The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 19th June 2016

Last week I wrote a prediction that the best trades for this week were likely to be short USD against the JPY, Gold and Silver. This turned out to be an excellent forecast, as all three of these pairs produced a positive result: USD/JPY 2.65%, GOLD 1.87%, SILVER 0.82%. The average result was a gain of 1.78%.

The focus of the market has been nicely re-established onto the USD with the FOMC statement suggesting that most of the committee are not looking to try to raise rates until towards the end of 2016. This gives a more dovish outlook overall and is also in line with the long-term trend of a weakening USD, so sentiment and macro are aligned.

This week therefore looks as if we can stick with short USD, the question is what is strong. I see strength in Gold, JPY, CAD and CHF.

Fundamental Analysis & Market Sentiment

Fundamental analysis has become more useful in the Forex market now as the USD is seriously weakened by a data-driven central bank being driven away from a previously anticipated rate hike by very poor economic data. Sentiment is also pointing in the same direction.

The Japanese Yen has again been the strongest currency this week. These days it has a status as a safe haven currency.

Gold undoubtedly remains strong although it so far has proven unable to decisively break the key resistance at $1300 and the advance could halt here, at least for a while. Silver faces a similar problem, but looks weaker. There is no doubt that there is a sentiment of safety that is benefiting precious metals, however risk assets are also rising so the picture does not appear to be so clear cut.

The Swiss Franc is strong and has continued to strengthen as the SNB kept interest rates on hold last week. It is worth pointing out that Switzerland has a strongly negative interest rate, so you have to ask what more the SNB could possibly do to weaken the currency. Even with a negative interest rate it is still rising! This suggests that in these uncertain times of weak growth, the Swiss Franc is attractive, like Gold and the Japanese Yen, as a safe haven asset.

Finally, it should be mentioned that the U.K. votes this Thursday on a referendum concerning a possible withdrawal from the European Union. Markets are likely to be turbulent as the results begin to be released. If the “Leave” vote looks likely to come ahead, we can expect a very sharp fall in the British Pound and some wild market movements that will probably cause turbulence everywhere.

Technical Analysis

USDX

The U.S. Dollar fell last week, printing a bearish engulfing candle which closed right at its low. It again closed at a price lower than the prices from both three months and six months ago, indicating the greenback remains in a downwards trend which never ended even during the recent price rise. The price action is suggestive of a downwards move this week.

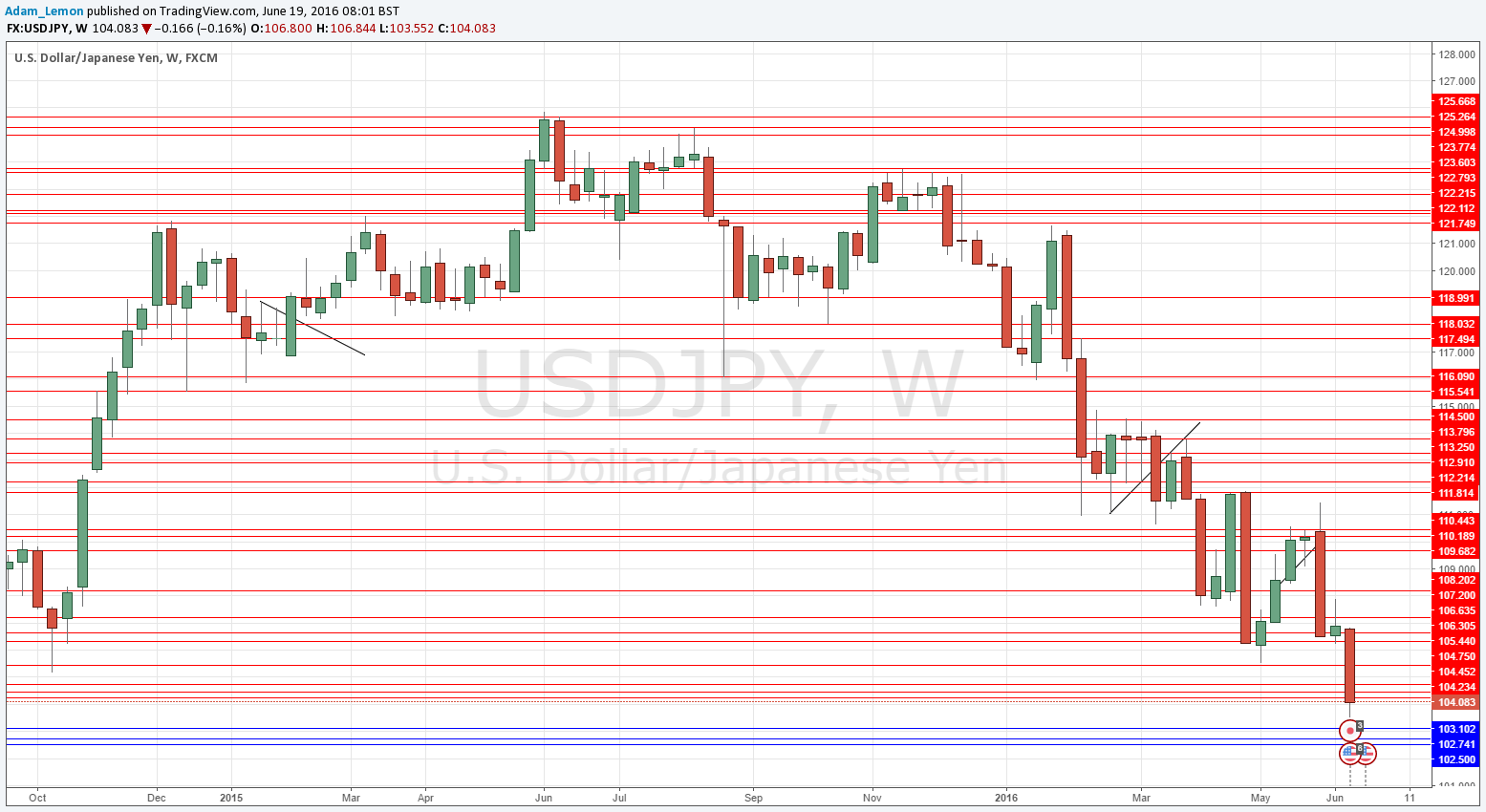

USD/JPY

Looking at the major pairs, probably the best one for exploiting any continuation of U.S. Dollar weakness will be the USD/JPY pair. It is a strong long-term trend, and the JPY enjoys bullish sentiment right now with the price making new multi-year lows. Of course, at these prices, there is always a danger of Bank of Japan intervention to weaken the Yen.

Gold

The next pair to look at for exploiting USD weakness would logically be spot Gold, simply because it has been making new highs with strong momentum and is at a level above its price from 1, 3 and 6 months ago. Spot Silver is also in a similar position. Regarding Gold, note the strong resistance level at $1300, and then the further level at $1340.

USD / CHF

After Gold, The next pair to look at for exploiting USD weakness would logically be USD/CHF, which is in a meaningful but somewhat more repressed downwards trend. It is probably that the next round number below, at 0.9500, will be hard to break as it has successfully held up the price for almost 1 year by now.

Conclusion

Bearish on the USD, bullish on the JPY, spot Gold, and CHF.