Gold prices ended Thursday nearly unchanged as market participants opted to remain on the sidelines ahead of the release of key economic data. Gold prices ended Thursday nearly unchanged as market participants opted to remain on the sidelines ahead of the release of key economic data. The May U.S. payrolls report will give investors fuel to speculate on the timing of an interest rate hike by the U.S. Federal Reserve. Automatic Data Processing Inc. reported that the private sector added 173K jobs in May, broadly in line with expectations. People tend to use ADP’s data to get a feeling for the Labor Department’s report, though these figures aren't always accurate in predicting the outcome.

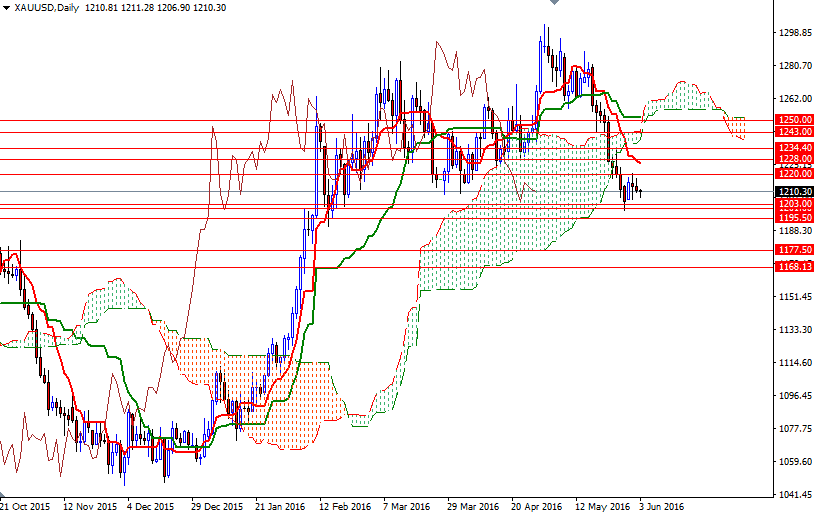

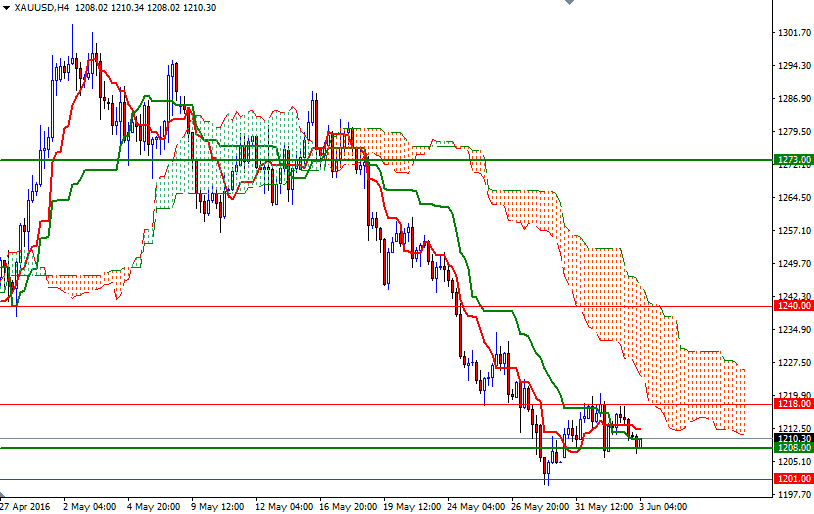

XAU/USD has gone nowhere over the past few days. The trading action is getting tight and as you can see the daily candlesticks are indicating a real lack of momentum. From a long term perspective, sailing above the Ichimoku clouds on the weekly time frame indicates lower prices will attract buyers. However, the medium-term outlook will remain bearish while the market trades below both the daily and 4-hourly charts.

To the upside, the bulls will have to push through 1220/18 area in order to gain enough traction to reach the next barrier standing in the way at 1228. Breaching this level would suggest that the market will be aiming for 1234 afterwards. On the other hand, if the greenback gets a boost and prices fall through the 1203/1 zone, we might head back to the 1177.50 level. But of course, in order to get there, the bears have clear nearby supports such as 1199.50 and 1188.