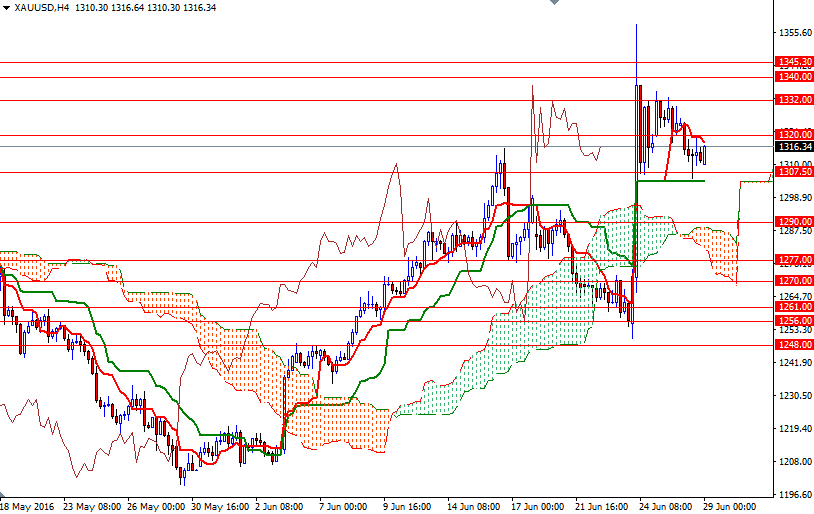

Gold prices ended yesterday's session down $11.72 as investors liquidated their positions to bank substantial profits from Friday's shock. The XAU/USD pair fell as low as $1305.44 an ounce after the support in the 1320-1318.40 zone was broken. In economic news on Tuesday, the U.S. Commerce Department reported that gross domestic product increased at a 1.1% annual rate. The Conference Board’s consumer confidence index came in at 98.0, up from the previous month's 92.4 and above expectations for a reading of 93.2.

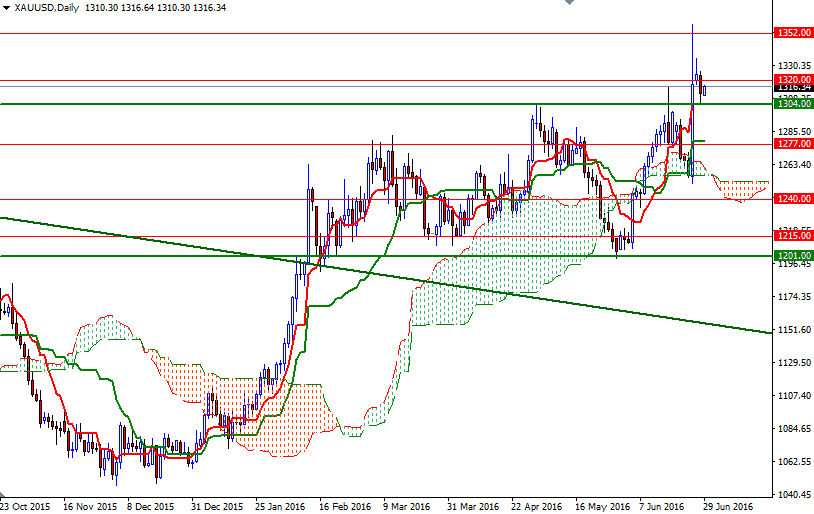

From a medium-term perspective, gold is likely to maintain a bullish trend. Prices are above the weekly, daily and 4-hourly Ichimoku clouds and we have bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses. The market will enjoy the death of rate hike expectations, though the strength in the dollar and a rebound in stock markets may put pressure on the metal. However, I wouldn't be surprised to see a range-bound movement (roughly between the 1334 and 1304 levels) for the next few days.

If XAU/USD can break through 1320, we might see a bullish attempt targeting the 1326 level - the top of the Ichimoku cloud on the hourly chart. The bulls will have to capture this strategic camp in order to gain more momentum and challenge the bears on the 1333.70-1332 battlefield. Closing above 1333.70 could signal a run up to 1340. On the other hand, if the 1312 support gives way, a retest of the 1307.50-1304 region might be realistic. A sustained break below 1304 would imply that the 1292/0 zone might be the next port of call.