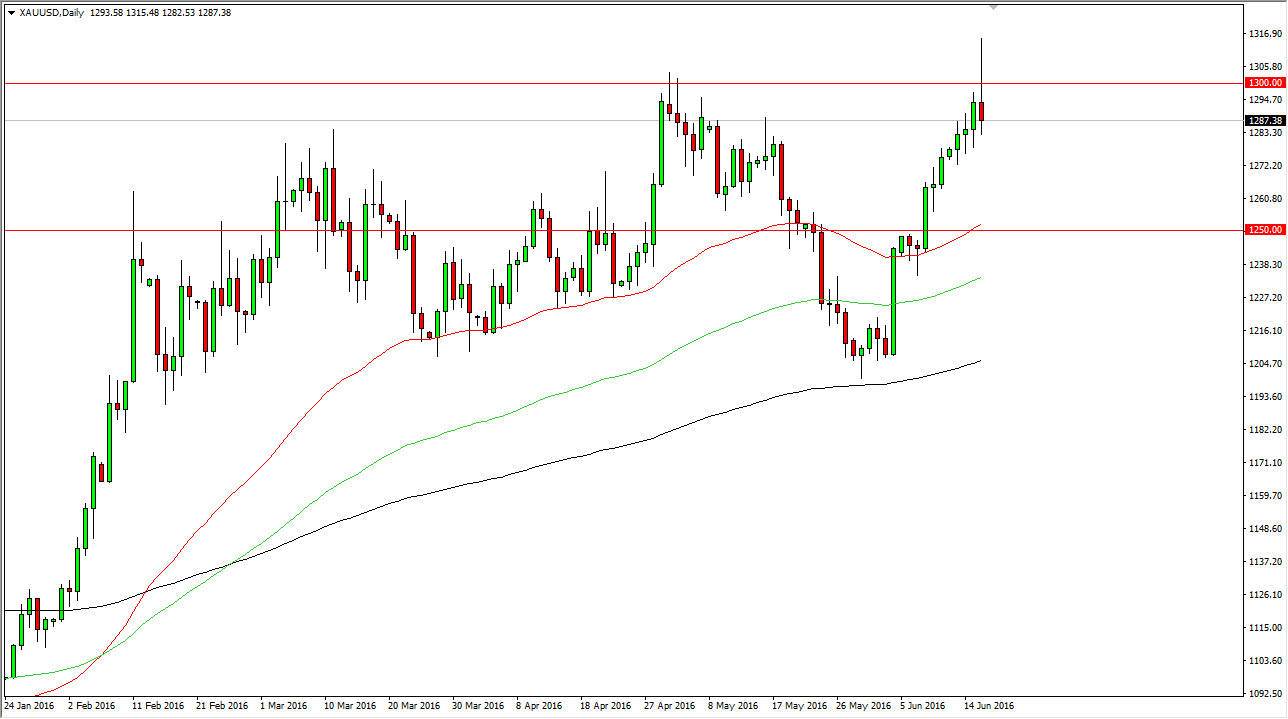

Gold markets had a very volatile session on Thursday, as we finally broke above the $1300 level. This was a major barrier as far as I can see, and I assumed that it would signal the next leg higher. However, we turned back around to form a massive shooting star and therefore it seems like we have a lot of questions and perhaps may have only found more questions instead of answers during the day. After all, the shooting star is a very negative sign but at the end of the day we did break out to higher levels than we had previously seen. In other words, we broke through a bunch of resistance only to turn back around.

This sets up an obvious trade

For myself, I have no interest in shorting this market although you could make an argument that breaking down below the bottom of the shooting star is a sell signal. When you look at this chart, I see the 50 day exponential moving average, pictured in red, reaching just above the $1250 level. I love to see the 100 and 200 day exponential moving average is below there and they all look very healthy. At this point in time, I would expect that any pullback will have to deal with the 50 day exponential moving average, but I would be surprised if we been reaching down that far. Any supportive candle below would have me buying as I believe it would be yet another attempt to break out in what seems to be a market that wants to go much higher.

On the other hand, we could break above the top of a shooting star which is an even more bullish sign as far as I can see. Quite often, we break over a significant level, it might take several attempts to get above there. I think that’s what we are seeing right now but ultimately gold should go higher in my opinion.