.

The Japanese Yen has again been the strongest currency this week. These days it has a status as a safe haven currency.

The British Pound is very weak following new opinion polls showing the “Leave” vote might well prevail in the British E.U. referendum which will take place on 23rd June. However should very different polling data be released the currency would probably recover very strongly.

Precious metals look strong and there are fundamental arguments suggesting they should be stronger in the current environment of central banks racing to manage their fiat currencies downwards.

Technical Analysis

USDX

The U.S. Dollar rose last week, printing fairly but not very strongly bullish candle. It again closed at a price lower than the prices from both three months and six months ago, indicating the greenback remains in a downwards trend which never ended even during the recent price rise. However, it is true that the candles are somewhat suggestive of a forthcoming upwards move.

USD/JPY

Looking at the major pairs, probably the best one for exploiting any continuation of U.S. Dollar weakness will be the USD/JPY pair. It is a strong long-term trend, and the JPY enjoys bullish sentiment right now with the price approaching multi-year lows.

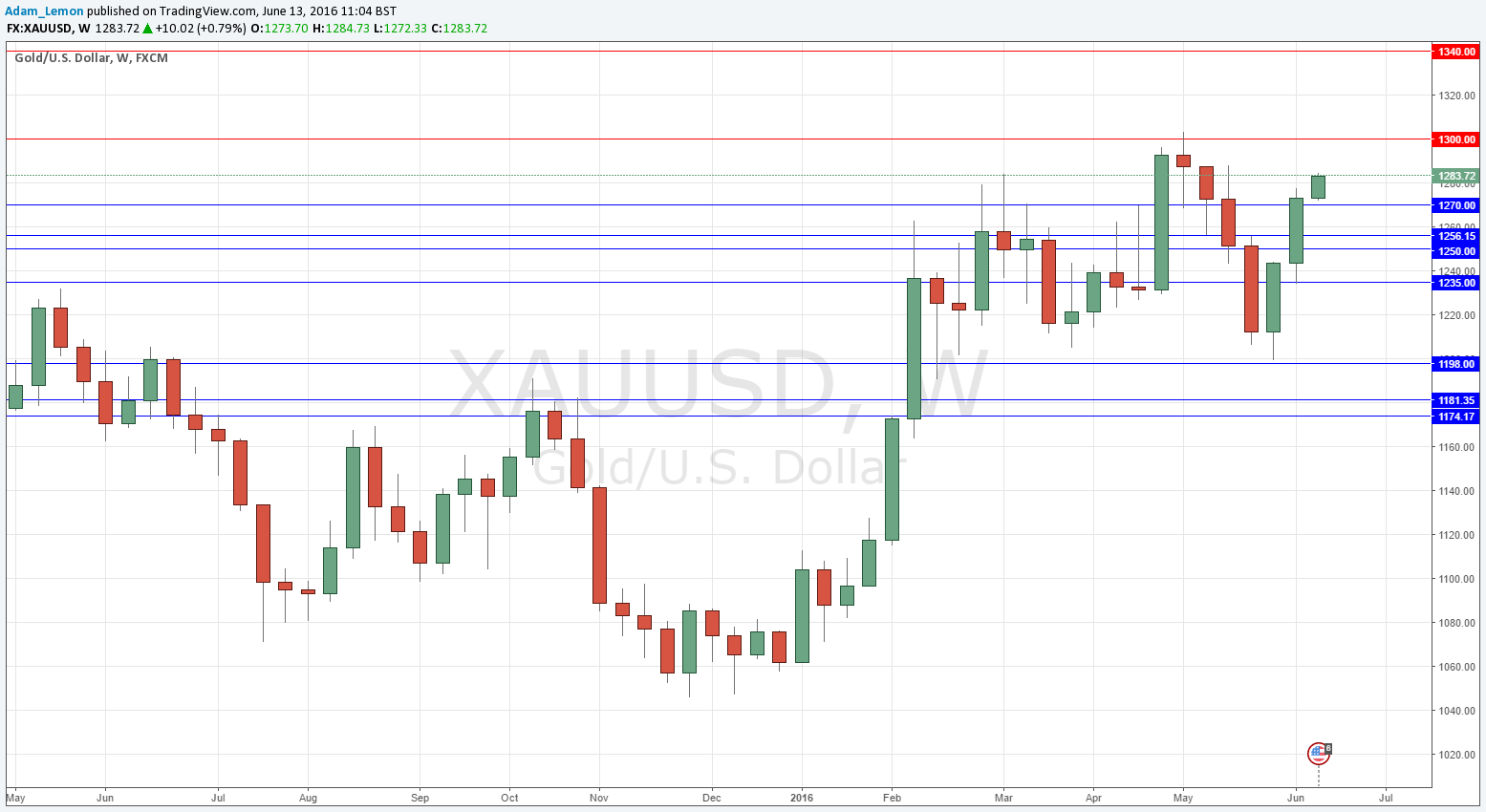

Gold

The next pair to look at for exploiting USD weakness would logically be spot Gold, simply because it has been making new highs with strong momentum and is at a level above its price from 1, 3 and 6 months ago. Spot Silver is also in a similar position. Regarding Gold, note the strong resistance level at $1300, and then the further level at $1340.

Conclusion

Bearish on the USD, bullish on the JPY and spot Gold.

.png)