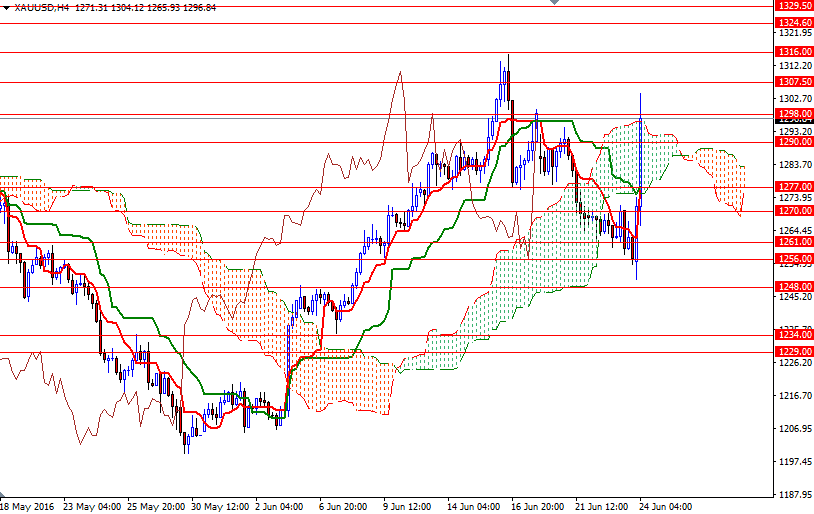

Gold prices fell for a third straight session on Thursday to settle at their lowest level since June 7 on expectations that Britain would vote to stay in the European Union. However, early results from the referendum surprised the majority of investors and sent them rushing back to the safety of gold. Leave has now reached 10 million votes and has 51.1% of the votes so far.

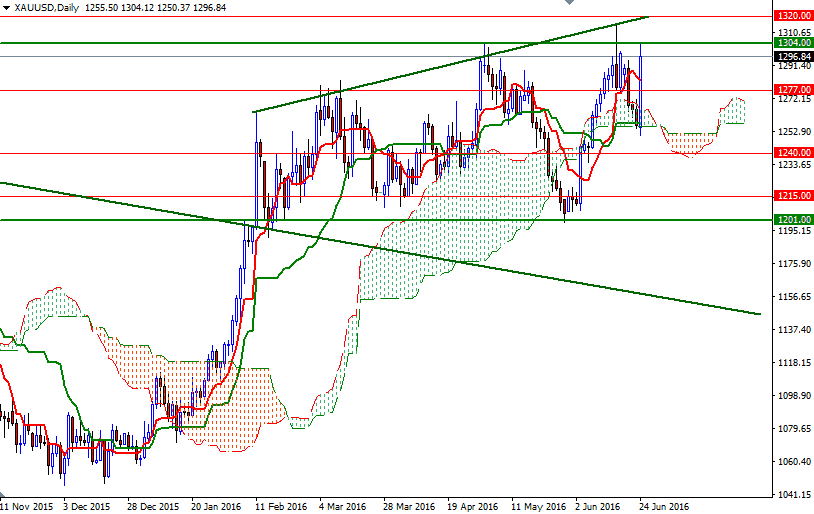

The XAU/USD pair has rallied 3.3% to $1296.84 an ounce after the news. The market is now working on the assumption that Leave is going to win. If the final result is a Leave victory, look for further upside with 1320/16, 1352 and 1392 as targets over the few days/weeks. In the meantime, keep an eye on global stock markets as the inverse correlation between gold and stocks has become more pronounced recently.

On the other hand, if Britons choose to remain in the bloc, the market could drop all the way back to the 1201 level. On its way down, support may be found at 1240, 1234(29) and 1215. A weekly close below the 1201 level would indicate that the bears will be aiming for 1182/77 afterwards.