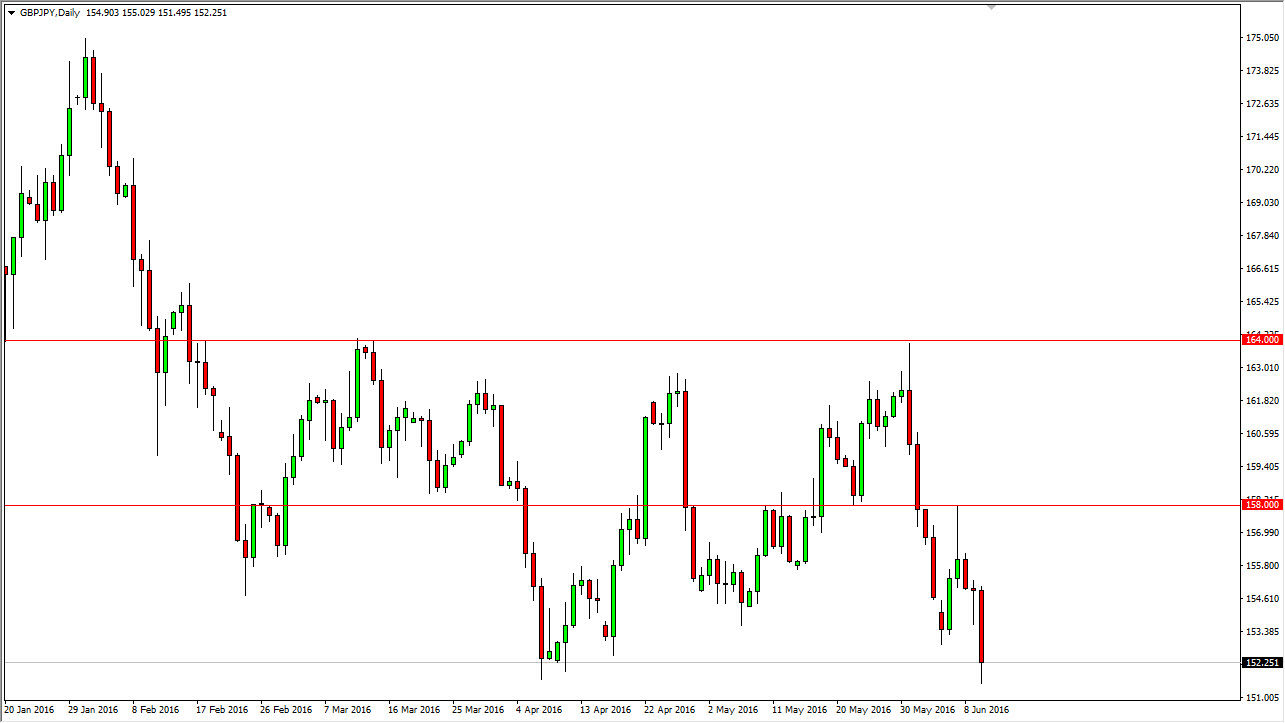

The GBP/JPY pair fell significantly during the course of the day on Friday, as we have seen the British pound selloff late in the day. There is a recent poll now suggesting that the “leave” crowd in the United Kingdom now has a 10-point lead. Because of this, the British pound really took it on the chin late during the day and Friday, but it should also be noted that a lot of this would’ve been exacerbated by the fact that it was in the afternoon during New York trading.

Looking at this chart, you can see that the candle is very strong to the downside and of course we did break down below the bottom of the hammer from the Thursday session which in and of itself is a negative sign. The fact that we are closing towards the bottom of the candle suggests that there is going to be a bit of continuation, and it now looks as if we are reaching towards the 150 level.

Bounces offer value in the yen

If the market bounces from here, I suspect that short-term rallies will find quite a bit of resistance above, and an exhaustive short-term candle will more than likely be a reason to start selling yet again. The 150 level below is of course a major round number, so at that point time I believe there would be a bit of a bounce. However, if we can break down below the 150 level, I believe that the market will continue to grind much lower. As long as there is fear out there about the British leaving the European Union, it’s very likely that the British pound will continue to see sellers again and again.

I have no interest whatever in buying the British pound, so having said that this is a “sell only” market as far as I can see. The latest poll numbers only strengthen that position.