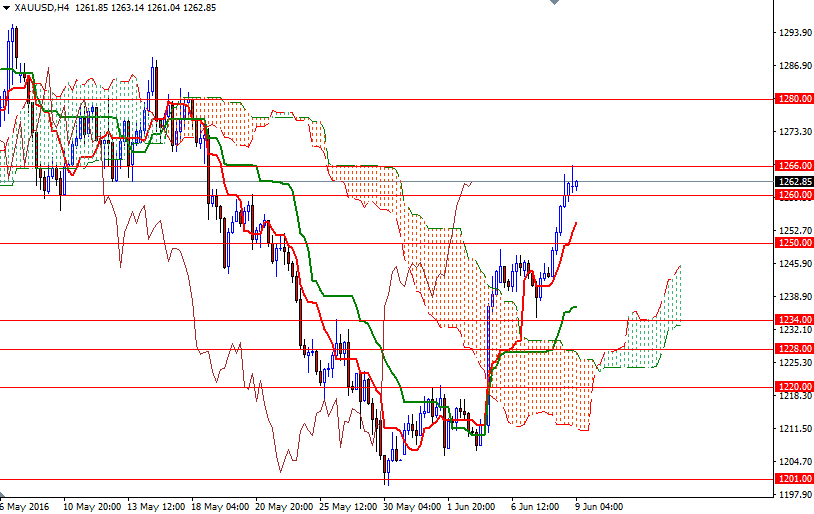

Gold prices rose 1.66% on Wednesday to settle at their highest level since May 18 as the US dollar continued to weaken on growing expectations the Federal Reserve won't raise interest rates this summer. The XAU/USD pair was able to cleanly break the key resistance at $1250 and move higher. Consequently, the market reached the $1266 level as expected during today's Asian session. The doji on the 4-hour chart is something to pay attention though as it implies the buying pressure may be starting to weaken.

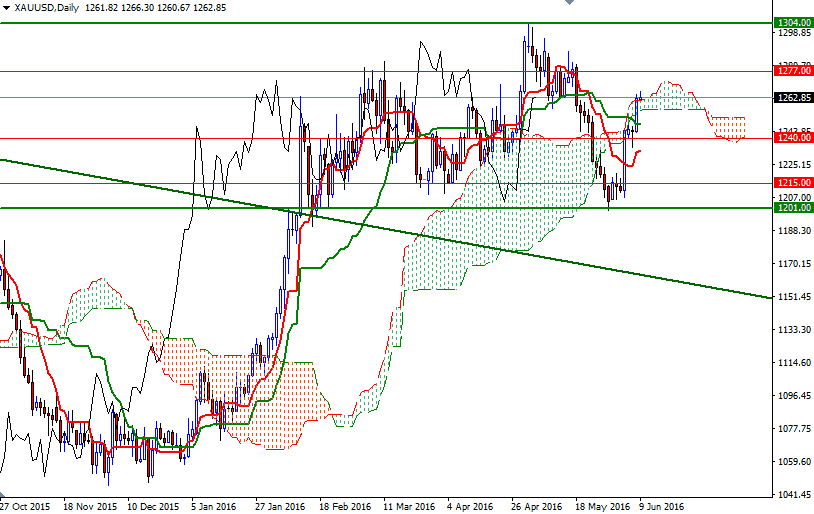

If the market finds it difficult to penetrate the 1266/4 zone, I wouldn't be surprised to see prices retreating back to 1260/58. The bears will need to push prices back below 1258 so that they can have a chance to challenge the intra-day support at 1254.80 - the Tenkan-Sen (nine-period moving average, red line) on the 4-hour chart. Below that, support can be seen in the 1250-1247.62 area where the daily Kijun-Sen (twenty six-period moving average, green line) resides. Invalidating this support would suggest that the market is on its way to test 1240.

On the other hand, if the bulls manage to defend their camp in the 1260/58 region and successfully break through 1266, then they may proceed to 1272.70-1270. A break up above 1272.70 would make me think that 1277 and 1280 will be the next possible targets. This will be the key level for the bulls to pass in order to challenge the bears at the next battlefield (1290-1287.50).