GBP/USD Signals Update

Last Thursday’s signals expired without being triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trade 1

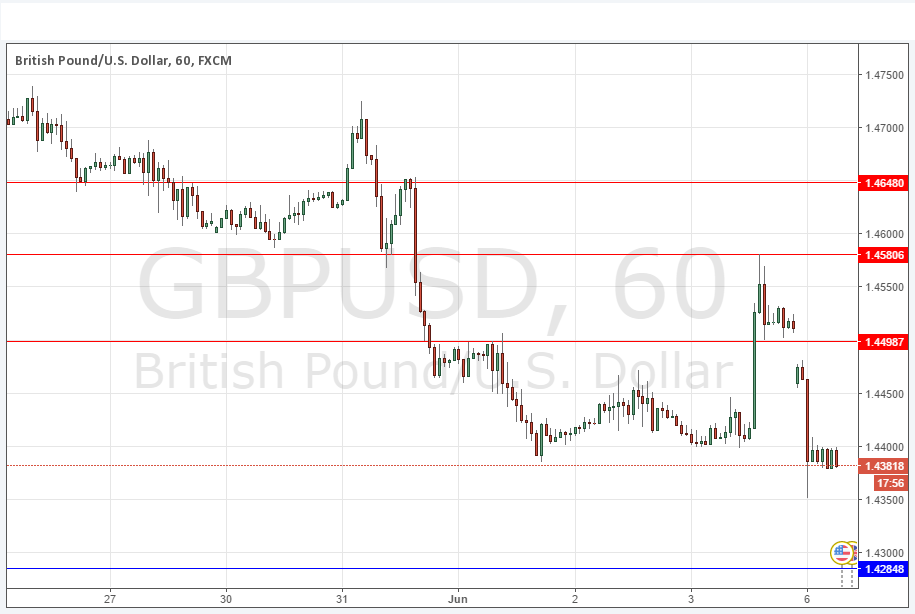

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4285.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4499 or 1.4581.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

This pair joined the general push up against the USD that resulted from the very poor U.S. economic data released on Friday, but the price has gapped down now with this weekly open below anticipated support levels to currently sit at a price lower than the one which prevailed before the U.S. data release!

The reason for this is certainly renewed weakness in the British pound resulting from the release of a new opinion poll showing the Leave camp ahead by three points in the forthcoming referendum on E.U. membership due on 23rd June.

As I wrote last Thursday, for the longer-term, much will depend upon the contents of any polls on Britain’s European Union membership.

It would not be surprising if the price reached the next support level of 1.4285 today or tomorrow.

There is nothing due today concerning the GBP. Regarding the USD, the Chair of the Federal Reserve will be speaking at 5:30pm London time.