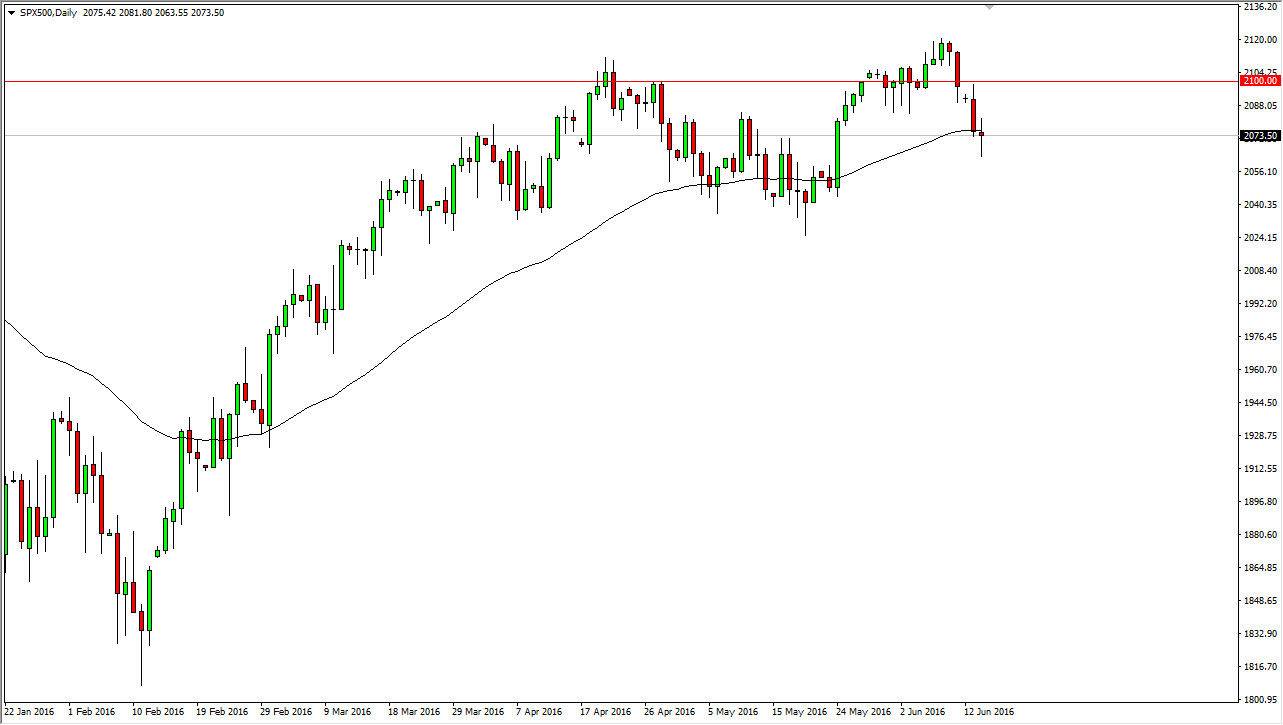

S&P 500

The S&P 500 had a very volatile session during the day on Tuesday, as we broke below the 50 day exponential moving average. However, we bounced enough to form a bit of a hammer so therefore I think that the buyers may return. Today is the FOMC statement so expect a lot of noise. With the FOMC suggests that it is ready to support the markets, the S&P 500 will shoot straight to the upside. I believe that a break above the top the range will have this market testing the 2100 level, and then the 2120 level after that. Personally, I believe that the Federal Reserve has caught itself in a situation where it has spent so much time placating the markets, it really doesn’t know what else to do. Ultimately, it would not surprise me at all to see the S&P 500 rally from here.

NASDAQ 100

The NASDAQ 100 did very much the same thing, testing the 4400 level for support. We ended up turning right back around and forming a hammer so I believe that we are going have a very similar scenario over here. Ultimately, I believe that we will reach towards the 4500 level given enough time, and with that being the case it is probably only a matter of time before we see the buyers get involved. Traders will more than likely look for some type of help from the Federal Reserve, and if they get it we could very well find ourselves going higher as the Federal Reserve could stimulate the markets yet again.

Ultimately, I believe that any pullback will more than likely find buyers below sooner or later, as it would more or less be a knee-jerk reaction. I believe that the 4300 level is the absolute “floor” in this market right now, and that we will not be able to break down below there.