Gold prices settled at $1298.43 an ounce on Friday, a rise of 1.81% over the course of the week's trading, as the Federal Reserve's cautious stance towards tightening policy, soft economic data and a slide in equities lured investors back into the market. U.S. Federal Reserve keeps interest rates on hold and ruled out a summer interest rate rise. Major stock indexes suffered bruising losses on concerns over the consequences of the coming U.K. vote on whether to stay in the European Union.

Fed chair Janet Yellen warned that Britain's departure from the EU would have "consequences for economic and financial conditions in global financial markets." "So, it is certainly one of the uncertainties that we discussed and that factored into today's decision," she said. Increasing safe-haven demand and diminished likelihood of a July rate hike should be supportive for gold for the time being. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 279862 contracts, from 228619 a week earlier. The market is now predicting a rate hike won't happen until at least September.

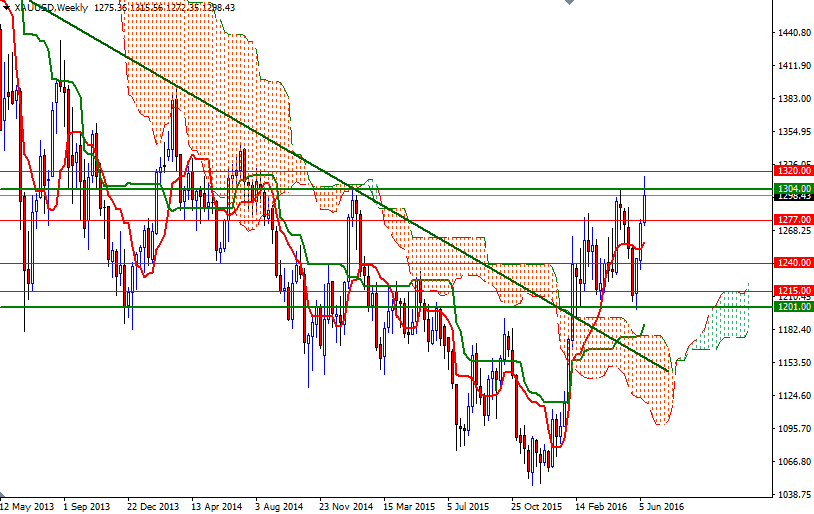

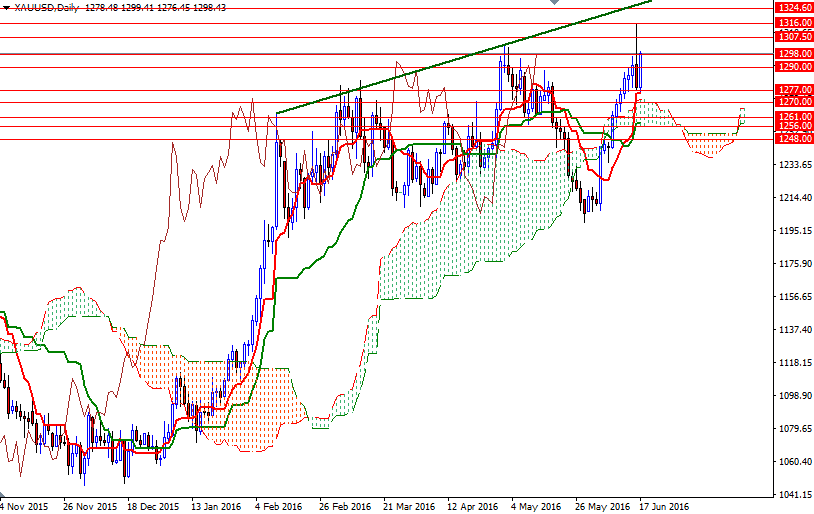

Speaking strictly based on the charts, XAU/USD is likely to maintain a bullish trend while the market trades above the Ichimoku clouds on almost all charts. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. To the upside, the key area to watch will be 1307.50-1304. Anchoring somewhere beyond this area could encourage buyers and pave the way for a retest of 1320/16. Once above 1324.60, the market will be aiming for 1332-1329.90. Currently the initial support is at around 1290, followed by 1286. If prices drop below 1286 then the market will probably retreat to 1280/77. A break below 1277 could foreshadow a move to the 1270 level which happens to be the top of the Ichimoku cloud on the daily chart. The bears have to eliminate this support on a daily basis if they intend to challenge the 1261 and 1256 levels.