GBP/USD Signals Update

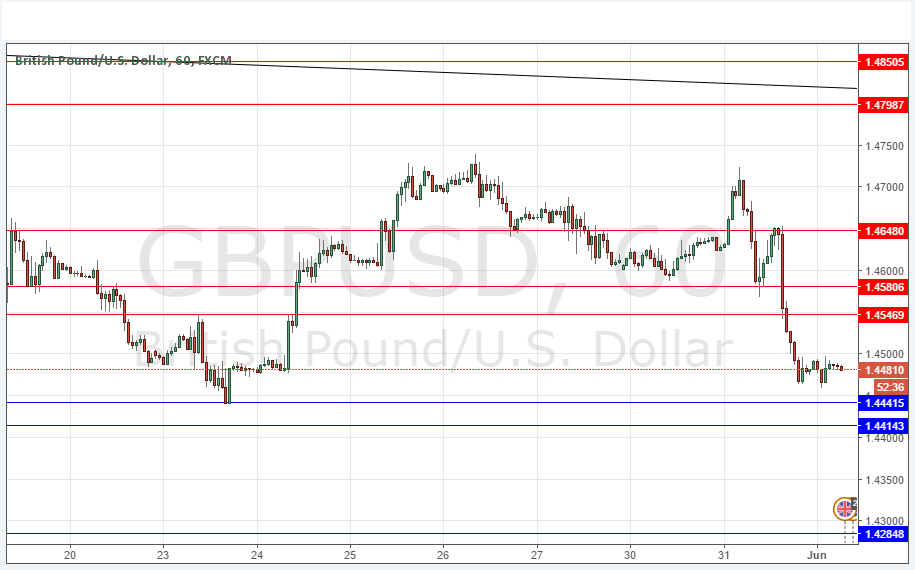

Yesterday’s signals were not triggered as there was no bullish price action at either 1.4648 or 1.4581.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4441, 1.4414 or 1.4285.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4547, 1.4580 or 1.4648.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

This pair turned bearish yesterday, in spite of its long-term upwards trend. The turn occurred with the release of an opinion poll showing that an exit vote in the British referendum on European Union membership that will be held last month is more likely than had been previously thought.

We can expect the British Pound to be volatile over the next three weeks in the run-up to the vote, depending upon the opinion polls.

In spite of this volatile picture, yesterday’s daily candle was very convincingly bearish, and it looks as if this pair has further to fall.

Concerning the GBP, there will be a release of Manufacturing PMI data at 9:30am London time. Regarding the USD, there will be a release of ISM Manufacturing data at 3pm.