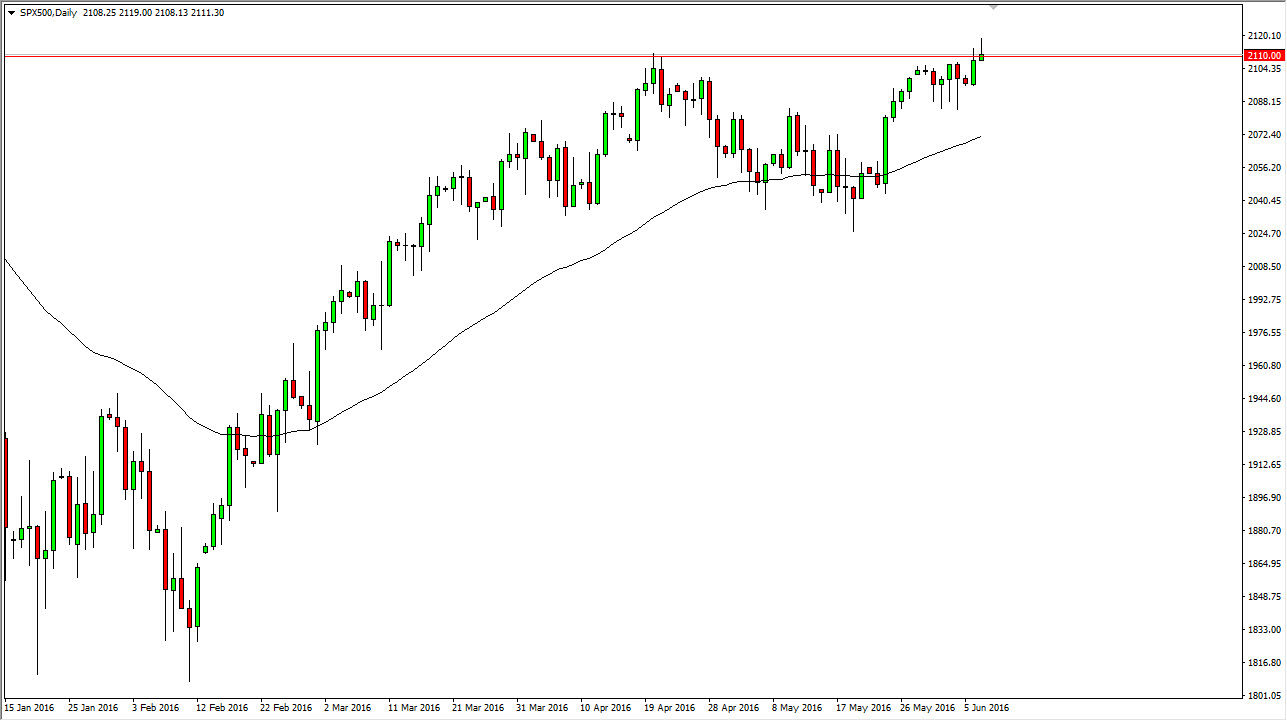

S&P 500

The S&P 500 rose initially during the course of the session on Tuesday, but then turned right back around to form a shooting star. That being the case, it looks as if the market is going to struggle with the 2110 level, but I believe it’s only a matter of time before we go higher. If we can break above the top of the shooting star, the market should continue to go much higher. However, there is more than enough bullish pressure underneath to drive this market higher, and I believe that the 50 day exponential moving average below will be a bit of a moving floor, and as a result any pullback that show signs of support will be looked at as value going forward.

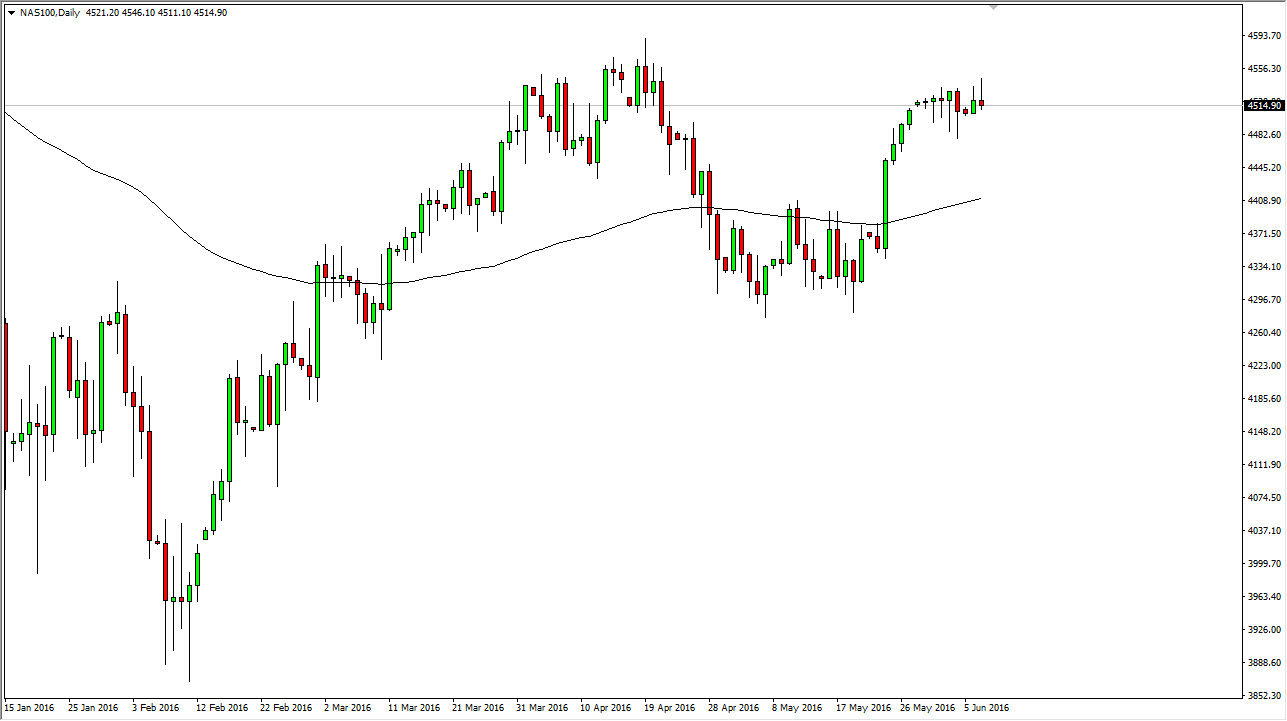

NASDAQ 100

The NASDAQ 100 try to rally as well, but also produced a shooting star. That being the case, the market looks as if the buyers ran out of steam during the day. We are initially trying to rally during the day but ended up forming that negative candle. However, I think that we are simply looking to buy pullbacks as value going forward. I believe that a break above the top of the shooting star also has the potential this in this market much higher. Ultimately, if we pullback, I believe that the 100 day exponential moving average below should have the effect of a “floor” in this market.

With this being the case, I believe that this is essentially a “buy only” type of market at the moment, although I don’t think that it will be a strong is the S&P 500 or the Dow Jones Industrial Average. In other words, I think it is positive but probably not the best place to put your money right now. With this, I’m optimistic but not overly excited about the NASDAQ 100.