Gold prices ended Tuesday's session down $21.72 as strength in the U.S. dollar and a recovery in stock markets weighed on the market. The market initially traded as high as $1294.21 an ounce in the Asian session yesterday but the bulls surrendered after the safe-haven buying dried up. As a result prices fell with momentum and broke down below the 1280/77 area which held the market up since last Monday.

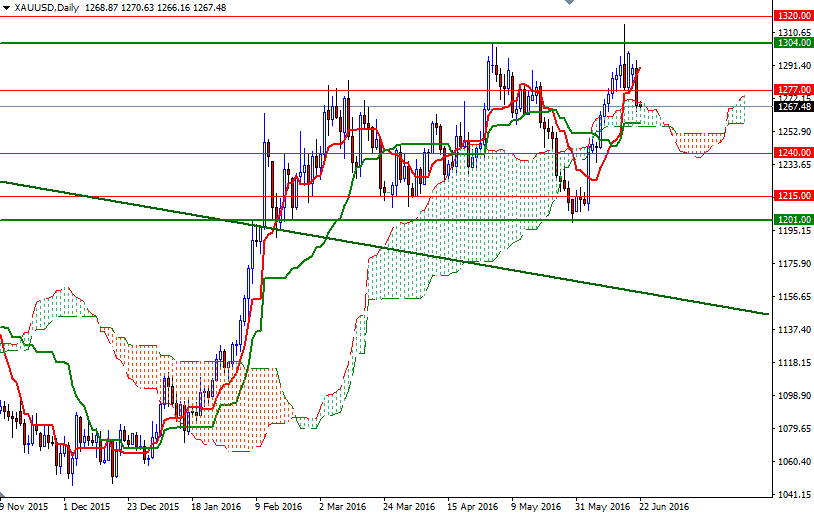

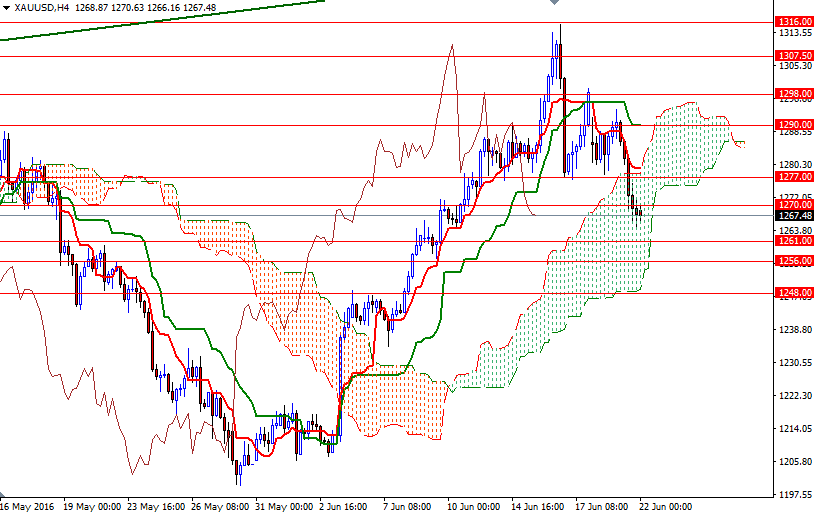

Invalidating this support is a negative sign, for the short-term at least and opens up the risk of a move towards 1256 (the bottom of the Ichimoku cloud on the daily chart) and a revisit to 1248 (a horizontal level acted as both support and resistance in the past). Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines and the Chikou Span/Price cross in the same direction also imply that short-term technical structure is weakening. Closing below 1240 would indicate that the 1234 level will be the next stop.

However, the XAU/USD pair is trading within the borders of both the daily and 4-hourly clouds. If the bulls can push and hold prices above 1272.60-1270, then prices may return to 1280/77 in a classic break and retest breakout pattern. The bulls will have to convincingly push the market beyond 1280 so that they tackle the next barrier in the 1290/87 zone. Penetrating this barrier would suggest an extension towards the 1300-1298 area.