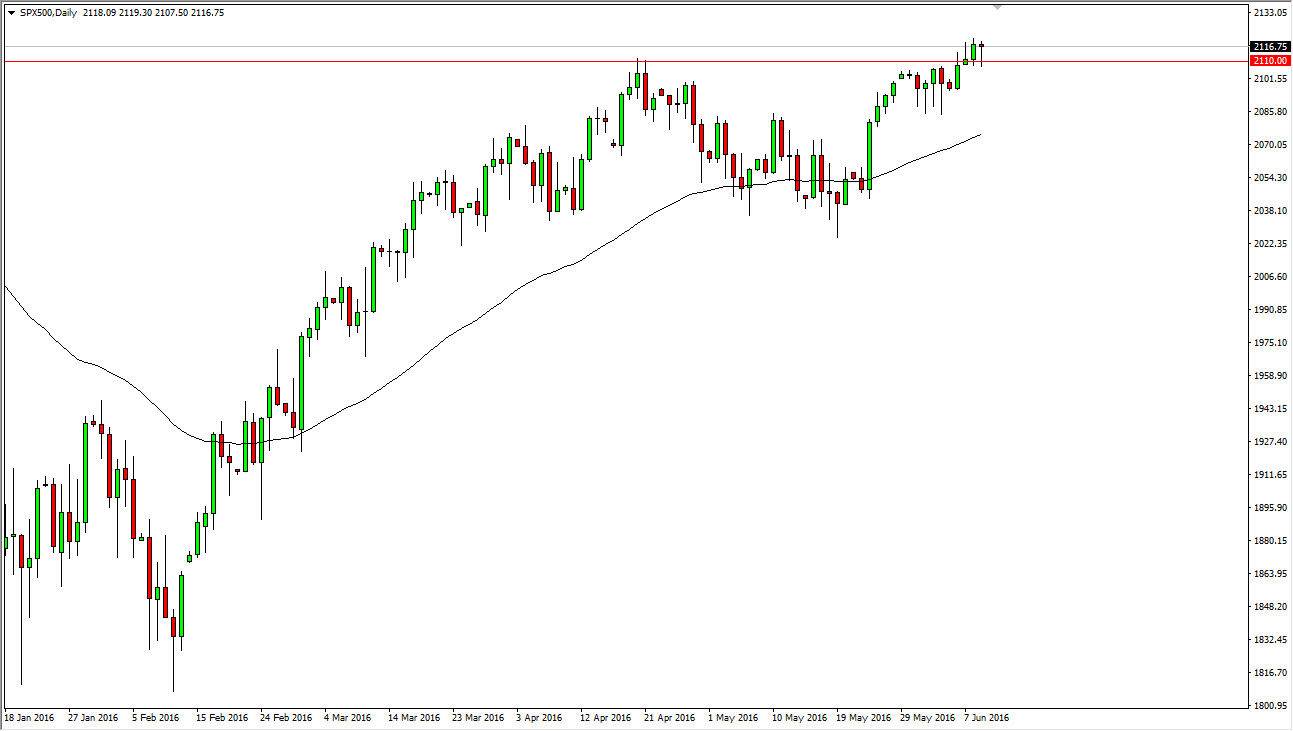

S&P 500

The S&P 500 fell a bit too during the day on Thursday, but as you can see bounced off of the 2110 level in order to show significant support. This was an area that was massively resistive in the past, so having said that it’s likely that the market will continue to go higher. After all, the hammer suggests that we are going to go higher and perhaps reach towards the 2150 level given enough time. I have no interest in selling this market, especially considering that the US dollar continues to fall and that of course is very good for stocks markets over the longer term. I have the 50 day exponential moving average on the chart, and that is what I’m using to define the overall trend of this particular market.

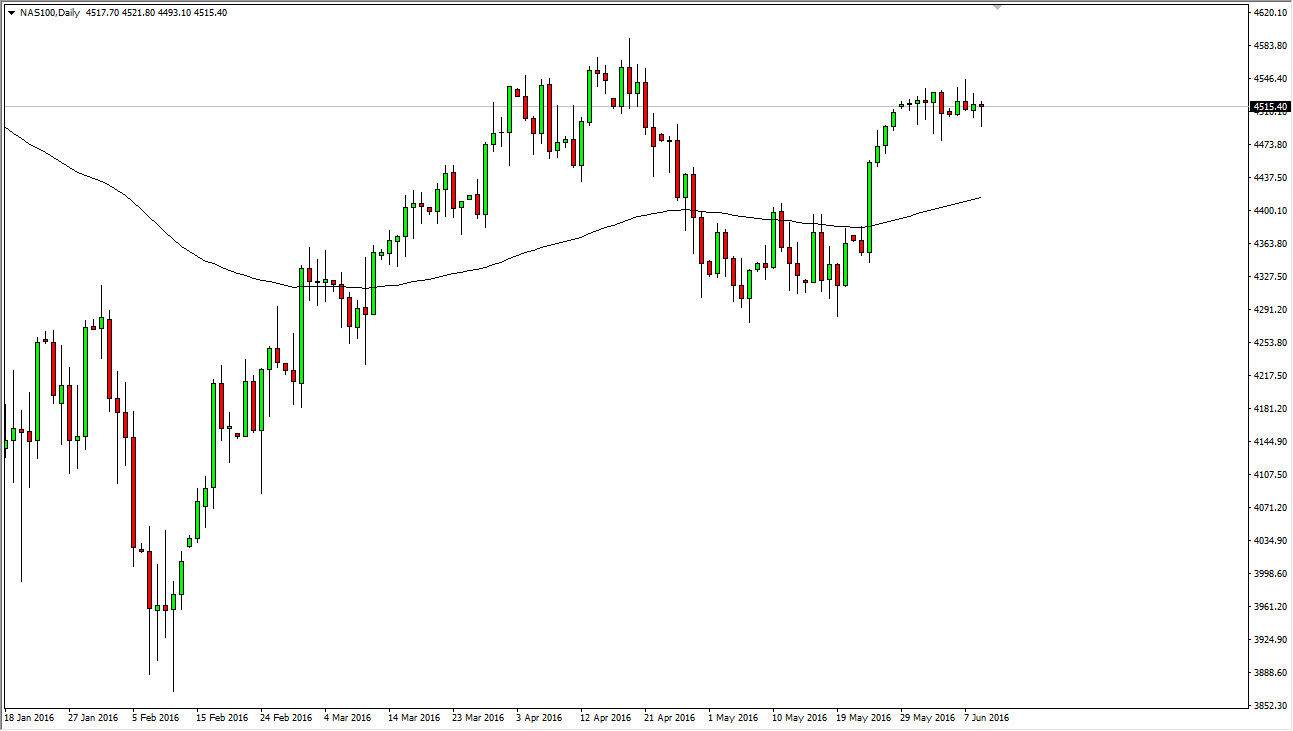

NASDAQ 100

The NASDAQ 100 fell slightly during the course of the session on Thursday, but bounced enough to form a bit of a hammer. Quite frankly though, this market is very flat at the moment so therefore I don’t have any interest in putting money into it. After all, the market looks like a market that simply cannot make up its mind in the time being. I do believe that the 100 day exponential moving average below could offer quite a bit of support, so even if we do fall from here I think that the buyers will return.

If we can break above the top of the shooting star from the Tuesday session, I believe the market will challenge the 4600 level. A break above the 4600 level frees this market to go much higher, and continue the longer-term uptrend that we have seen recently. Quite frankly, I think it does happen but it’s probably going to take a bit of time. I believe that the other indices in the United States probably break out to the upside sooner.