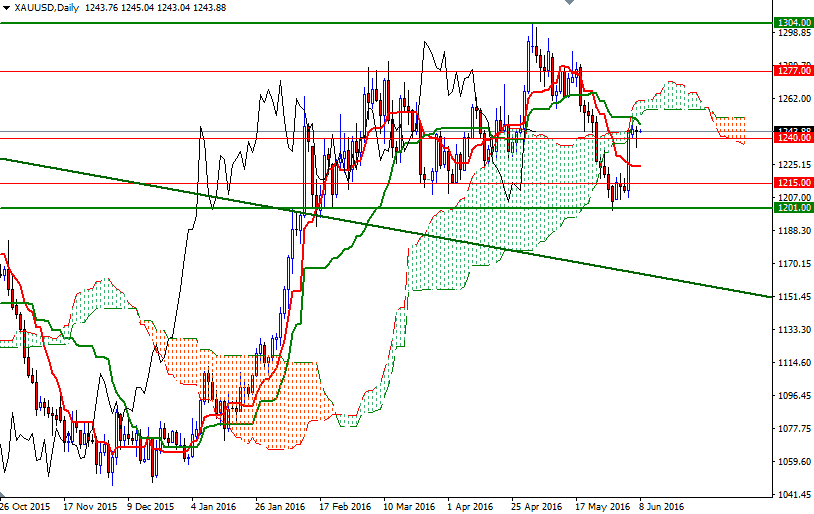

Gold prices initially fell yesterday but bounced up nicely from the anticipated support level at $1234 and pared most of the losses. The XAU/USD pair has advanced 3.7% since it hit the lowest level since February 17 last week as disappointing May jobs growth pushed the prospect of a US interest rate hike this month firmly off the table. Although growing perception that the Federal Reserve will not make its move until September is supportive for the market, buoyant equities markets may depress the attractiveness of gold.

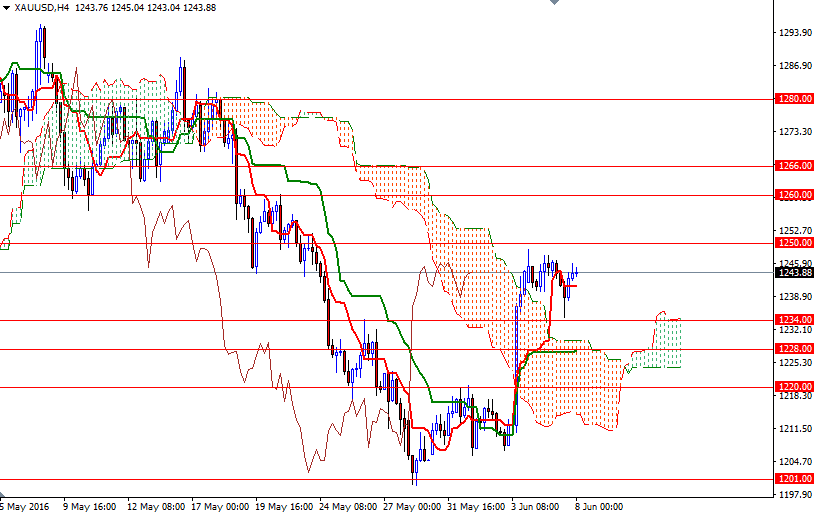

From a technical point of view, the odds favor further upside as long as the XAU/USD pair remains above the Ichimoku cloud on the 4-hour time frame. The long lower shadow of yesterday's candle and positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also improve the short-term picture. The first hurdle gold needs to jump is located around the 1250 level. If the bulls successfully push prices above 1337, there is a possibility that we can visit 1256 (the bottom of the daily cloud) and 1261 (the top of the daily cloud) afterwards. Closing beyond 1261 would suggest that the market will be aiming for 1266/4.

On the other hand, if the market encounters heavy resistance and prices break down below 1234-1232.50, then we will probably heading back to the 4-hourly Ichimoku cloud which occupies the area between the 1228 and 1224 levels. The bears will have to drag prices below 1224 so that they can force the market to test the 1220/15 zone. A break below the 1215 support level could provide the bears extra power they need to visit 1208.