Gold climbed for a sixth straight session on Wednesday to settle at their highest level since April 29 as the dollar tumbled after the Federal Reserve officials left monetary policy unchanged and lowered projections of how much they will raise interest rates in the next few years. "Recent economic indicators have been mixed, suggesting our cautious approach to adjusting monetary policy remains appropriate," Fed Chair Yellen said at a news conference held after the central bank announced it now expects the economy to grow by 2% this year, down from a projection of 2.2% in March.

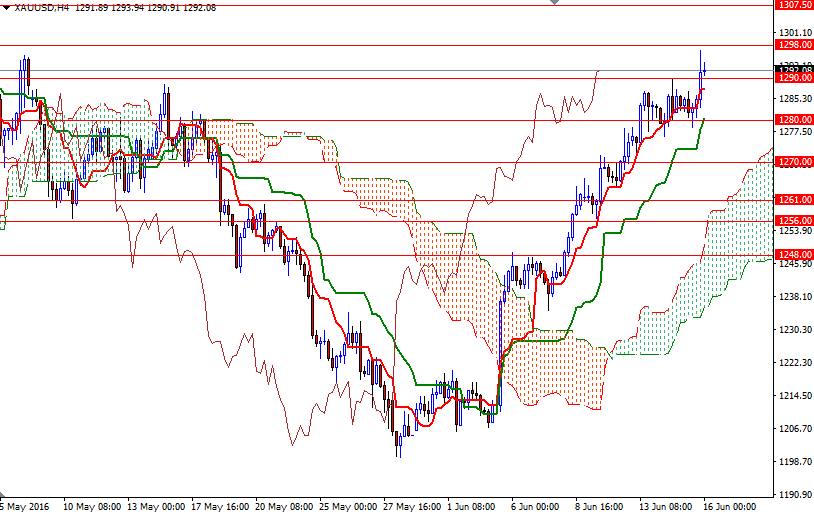

Although Yellen stressed that a rate hike at the next meeting was "not impossible", traders put the odds of July rate hike at about 10%. The XAU/USD pair traded as high as $1296.80 an ounce after breaching a key resistance at $1290 provided additional momentum. The XAU/USD pair is currently trading at $1292.08, slightly higher than the opening price of $1291.89.

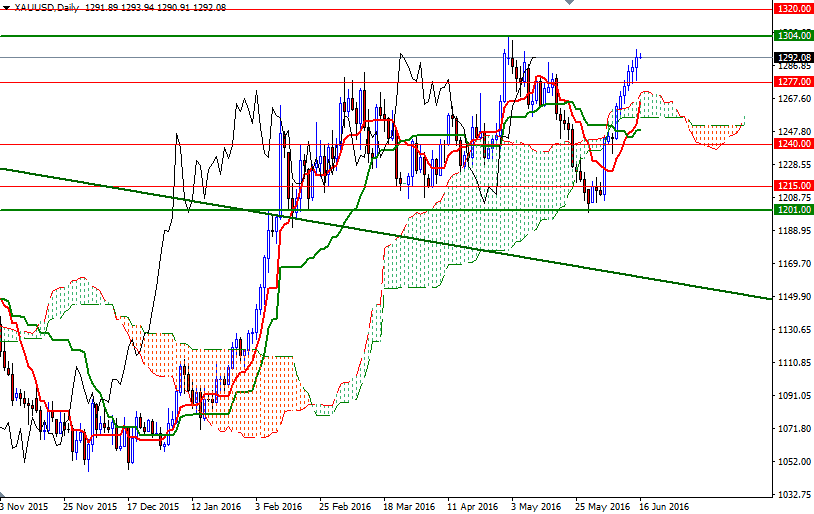

The bulls have been dominating the market since prices climbed back above the Ichimoku clouds on the 4-hour chart and now I think the outcome of the test of 1307.50-1304 will probably determine what will happen next. But of course in order to get there, the market has to push through 1298/5 first. While a sustained break above 1307.50 would set the XAU/USD pair up for a test of the resistance at the 1320/16 level, failure to do so could pull prices back to the 1290/87 region. The bears will need to capture this area so that they can march towards 1280/77.