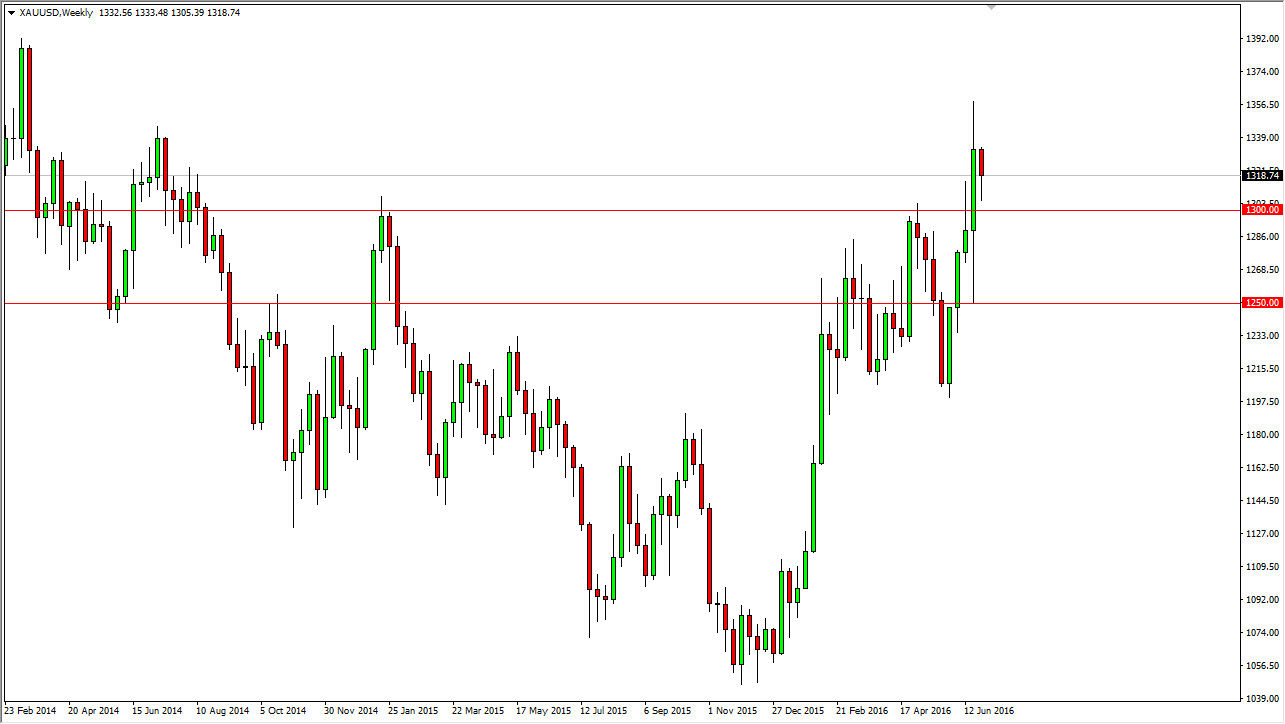

Gold markets have been very bullish over the last couple of weeks, as the United Kingdom voted to leave the European Union. That being the case, there is quite a bit of concern when it comes down to the economic markets, and the list to say the currency markets. With this, a lot of people will prefer to own “hard currency” such as gold. While there is a rush to the US dollar in general, the reality is that both gold in the US dollar can go higher at the same time, as it has done in the past. On top of that, there is a massive candle from the previous week where we had initially fell all the way down to the $1250 level, and then shot straight up in the air as we reached towards the $1350 level.

Pullback

We did pullback to the $1300 level, and a bounce from there. That being the case, the market looks as if it is finding buyers below, and I believe that gold markets will be considered to be a “value” every time we pullback as it could be opportunity to pick up momentum to finally go even higher. I believe that it is essentially going to be a “buy on the dips” or perhaps even a “buy-and-hold” type of market. In this sense, the gold markets are acting as a bit of a safety play, and that of course is a very positive sign.

If we did break down below the $1300 level, I think that the next layer of massive support is somewhere near the $1250 level, and it’s not until we break down below there that I would consider selling gold as I believe it will continue to go much higher due to not only the uncertainty, but you have to keep in mind that gold is also priced in British pounds and Euros, and both of those markets should be screaming much higher at the moment.