Gold prices settled at $1244.18 an ounce on Friday, making a gain of 2.52% on the week, as disappointing U.S. jobs data dimmed the prospect of an interest rate hike by the Fed in the near term. The XAU/USD pair, which steadied after hitting the lowest level since February 17 earlier in the week, spent some time consolidating between $1205 and $1220 levels. The market broke above the $1220 level after the Labor Department reported that nonfarm payrolls grew by just 38K in May, well below consensus estimates of 159K, and gains for the prior two months were revised down by a total 59K.

A potential delay in a rate increase to September should weigh on the American dollar and create an environment in which people are reluctant to go heavily short on gold for some time. Moreover, market expectations for rate hikes in the coming months also have dwindled: Fed-funds futures is now pricing in a 37% likelihood of a Federal Reserve rate move at July’s policy meeting, down from 59% on Thursday. However, considering the fact that we also had some strong reports over the past few weeks, I don't think that this single report will result in the Fed changing its view on tightening monetary policy this year. A first hint of the central bank's view on the weak employment number is likely to come on Monday, when Fed chair Janet Yellen speaks in Philadelphia.

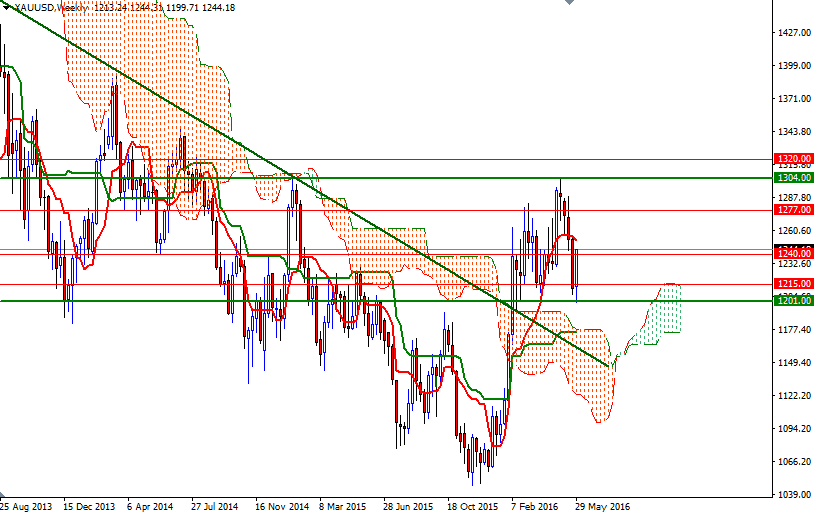

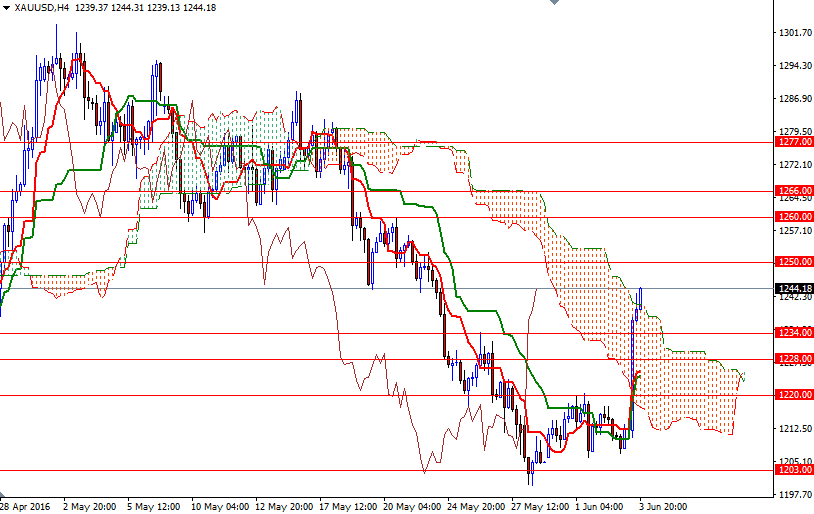

From a technical perspective, there are two things catch my attention at first glance. Firstly, the long-term outlook still points to an upwards bias, with prices residing above the weekly Ichimoku cloud (the precious metal's rally at the beginning of February not only pushed prices above the cloud but also invalidated a long-term bearish trend line). Secondly, breaching the 4-hourly clouds and closing near the highs of the trading range have altered the short-term charts. With these in mind, it wouldn't be surprising to see prices approaching the daily cloud. On its way up, resistance can be seen at 1250, 1260/57 and 1266/4. A close above 1266 suggests that the XAU/USD pair may extend its gains and proceed to the 1280/77 zone. If this resistance is broken, it is technically possible to see a bullish continuation targeting 1190. To the downside, initial support is located in 1234-1232.50, followed by 1228/5. A break below 1225 could see a fall down to the 1220/15 zone. The bears will need to capture this camp so that they can find a chance to challenge the 1208 level. Once below that, the market will be aiming for 1203/1.