Gold prices rose on Monday but the precious metal's gains were limited by signs of stabilization in riskier markets and the strength in the dollar. The XAU/USD pair traded as high as $1335.30 an ounce before giving up some of the gains to settle at $1324.11. Investors will now look to The Commerce Department's final gross domestic product reading for the first quarter of 2016.

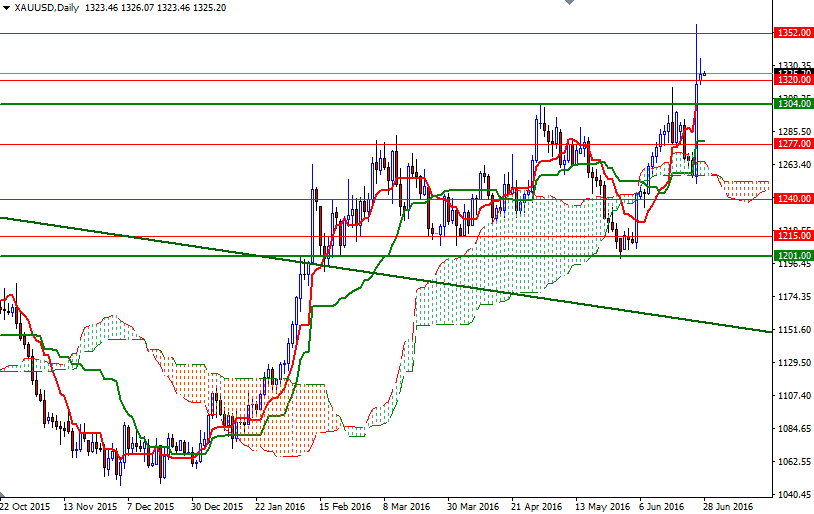

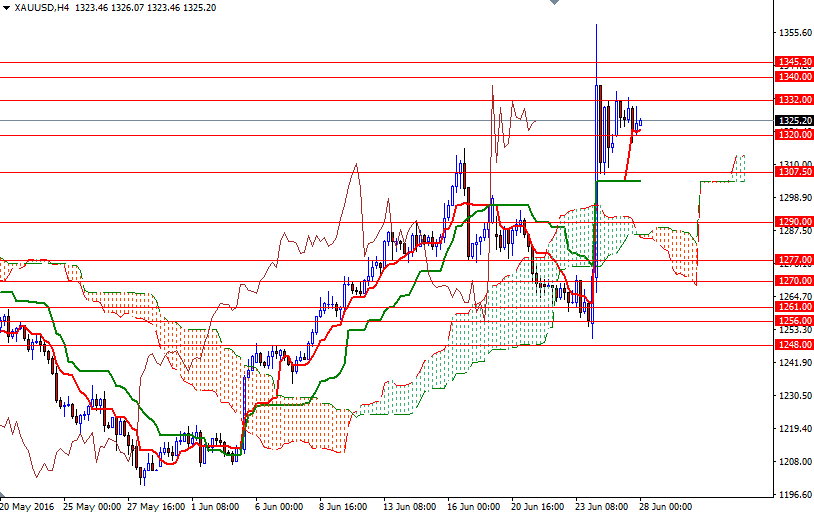

The medium term technical picture remains bullish, with the market trading above the Ichimoku clouds on the weekly, daily and 4-hourly time frames. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is above both prices and the clouds. However, at this point, lack of momentum is something to watch, especially when short term charts indicate exhaustion.

With these in mind, keep an eye on the 1320-1318.40 and 1333.70-1332 areas. However, if the bulls run out of steam and prices return below 1318.40, we could possibly see the bears making a run for the 1312 level. The bears will need to capture this level so that they can find a chance to challenge the 1307.50-1304 support. A break down below the 1304 level which happens to be the bottom of the hourly chart could send XAU/USD back to 1292/0. The top of the hourly currently sits at 1328, so the market has to move beyond there to pay another visit to 1333.70-1332. If this resistance is broken, then the next stop will be 1340. Closing above 1340 would suggest that the bulls will be targeting 1352.